Question: Finance just short answer please A or B or C or D or E Finance management plz help to answer yeah sorry now its clear

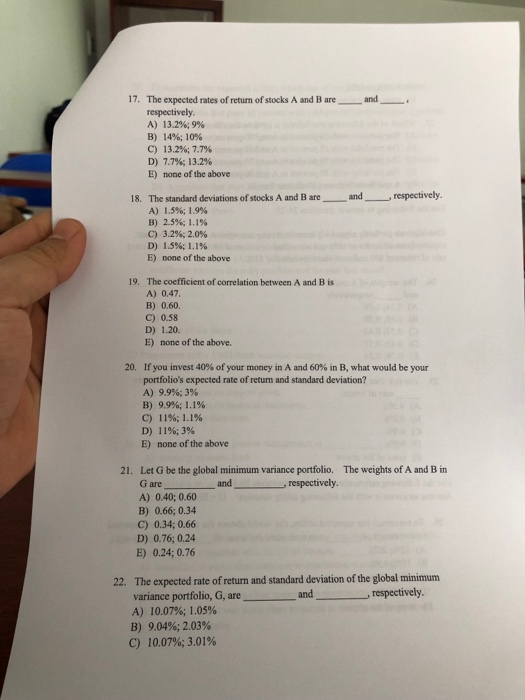

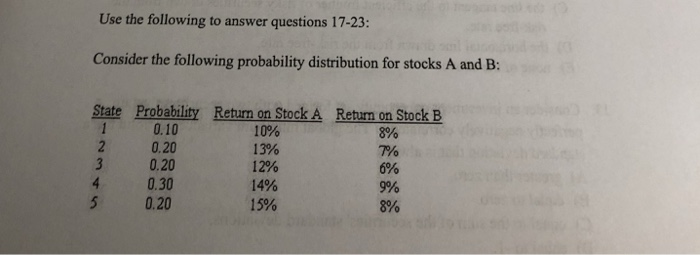

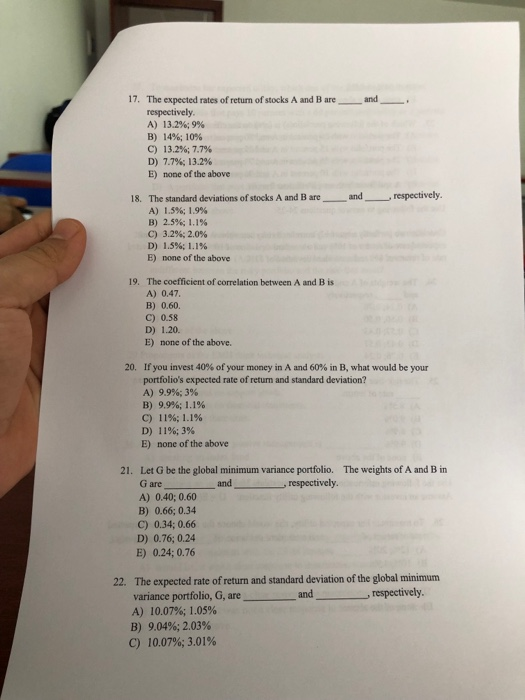

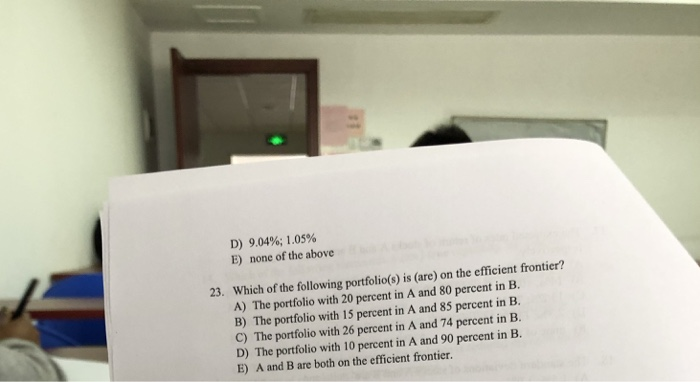

I 7. The expected rates of return of stocks A and B are respectively A) 13.2%;9% B) 14%:10% C) 13.296; 7.7% D) 7.7%; 13.2% E) none of the above and--. 18. The standard deviations of stocks A and B are- and, respectively A) 1.5% 1.9% B) 2.5%; 1.1% C) 3.2%; 2.0% B) none of the above 19. The coefficient of correlation between A and B is A) 0.47 B) 0.60. C) 0.58 D) 1.20. E) none of the above. 20. If you invest 40% of your money in A and 60% in B, what would be your portfolio's expected rate of return and standard deviation? A) 9.996; 3% B) 9.9% 1.1% C) 1196; 1.196 D) 11%,3% E) none of the above 21. Let G be the global minimum variance portfolio. The weights of A and B in G areandrespectively. A) 0.40; 0.60 B) 0.66; 0.34 C) 0.34; 0.66 D) 0.76; 0.24 E) 0.24; 0.76 The expected rate of return and standard deviation of the global minimum variance portfolio, G, are A) 10.07%; 1.05% 22. -respectively. _ an, B) 9.04%; 2.03% C) 10.07%,3.01% Use the following to answer questions 17-23: Consider the following probability distribution for stocks A and B: State Probability Retum on Stock A Retun on Stock B 10% 13% 12% 14% 15% 0.10 0.20 3 0.20 0.30 0.20 8% 7% 0% 9% 8% I 7. The expected rates of return of stocks A and B are respectively A) 13.2%;9% B) 14%:10% C) 13.296; 7.7% D) 7.7%; 13.2% E) none of the above and--. 18. The standard deviations of stocks A and B are- and, respectively A) 1.5% 1.9% B) 2.5%; 1.1% C) 3.2%; 2.0% B) none of the above 19. The coefficient of correlation between A and B is A) 0.47 B) 0.60. C) 0.58 D) 1.20. E) none of the above. 20. If you invest 40% of your money in A and 60% in B, what would be your portfolio's expected rate of return and standard deviation? A) 9.996; 3% B) 9.9% 1.1% C) 1196; 1.196 D) 11%,3% E) none of the above 21. Let G be the global minimum variance portfolio. The weights of A and B in G areandrespectively. A) 0.40; 0.60 B) 0.66; 0.34 C) 0.34; 0.66 D) 0.76; 0.24 E) 0.24; 0.76 The expected rate of return and standard deviation of the global minimum variance portfolio, G, are A) 10.07%; 1.05% 22. -respectively. _ an, B) 9.04%; 2.03% C) 10.07%,3.01% D) 9.04%; 1.05% E) none of the above 23. Which of the following portfolio(s) is (are) on the efficient frontier? A) The portfolio with 20 percent in A and 80 percent in B B) The portfolio with 15 percent in A and 85 percent in B C) The portfolio with 26 percent in A and 74 percent in B D) The portfolio with 10 percent in A and 90 percent in B E) A and B are both on the efficient frontier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts