Question: Financial Applications Instructions: Complete solutions must be provided. Justification must also be provided. Part 1 - Planning Your Retirement You are going to start planning

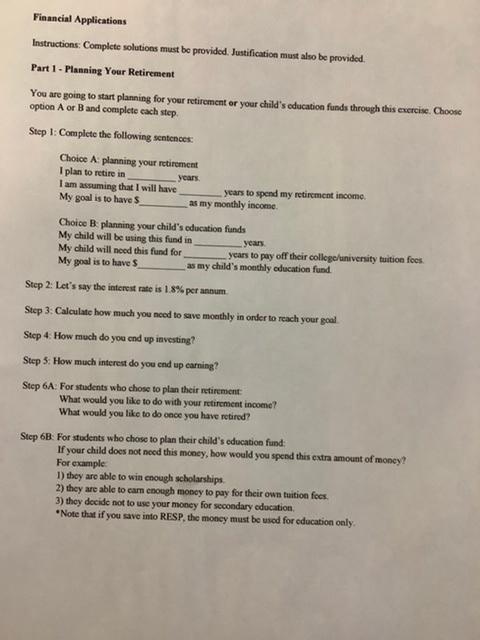

Financial Applications Instructions: Complete solutions must be provided. Justification must also be provided. Part 1 - Planning Your Retirement You are going to start planning for your retirement or your child's education funds through this exercise. Choose option A or Band complete each step. Step 1: Complete the following sentences: Choice A planning your retirement I plan to retire in years I am assuming that I will have years to spend my retirement income My goal is to have s as my monthly income Choice B planning your child's education funds My child will be using this fund in years My child will need this fund for years to pay off their college/university tuition fees My goal is to have as my child's monthly education fund Step 2: Let's say the interest rate is 1.8% per annum Step 3. Calculate how much you need to save monthly in order to reach your goal Step 4. How much do you end up investing? Step 3: How much interest do you end up carning? Step 6A: For students who chose to plan their retirement What would you like to do with your retirement income? What would you like to do once you have retirod? Step 6B: For students who chose to plan their child's education fund: If your child does not need this money, how would you spend this extra amount of money! For example 1) they are able to win enough scholarships 2) they are able to car enough money to pay for their own tuition fees 3) they decide not to use your money for secondary education *Note that if you save into RESP. the money must be used for education only Financial Applications Instructions: Complete solutions must be provided. Justification must also be provided. Part 1 - Planning Your Retirement You are going to start planning for your retirement or your child's education funds through this exercise. Choose option A or Band complete each step. Step 1: Complete the following sentences: Choice A planning your retirement I plan to retire in years I am assuming that I will have years to spend my retirement income My goal is to have s as my monthly income Choice B planning your child's education funds My child will be using this fund in years My child will need this fund for years to pay off their college/university tuition fees My goal is to have as my child's monthly education fund Step 2: Let's say the interest rate is 1.8% per annum Step 3. Calculate how much you need to save monthly in order to reach your goal Step 4. How much do you end up investing? Step 3: How much interest do you end up carning? Step 6A: For students who chose to plan their retirement What would you like to do with your retirement income? What would you like to do once you have retirod? Step 6B: For students who chose to plan their child's education fund: If your child does not need this money, how would you spend this extra amount of money! For example 1) they are able to win enough scholarships 2) they are able to car enough money to pay for their own tuition fees 3) they decide not to use your money for secondary education *Note that if you save into RESP. the money must be used for education only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts