Question: Financial Goals & Concerns: - Noah 1 . They would like to retire when Bob is age 6 0 with $ 2 5 0 ,

Financial Goals & Concerns: Noah

They would like to retire when Bob is age with $ of annual income in todays dollars. They expect Social Security will reduce what they need to save. For planning purposes, they plan on living until Bob is age

They want to pay for their childrens college education and expect Cinnamon and Pepper will attend college for years each and will need about $ per year in todays dollars. They expect that the cost of tuition will continue to increase at per year, which has been the trend lately.

They want to purchase a foot sailboat when they retire so they can sail around the world. They expect they will purchase a boat that is about $ in todays dollars. They expect that the cost of the boat will increase at the general rate of inflation. This acquisition will increase their annual operating costs, but any increase should be covered in the $ of annual income needs.

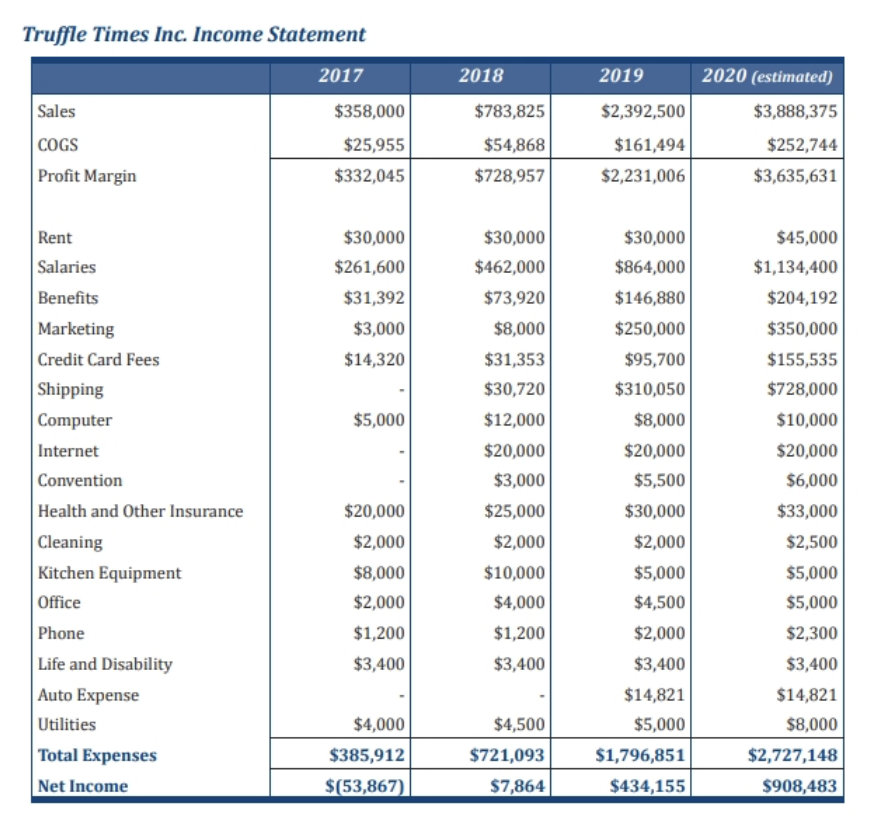

They want to decide what to do with Truffle Times in terms of transferring it or selling it They are certainly open to discussing other alternatives.

They would like to figure out how to reduce their income tax burden.

Assumptions

Bobs Retirement Target Age: Currently

Bobs Life Expectancy:

Bobs Social Security Benefits : $ per month $k annually in today's dollars

Candis Social Security Benefits : $ per month $k in todays dollars

Inflation Rate:

Education Cost Increase:

College Tuition: $ in today's dollars

Required Return:

New Sailboat: $ in today's dollars increasing at the rate of inflation

Truffle Times Inc. Income Statement Insurance Information

Life Insurance

Bob has a whole life policy that he acquired while he worked in the corporate world. His former company paid the premiums for the policy, but now he pays the premiums. The policy has a face value of $ million and has a monthly premium of $ It currently has a cash value of $ The crediting rate is

Candi has a term policy that is paid for by Truffle Times. It has a face value of $ with an annual premium of $

Health Insurance

Bob and Candi are covered under the Truffle Times health policy. They believe the policy is satisfactory in every way regarding major medical, stop loss, etc.

Disability Insurance

Bob and Candi are covered under disability policies paid for by Truffle Times. The policies provide for a day elimination period and provide benefits of of gross pay up to age The policies have an own occupation definition and cover both accidents and sickness. The annual premiums are $ for each policy $ total.

Property Home and Automobile Insurance

Bob and Candi have the following coverages:

Liability Insurance

Bob and Candi have a personal liability umbrella policy with a face value of $ million. The annual premium is $ Economic Information

General inflation CPI is expected to be annually.

Education inflation is expected to be annually.

They live in the state of Texas which has no state income tax.

Raises are uncertain but in the long run are expected to be equal to general inflation CP

The economy is in a slow growth recovery from a recession with moderate to high unem

Bank Lending Rates

Mortgage years conforming rate

Mortgage years conforming rate

Any closing costs associated with mortgage refinancing are an additional of the amot

Investment Return Expectations

The Sweets' required rate of return is Statement of Financial Position End of Year

Title Designations:

mathrmH Husband Sole Owner

W Wife Sole Owner

JT Joint Tenancy with Survivorship Rights Statement of Income and Expenses

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock