Question: FINANCIAL RISK MANAGEMENT Case Study 1 Maximum Word Limit 800 words In order to gain full marks, please show full workings step by step. You

FINANCIAL RISK MANAGEMENT

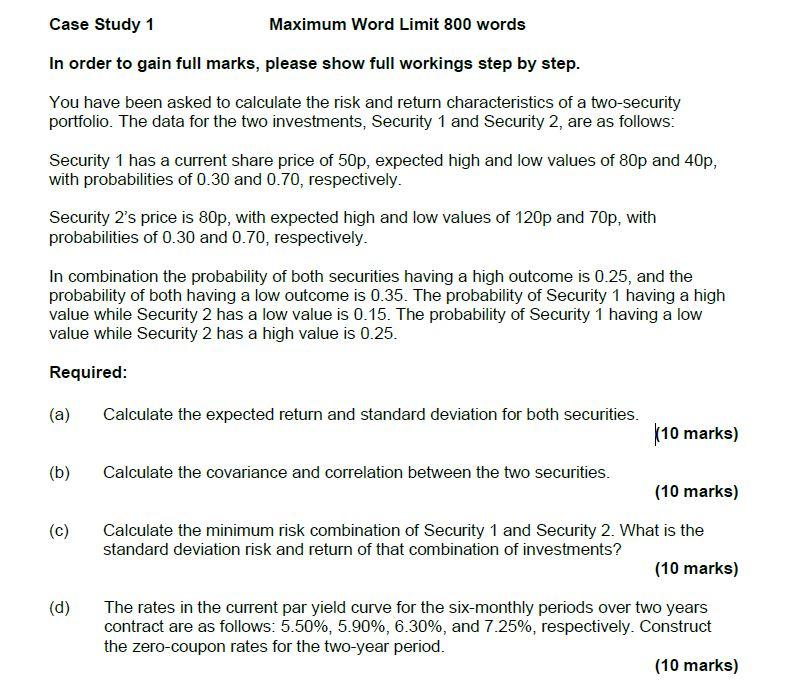

Case Study 1 Maximum Word Limit 800 words In order to gain full marks, please show full workings step by step. You have been asked to calculate the risk and return characteristics of a two-security portfolio. The data for the two investments, Security 1 and Security 2, are as follows: Security 1 has a current share price of 50p, expected high and low values of 80p and 40p, with probabilities of 0.30 and 0.70, respectively. Security 2's price is 80p, with expected high and low values of 120p and 70p, with probabilities of 0.30 and 0.70, respectively. In combination the probability of both securities having a high outcome is 0.25, and the probability of both having a low outcome is 0.35. The probability of Security 1 having a high value while Security 2 has a low value is 0.15. The probability of Security 1 having a low value while Security 2 has a high value is 0.25. Required: (a) Calculate the expected return and standard deviation for both securities. (10 marks) (b) Calculate the covariance and correlation between the two securities. (10 marks) (c) Calculate the minimum risk combination of Security 1 and Security 2. What is the standard deviation risk and return of that combination of investments? (10 marks) (d) The rates in the current par yield curve for the six-monthly periods over two years contract are as follows: 5.50%, 5.90%, 6.30%, and 7.25%, respectively. Construct the zero-coupon rates for the two-year period. (10 marks) Case Study 1 Maximum Word Limit 800 words In order to gain full marks, please show full workings step by step. You have been asked to calculate the risk and return characteristics of a two-security portfolio. The data for the two investments, Security 1 and Security 2, are as follows: Security 1 has a current share price of 50p, expected high and low values of 80p and 40p, with probabilities of 0.30 and 0.70, respectively. Security 2's price is 80p, with expected high and low values of 120p and 70p, with probabilities of 0.30 and 0.70, respectively. In combination the probability of both securities having a high outcome is 0.25, and the probability of both having a low outcome is 0.35. The probability of Security 1 having a high value while Security 2 has a low value is 0.15. The probability of Security 1 having a low value while Security 2 has a high value is 0.25. Required: (a) Calculate the expected return and standard deviation for both securities. (10 marks) (b) Calculate the covariance and correlation between the two securities. (10 marks) (c) Calculate the minimum risk combination of Security 1 and Security 2. What is the standard deviation risk and return of that combination of investments? (10 marks) (d) The rates in the current par yield curve for the six-monthly periods over two years contract are as follows: 5.50%, 5.90%, 6.30%, and 7.25%, respectively. Construct the zero-coupon rates for the two-year period. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts