Question: Finance_for_Decision Making 1st semester_May 2021 assignment.v2.pdf - Adobe Acrobat Reader DC (32-bit) File Edit View Sign Window Help Home Tools Finance for Decisio... X Sign

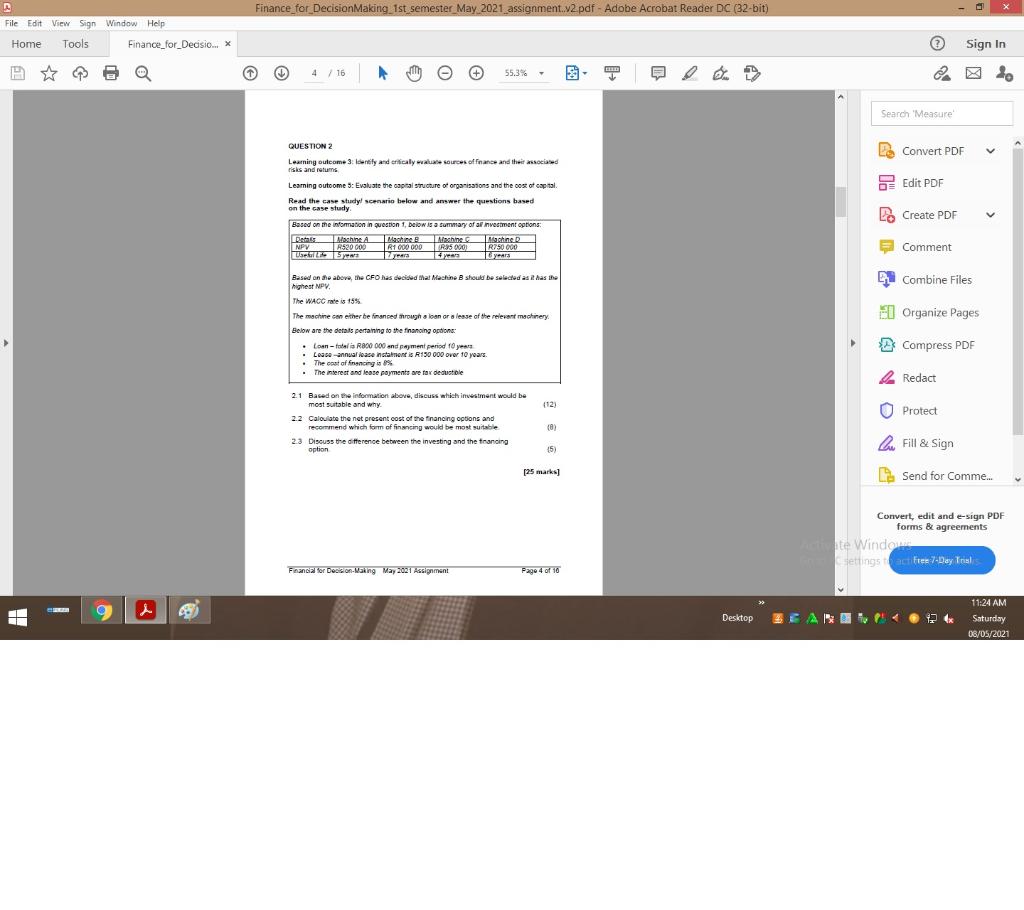

Finance_for_Decision Making 1st semester_May 2021 assignment.v2.pdf - Adobe Acrobat Reader DC (32-bit) File Edit View Sign Window Help Home Tools Finance for Decisio... X Sign In 4 / 16 55.3% c2 Search 'Measure Convert PDF V Edit PDF QUESTION 2 Learning outcome 3. Identity and effically sources of finance and the associased risks and returns Learning outcome 3: Evaluate the capital structure of organisasons and the cost of capital Read the case study scenario below and answer the questions based on the case study Based on the information in question 1, below is a summary of al Investment options: Detalleshing Machinesische Machine NPV R520 000 R1 000 000 RSD TR750 000 USIPAS 17 years Create PDF = Comment Dar Combine Files El Organize Pages Besed on the above, the CFO has decided that Machine B should be selected as has the highest NPV The WACC rate is 15% The machine can either be financed through a loan or a lease of the relevant machinery Below are the detais pertaining to the financing options: Loan-totalla ROO 000 and payment period 10 years Looseannual oaze instalment is R150 000 over 10 years. The cost of Kencing is The interest and lease payments are tax deductible Compress PDF 2 Redact (12) O Protect 21 Based on the information above, discuss which investment would be most suitable and why 2.2 Calculate the net present cost of the financing options and recommend which form of financing would be most suitable 23 Discuss the difference between the investing and the traning option () 15) Fill & Sign [25 marks Send for Comme... Convert, edit and e-sign PDF forms & agreements ate Window Settings actifrer 7-Day Trials Francia for Deble on Making May 2021 Assignment Page 4 of 10 11:24 AM Saturday Desktop 08/05/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts