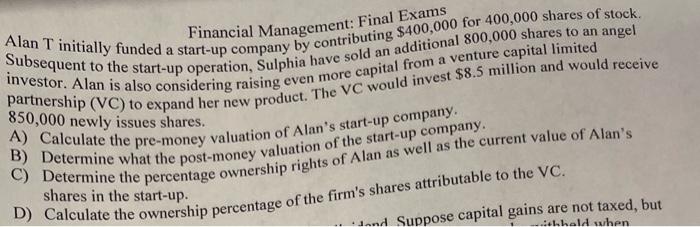

Question: Financial Management: Final Exams Alan T initially funded a start-up company by contributing $400,000 for 400,000 shares of stock. Subsequent to the start-up operation, Sulphia

Alan T initially funded a start-up company by Subsequent to the start-up operation, Sulphia have sold an additional 800,000 shares to an angel investor. Alan is also considering raising even more capital from a venture capital limited partnership (VC) to expand her new product. The VC would invest $8.5 million and would receive A) Calculate the pre-money valuation of Alan's start-up company. 850,000 newly issues shares. B) Determine what the post-money valuation of the start-up company. C) Determine the percentage ownership rights of Alan as well as the current value of Alan's D) Calculate the ownership percentage of the firm's shares attributable to the VC. shares in the start-up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts