Question: Finance just short answer please A or B or C or D or E Which of the following statements is (are) true regarding the variance

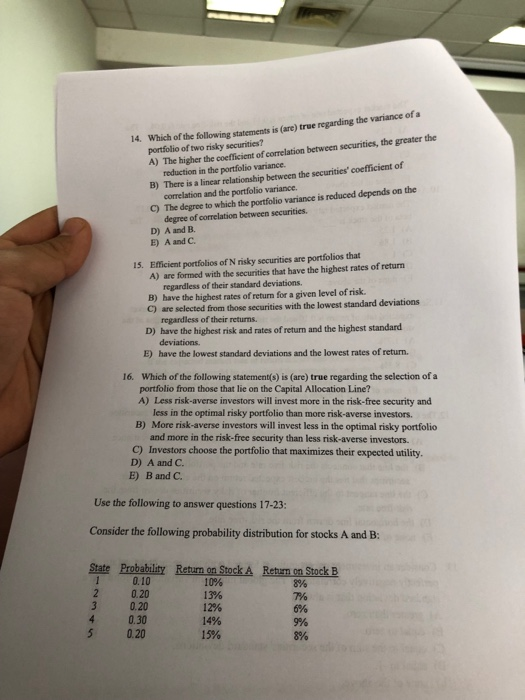

Which of the following statements is (are) true regarding the variance of a portfolio of two risky securities? 14. A) The higher the coefficient of correlation between securities, the greater the reduction in the portfolio variance. B) There is a linear relationship between the securities' coefficient of correlation and the portfolio variance. C) The degree to which the portfolio variance is reduced depends on the degree of correlation between securities. D) A and B. E) A and C 15. Efficient portfolios of N risky securities are portfolios that A) are formed with the securities that have the highest rates of return regardless of their standard deviations. B) have the highest rates of return for a given level of risk C) are selected from those securities with the lowest standard deviations regardless of their returns. D) have the highest risk and rates of return and the highest standard deviations. E) have the lowest standard deviations and the lowest rates of return. Which of the following statement(s) is (are) true regarding the selection of a portfolio from those that lie on the Capital Allocation Line? A) Less risk-averse investors will invest more in the risk-free security and 16. less in the optimal risky portfolio than more risk-averse investors. B) More risk-averse investors will invest less in the optimal risky portfolio and more in the risk-free security than less risk-averse investors. C) Investors choose the portfolio that maximizes their expected utility D) A and C E) B and C. Use the following to answer questions 17-23: Consider the following probability distribution for stocks A and B: S Probahl Retur on StockA Retrmon Stock B 0.10 0.20 0.20 0.30 0.20 10% 13% 12% 14% 15% 896 7% 0% 9% 3% 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts