Question: finance problems thx! We are comparing the performance of two different investors, using the CAPM as their reference benchmark. Throughout the last year, investor A

finance problems thx!

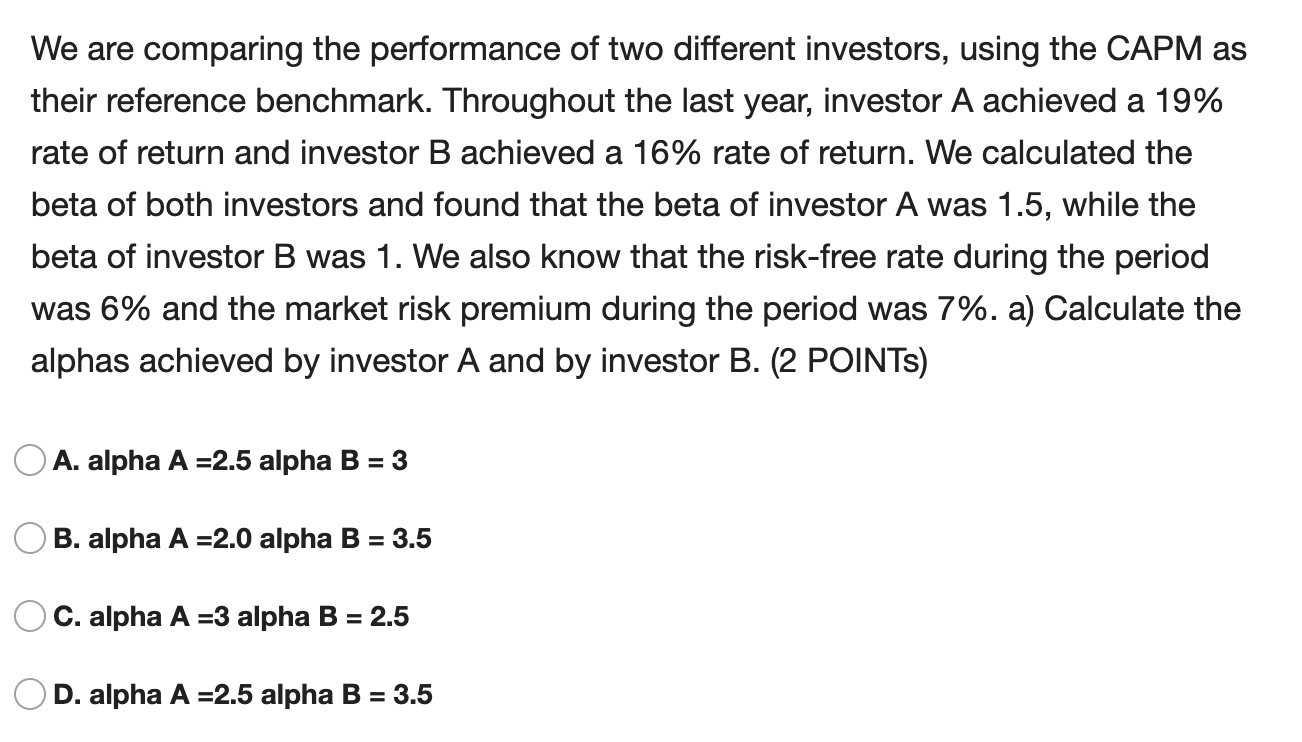

We are comparing the performance of two different investors, using the CAPM as their reference benchmark. Throughout the last year, investor A achieved a 19% rate of return and investor B achieved a 16% rate of return. We calculated the beta of both investors and found that the beta of investor A was 1.5, while the beta of investor B was 1. We also know that the risk-free rate during the period was 6% and the market risk premium during the period was 7%. a) Calculate the alphas achieved by investor A and by investor B. (2 POINTS) O A. alpha A =2.5 alpha B = 3 O B. alpha A =2.0 alpha B = 3.5 O C. alpha A =3 alpha B = 2.5 OD. alpha A =2.5 alpha B = 3.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts