Question: Finance just short answer please A or B or C or D or E its Finance management i need the answer now plz 27. To

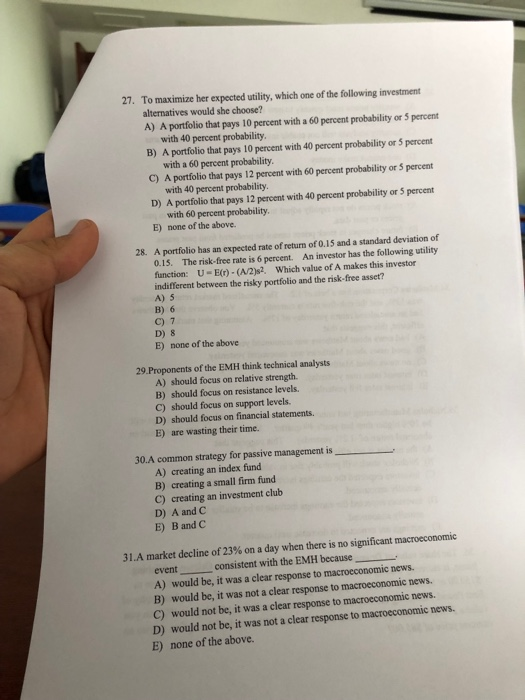

27. To maximize her expected utility, which one of the following investment alternatives would she choose? A) A portfolio that pays 10 percent with a 60 percent probability or 5 percent with 40 percent probability B) A portfolio that pays 10 percent with 40 percent probability or 5 percent with a 60 percent probability. C) A portfolio that pays 12 percent with 60 percent probability or 5 percent with 40 percent probability D) A portfolio that pays 12 percent with 40 percent probability or 5 percent with 60 percent probability E) none of the above. A portfolio has an expected rate of return of 0.15 and a standard deviation of 0.15. The risk-free rate is 6 percent. An investor has the following utility function: U-E(r) (A/2)s2. Which value of A makes this investor indifferent between the risky portfolio and the risk-free asset? A) 5 B) 6 C) 7 D) 8 E) none of the above 28. 29 Proponents of the EMH think technical analysts A) should focus on relative strength. B) should focus on resistance levels C) should focus on support levels D) should focus on financial statements. E) are wasting their time. 30.A common strategy for passive management is A) creating an index fund B) creating a small firm fund C) creating an investment club D) A and C E) B and C 31.A market decline of 23% on a day when there is no significant macroeconomic event consistent with the EMH because A) would be, it was a clear response to macroeconomic news. B) would be, it was not a clear response to macroeconomic news. C) would not be, it was a clear response to macroeconomic news D) would not be, it was not a clear response to macroeconomic news. E) none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts