Question: Financial Auditing: On December 3 1 , 2 0 2 4 , Joe Smith sold unimproved real estate, located in Southern Shores, NC , for

Financial Auditing:

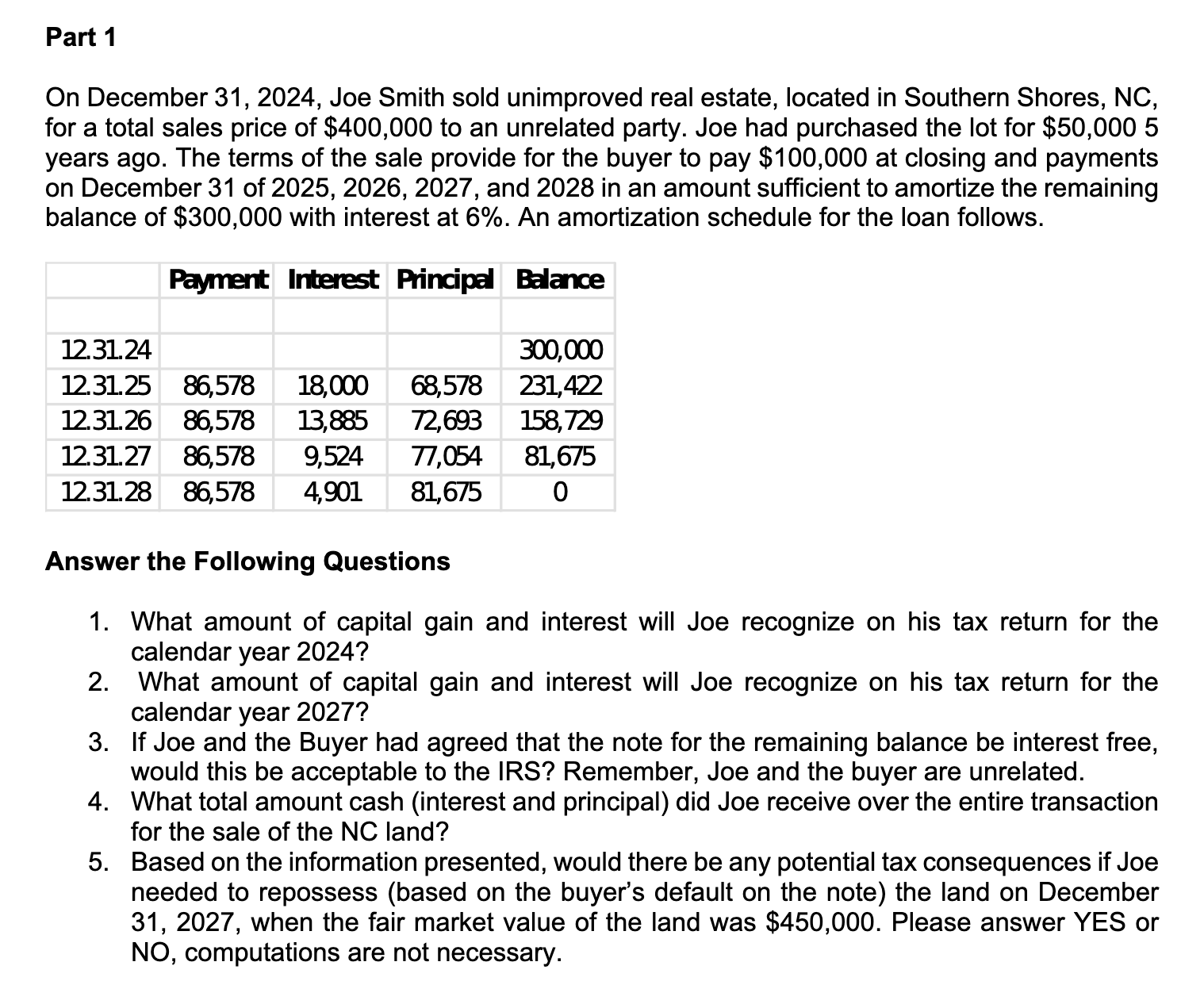

On December Joe Smith sold unimproved real estate, located in Southern Shores, NC for a total sales price of $ to an unrelated party. Joe had purchased the lot for $ years ago. The terms of the sale provide for the buyer to pay $ at closing and payments on December of and in an amount sufficient to amortize the remaining balance of $ with interest at An amortization schedule for the loan follows. Answer the Following Questions What amount of capital gain and interest will Joe recognize on his tax return for the calendar year What amount of capital gain and interest will Joe recognize on his tax return for the calendar year If Joe and the Buyer had agreed that the note for the remaining balance be interest free, would this be acceptable to the IRS? Remember, Joe and the buyer are unrelated. What total amount cash interest and principal did Joe receive over the entire transaction for the sale of the NC land? Based on the information presented, would there be any potential tax consequences if Joe needed to repossess based on the buyer's default on the note the land on December when the fair market value of the land was $ Please answer YES or NO computations are not necessary.

Required

By reference to mathrmAUmathrmC Section Subsequent Events and Subsequently Discovered Facts and ASC Subsequent Events, prepare a memorandum that will address the accounting and disclosure requirements of each of the matters described above that occurred after the Company's balance sheet date of December

In the event that any of the preceding matters require financial statement disclosure, draft a suggested financial statement note that would be appropriate. In the event that more than one matter requires disclosure, feel free to combine those disclosures.

Prepare a brief outline of auditor responsibility for subsequent events and the impact, if any, that any of the preceding may have with respect to the dating of the auditor's report on the financial statements of Bravo Corporation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock