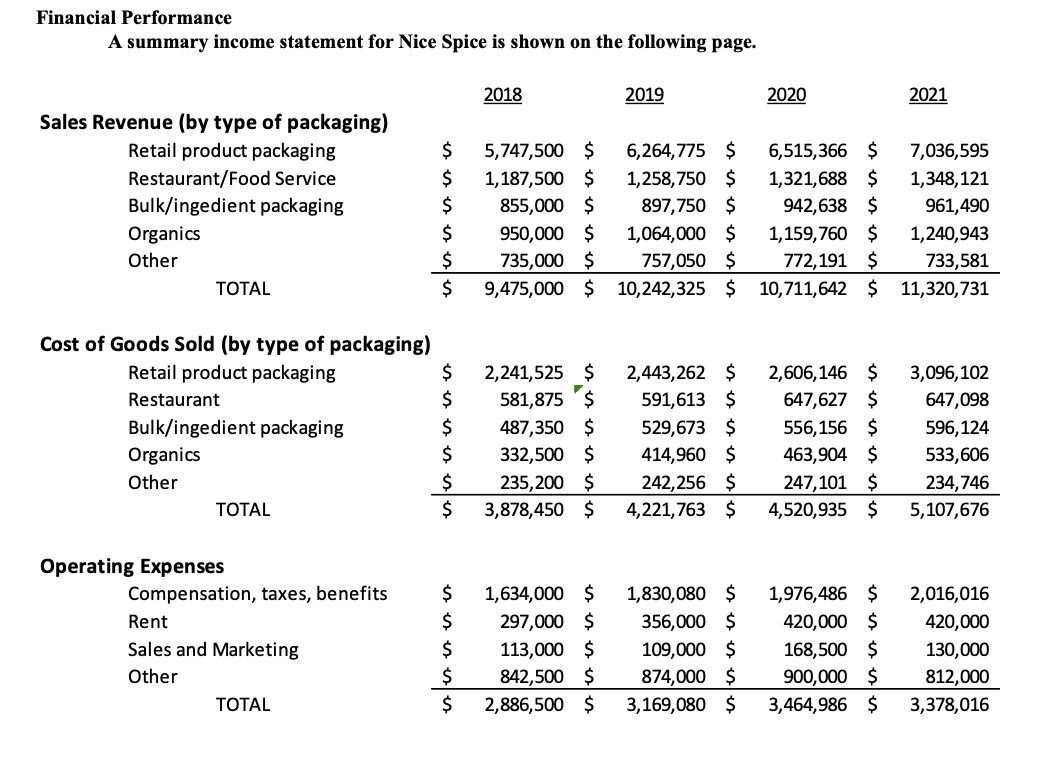

Question: Financial Performance A summary income statement for Nice Spice is shown on the following page. 2018 2019 2020 2021 Sales Revenue (by type of packaging)

Financial Performance A summary income statement for Nice Spice is shown on the following page. 2018 2019 2020 2021 Sales Revenue (by type of packaging) Retail product packaging 5,747,500 $ 6,264,775 $ 6,515,366 $ 7,036,595 Restaurant/Food Service 1,187,500 $ 1,258,750 $ 1,321, 688 $ 1,348,121 Bulk/ingedient packaging 855,000 $ 897,750 $ 942,638 961,490 Organics 950,000 1,064,000 $ 1, 159,760 1,240,943 in un t Other 735,000 757,050 $ 772, 191 $ 733,581 TOTAL 9,475,000 $ 10,242,325 $ 10,711,642 $ 11,320,731 Cost of Goods Sold (by type of packaging) Retail product packaging 2,241,525 $ 2,443,262 $ 2,606,146 $ 3,096,102 Restaurant 581,875 $ 591,613 $ 647,627 $ 647,098 Bulk/ingedient packaging 487,350 529,673 556, 156 S 596,124 Organics 332,500 414,960 463,904 533,606 Other 235,200 $ 242,256 247,101 $ 234,746 TOTAL 3,878,450 $ 4,221,763 $ 4,520,935 $ 5,107,676 Operating Expenses Compensation, taxes, benefits 1,634,000 $ 1,830,080 $ 1,976, 486 $ 2,016,016 Rent 297,000 $ 356,000 $ 420,000 $ 420,000 Sales and Marketing 113,000 109,000 $ 168,500 130,000 Other 842,500 874,000 900,000 $ 812,000 TOTAL 2,886,500 $ 3,169,080 $ 3,464,986 3,378,016Nice Spice Company The desire to enjoy avorful food has motivated trade and business activity for over 2,000 years. The spice industry, therefore, is one of the oldest and most enduring global industries, one that has shaped the progress of history. Spices we consider common today, such as cinnamon, ginger, pepper, nutmeg, and turmeric were once known and used only in east Asia because they were derived from plants found only in the islands of Indonesia. These rare spices were extremely valuable and were in great demand wherever they were introduced. As a valuable resource offering opportunities for wealth, the spice trade eventually made its way to Europe. As European nations and their populations developed, the demand for spices motivated European traders (1.4:, entrepreneurs) to set out on foot across Asia in the hopes of establishing regular trade routes. By the 14'11 century, traders took to large ocean-going ships and risked sailing across vast, uncharted oceans in search of faster routes to the spices of Indonesia. It was on one such voyage seeking a faster route to the spices that Columbus accidentally 'discovered' the western hemisphere. Through the Middle Ages, nations that gained control of spice production and supply, such as Portugal and Denmark, became rich and powerful. Indeed, the spice industry was so vital to the Dutch economy that when, in the late 1600s, the English threatened to attack the Dutch settlement called New Amsterdam on the east coast of North America, the Dutch negotiated to peacefully exchange the colony for control of an Indonesian island that produced nutmeg. We now call that New Amsterdam settlement New York City. The spice industry thrived in the United States after the colonies won their independence from Britain in the late 18'\" century. Great quantities of raw spices arrived via sailing fleets in the port of Salem, Massachusetts and were redistributed across the Atlantic Ocean to Europe or onto Philadelphia, Boston, and Baltimore for processing, packaging, and further distribution. As one of the nation's rst major ports, Baltimore played a major role in the development of the U.S. spice industry has remained an important market ever since. The modern U.S. seasoning, sauce, and condiment industry is a $24 billion portion of the overall U.S. food industry. Dry spices are a further subsegment, representing nearly 20% ($4.8 billion) of that total subsegment revenue. The U.S. spice industry has beneted in recent years from consumers' increasing interests in healthier food, organics, and a variety of ethnic cuisines. The retailing of such products has also been boosted by the increased interest in home cooking, fueled by the rise of popular cable cooking shows, celebrity chefs, and cooking competitions (Egg bar-g-que and chili cook-offs). During the pandemic, when many industries felt the pain of decreased demand, many seasoning and spice rms did quite well. Because home cooking increased due to restaurant closures, the demand for consumer-packaged spices remained strong. As restaurants reopened, business shifted back toward its more traditional mix between retail (consumer) sales and foodservice (restaurants). The supply chain of the industry begins with growers located throughout the world. Many spices require specific conditions only available in specic climates and even soil. Very large buyers such as McCormick & Company can buy direct from the growers and move the raw spices directly into their owned processing and packaging operations. Alternatively, large buying groups and wholesalers buy the raw spices and either resell them to processors or they process the spices themselves and sell the nished spices directly to food manufacturing rms or to packaged spice rms such as Nice Spice (and to some degree large rms like McCormick when the quantity of a specic spice is low such that McCormick does not work directly to the farms). The growth of the spice industry overall is generally reflected in the growth of each value chain segment, that is, the role of each segment is mostly consistent and thus each grows or shrinks at roughly the same rate as the entire industry. In the most recent years, this industry revenue growth has been 2-4% due to the mature nature of the industry. As noted, demand increased slightly during the pandemic with 2020 showing 5% growth overall. Protability by value chain segment, however, differs a great deal due to nature of the different business operations and the value added at stages closer to the end customer. The packaging of end-user spices is done either by packaged goods rms such as McCormick or by private-label co-packers. The protability for co-packers is not as high as for rms buying directly from growers and selling directly to retail (such as McCormick). Co-packer protability, however, is higher than all other segments of the value chain. In recent years, co-packers have average gross margins of nearly 60% and operating margins of 30%. Nice Spice Company One of many co-packers in the spice industry, Nice Spice Company was founded in Baltimore in 1974. Although their clients are located primarily in the eastern region of the U.S., Nice Spice does business across the United States and continues to build out more of a national client base. The rm's growth in recent years has resulted in signicant change in their organization and facilities, too. With a large increase in demand from several large new clients in 2018 came the need for a major expansion in their production capacity. The rm therefore went through a major relocation to a larger facility in which they installed multiple new production lines. With that expansion came the need for more employees and an increasingly complex organizational structure. Nice Spice processes and packages over 280 different spices, seasoning blends, and avor extracts. The products range from staples such as black pepper, sea salt, cinnamon, and basil to specialty products such as fenugreek and African bird pepper. For premium freshness, Nice Spice buys, blends, and packages items to order, all within their large production and packaging facility. Rather than package and sell their own branded consumer products, Nice Spice specializes in custom blending and packaging private label products for others. Clients include rms that own and market their own brand of spices and spice blends to retailers. For example, the owners of Eddie's Famous, a global brand of seasoning mixes which you can nd at almost any grocery store, contracts with Nice Spice to blend, package, and ship their products to their retailers worldwide. Clients also include grocery retailers (both national chains and local independents) who want to offer their own store brand of packaged spices. This private-label, consumer-packaged goods segment is very important to Nice Spice as it makes up roughly 80% of their total sales and is handled directly between the company and these types of clients. Conversely, nearly 80% of sales to food service and bulk buyers (food processors) are handled by distributors. As a co-packer (a rm that packages goods for clients\" brands rather than their own), Nice Spice offer clients many choices beyond just the hundreds of individual spices or spice blends. Nice Spice's skilled staff can help clients develop their own custom blend recipes. Their label design and packaging experts help clients design and execute creative and attractive packaging. Customers can choose to order non-irradiated ingredients and those processed to be gluten- free. Customers can order products that are certied organic, kosher, or veried as non-GMO. Packaging options range from bulk bags and cartons to round and square glass jars, grinder top jars, and a variety of canisters with plastic dispensing tops. The level of service, too, is very exible. Clients can order relatively small batches (Eg 100 bottles) or they can order major production runs with palletized shipments sent directly from Nice Spice to retailers around the world. Such flexibility allows Nice Spice to serve a wide range of customers from entrepreneurs, small specialty retailers, large retailers, and on up to global spice brand companies. Whereas consumer brand seasoning and spice companies drive growth largely through the development and launch of new products, Nice Spice, as a co-packing service company, focuses on sales and marketing to gain new clients. It is the value of services offered, along with the quality and range of spices, that attract and retain clients. Business development efforts include attendance at food industry trade shows and conferences, listings in major registries of food co-packing rms, and a reliance on referrals from existing clients and other rms in the food industry. As a relatively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts