Question: Financial math problem (Discounting is assumed yearly - meaning given r, the present value of 1 dollar in one year is worth 1/(1+r) today.) 2.

Financial math problem

(Discounting is assumed yearly - meaning given r, the present value of 1 dollar in one year is worth 1/(1+r) today.)

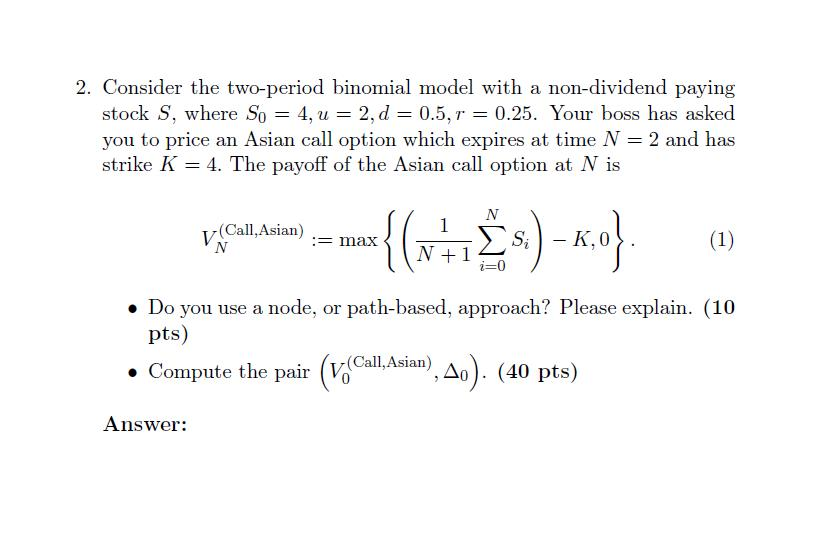

2. Consider the two-period binomial model with a non-dividend paying stock S, where So = 4, u = 2, d = 0.5, r = 0.25. Your boss has asked you to price an Asian call option which expires at time N = 2 and has strike K = 4. The payoff of the Asian call option at N is V(Call,Asian) N :=max {( 1 N +1 N =0 s.) K,o} (1) Do you use a node, or path-based, approach? Please explain. (10 pts) Compute the pair (v/Call,Asian), Ao). (40 pts) ( Answer: 2. Consider the two-period binomial model with a non-dividend paying stock S, where So = 4, u = 2, d = 0.5, r = 0.25. Your boss has asked you to price an Asian call option which expires at time N = 2 and has strike K = 4. The payoff of the Asian call option at N is V(Call,Asian) N :=max {( 1 N +1 N =0 s.) K,o} (1) Do you use a node, or path-based, approach? Please explain. (10 pts) Compute the pair (v/Call,Asian), Ao). (40 pts) (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts