Question: Financial forecasts are the basis for Answer equity valuation based on and / or market multiples. An analyst begins with a review of the company

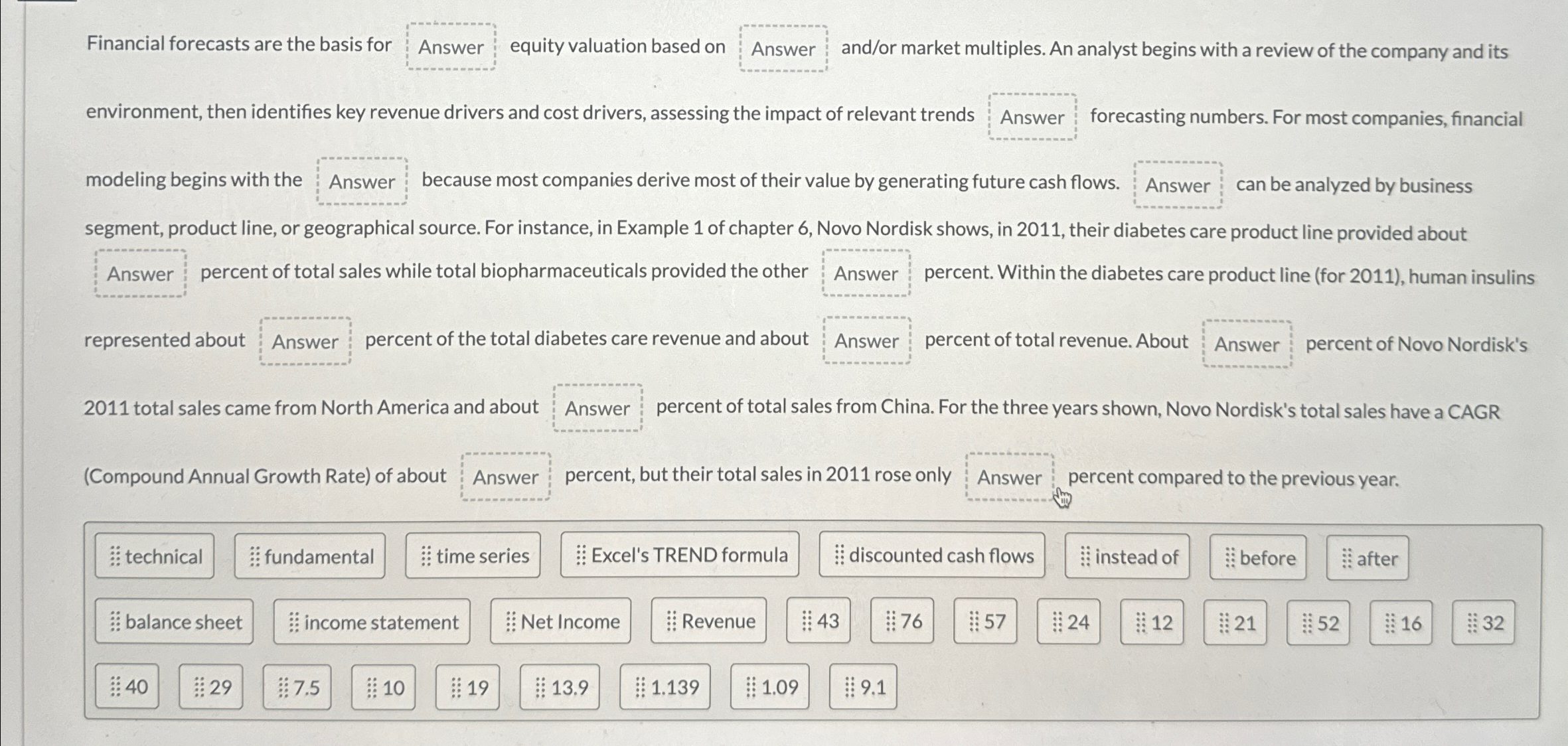

Financial forecasts are the basis for Answer equity valuation based on andor market multiples. An analyst begins with a review of the company and its environment, then identifies key revenue drivers and cost drivers, assessing the impact of relevant trends forecasting numbers. For most companies, financial modeling begins with the because most companies derive most of their value by generating future cash flows. can be analyzed by business segment, product line, or geographical source. For instance, in Example of chapter Novo Nordisk shows, in their diabetes care product line provided about

percent of total sales while total biopharmaceuticals provided the other percent. Within the diabetes care product line for human insulins represented about percent of the total diabetes care revenue and about percent of total revenue. About percent of Novo Nordisk's total sales came from North America and about percent of total sales from China. For the three years shown, Novo Nordisk's total sales have a CAGR Compound Annual Growth Rate of about percent, but their total sales in rose only Excel's TREND formula

income statement

:: Net Income

vdots

:

:

:

after

vdots

:

vdots

:: ::

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock