Question: Finance just short answer please A or B or C or D or E 32. In an efficient market, A) security prices react quickly to

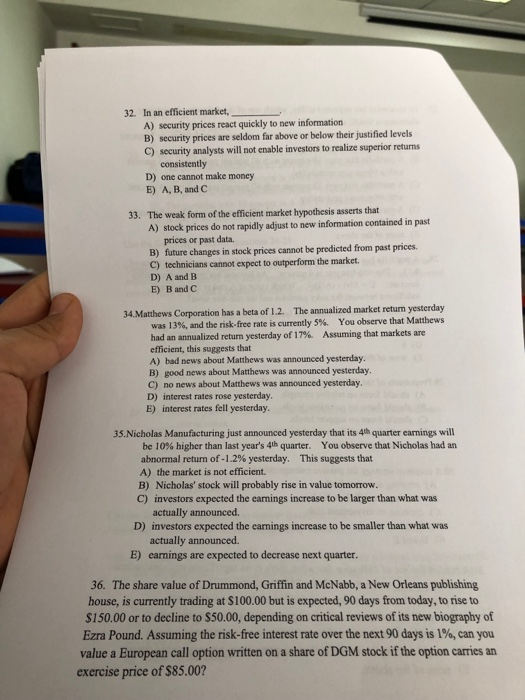

32. In an efficient market, A) security prices react quickly to new information B) security prices are seldom far above or below their justified levels C) security analysts will not enable investors to realize superior returns consistently D) one cannot make moncy E) A,B,and C The weak form of the efficient market hypothesis asserts that A) stock prices do not rapidly adjust to new information contained in past 33. prices or past data. B) future changes in stock prices cannot be predicted from past prices D) A and B E) B and C 34.Mathews Corporation has a beta of 1.2. The annualized market return yesterday was 13%, and the nsk-free rate is currently 5%. You observe that Matthews had an annualized return yesterday of 17% Assuming that markets are efficient, this suggests that A) bad news about Matthews was announced yesterday. B) good news about Matthews was announced yesterday. C) no news about Matthews was announced yesterday. D) interest rates rose yesterday E) interest rates fell yesterday. 35.Nicholas Manufacturing just announced yesterday that its 4th quarter earnings will be 10% higher than last year's 4th quarter. You observe that Nicholas had an abnormal return of-1.2% yesterday. This suggests that A) the market is not efficient. B) Nicholas' stock will probably rise in value tomorrow. C) investors expected the earnings increase to be larger than what was actually announced. investors expected the earnings increase to be smaller than what was actually announced. D) E) earnings are expected to decrease next quarter. 36. The share value of Drummond, Griffin and McNabb, a New Orleans publishing house, is currently trading at $100.00 but is expected, 90 days from today, to rise to $150.00 or to decline to $50.00, depending on critical reviews of its new biography of Ezra Pound. Assuming the risk-free interest rate over the next 90 days is 1%, can you value a European call option written on a share of DGM stock if the option carries an exercise price of $85.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts