Question: Financial Management | 14th Edition Chapter 22, Problem 7 Problem Start with the partial model in the file Ch22 P07 Build a Model.xls on the

Financial Management | 14th Edition

Chapter 22, Problem 7 Problem

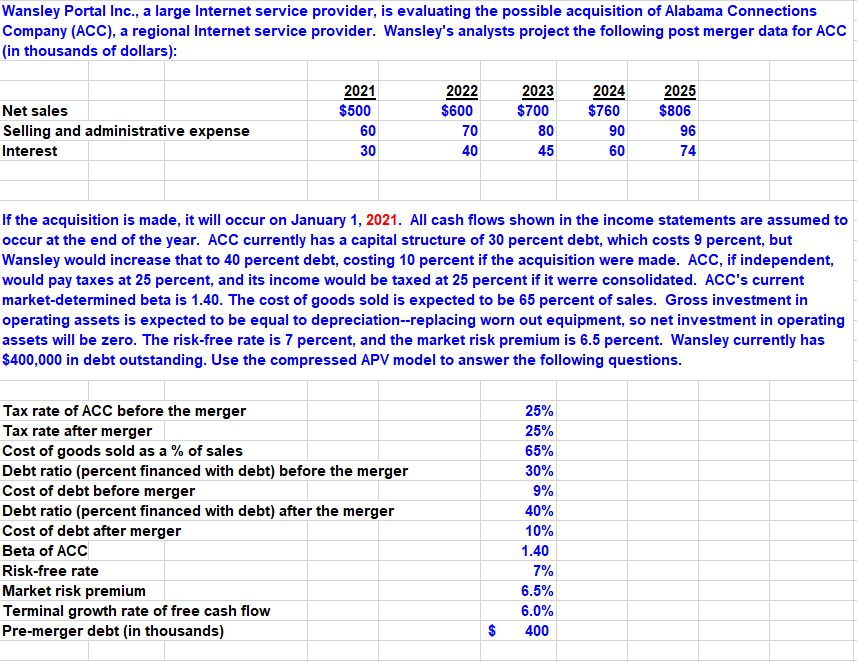

Start with the partial model in the file Ch22 P07 Build a Model.xls on the textbooks Web site. Wansley Portal Inc., a large Internet service provider, is evaluating the possible acquisition of Alabama Connections Company (ACC), a regional Internet service provider. Wansleys analysts project the following post-merger data for ACC (in thousands of dollars):

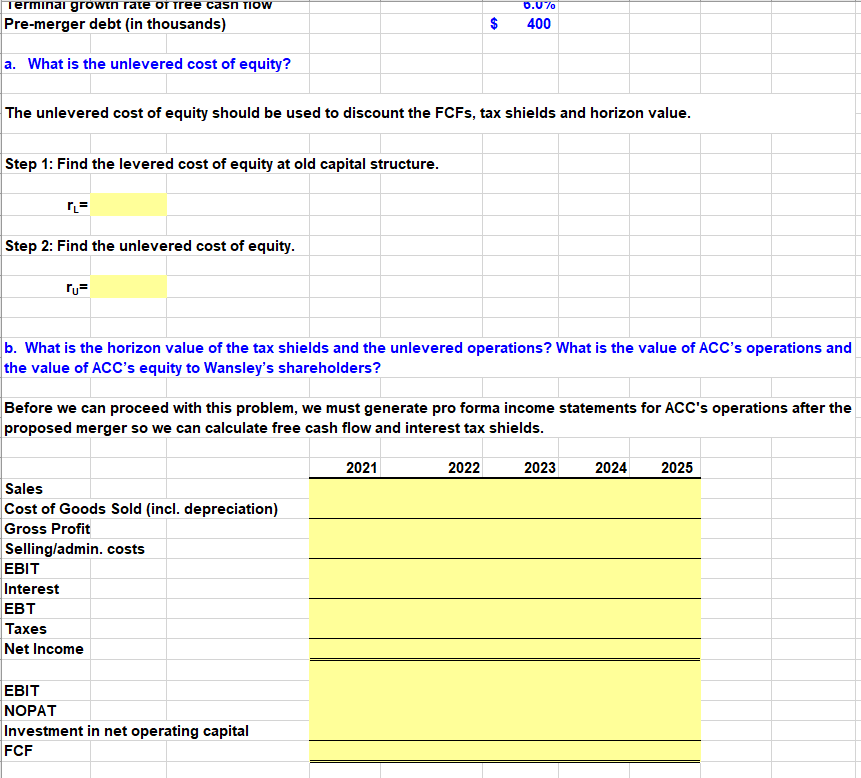

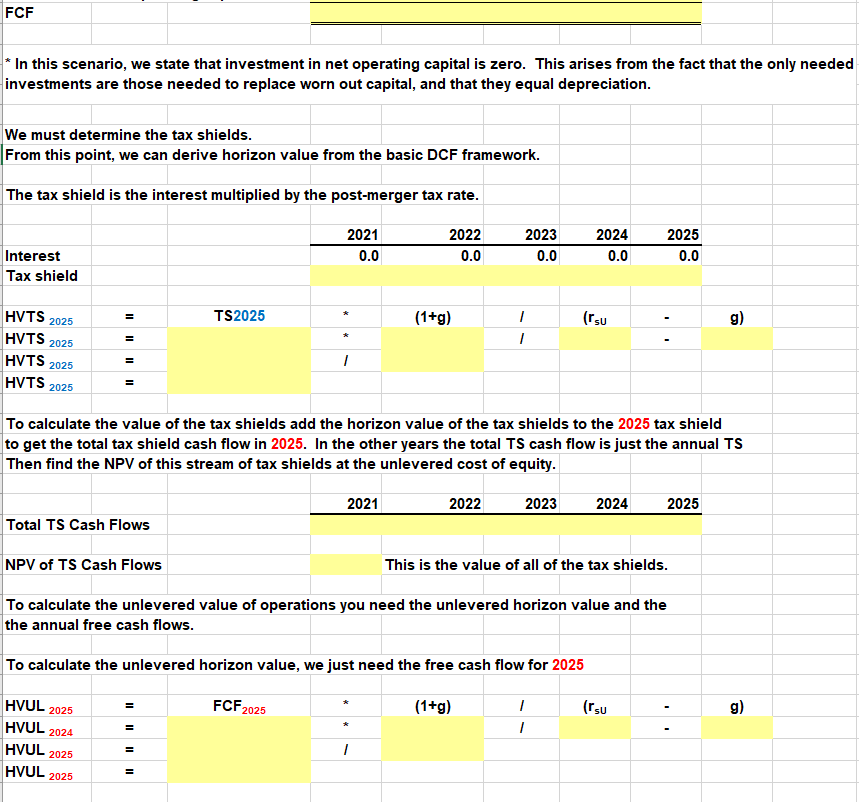

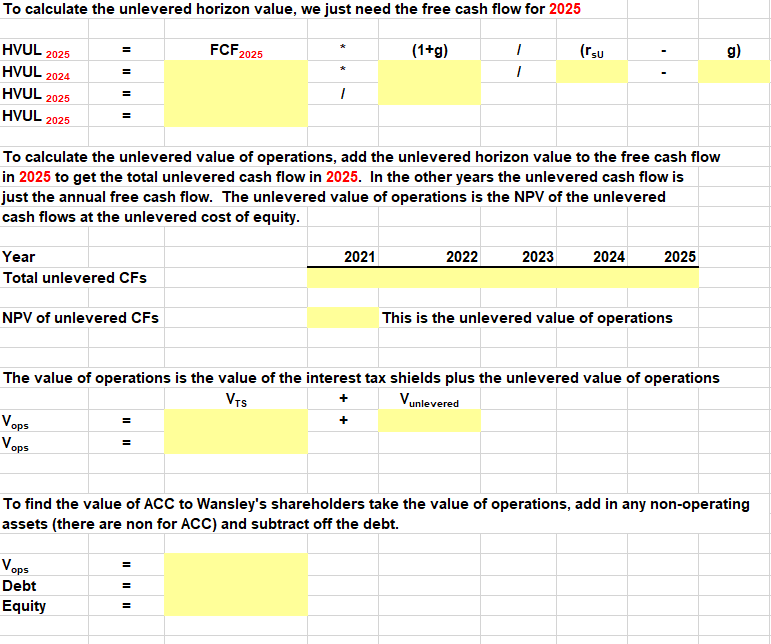

Wansley Portal Inc., a large Internet service provider, is evaluating the possible acquisition of Alabama Connections Company (ACC), a regional Internet service provider. Wansley's analysts project the following post merger data for ACC (in thousands of dollars): If the acquisition is made, it will occur on January 1, 2021. All cash flows shown in the income statements are assumed to occur at the end of the year. ACC currently has a capital structure of 30 percent debt, which costs 9 percent, but Wansley would increase that to 40 percent debt, costing 10 percent if the acquisition were made. ACC, if independent, would pay taxes at 25 percent, and its income would be taxed at 25 percent if it werre consolidated. ACC's current market-determined beta is 1.40 . The cost of goods sold is expected to be 65 percent of sales. Gross investment in operating assets is expected to be equal to depreciation--replacing worn out equipment, so net investment in operating assets will be zero. The risk-free rate is 7 percent, and the market risk premium is 6.5 percent. Wansley currently has $400,000 in debt outstanding. Use the compressed APV model to answer the following questions. Step 2: Find the unlevered cost of equity. led To calculate the unlevered horizon value, we just need the free cash flow for 2025 HVUL5 HVUL 2024= HVUL HVUL 2025 = 2025 = FCF2025 2025 (1+g) (rsu g) To calculate the unlevered value of operations, add the unlevered horizon value to the free cash flow in 2025 to get the total unlevered cash flow in 2025. In the other years the unlevered cash flow is just the annual free cash flow. The unlevered value of operations is the NPV of the unlevered cash flows at the unlevered cost of equity. Year 2021 2022 2023 5024 2025 Total unlevered CFs NPV of unlevered CFs This is the unlevered value of operations The value of operations is the value of the interest tax shields plus the unlevered value of operations Vops vops VTS Vunlevered =+ = To find the value of ACC to Wansley's shareholders take the value of operations, add in any non-operating assets (there are non for ACC ) and subtract off the debt. \begin{tabular}{l|l} Vops & = \\ \hline Debt & = \\ Equity & = \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts