Question: FINANCIAL RISK MODELLING Question 8 11 Suppose Peter has a utility function U(I) = In r, where r >0 is the total wealth. Moreover, he

FINANCIAL RISK MODELLING

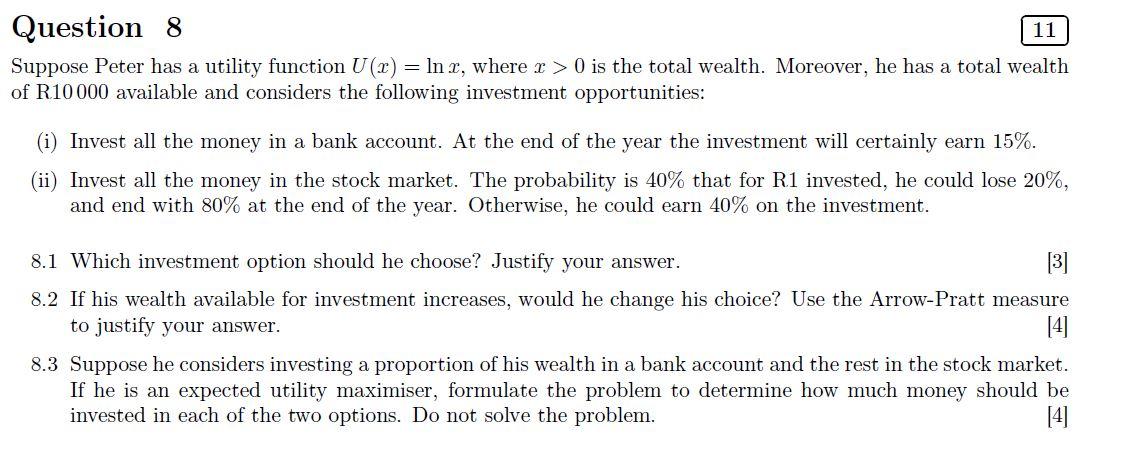

Question 8 11 Suppose Peter has a utility function U(I) = In r, where r >0 is the total wealth. Moreover, he has a total wealth of R10 000 available and considers the following investment opportunities: Invest all the money in a bank account. At the end of the year the investment will certainly earn 15%. (ii) Invest all the money in the stock market. The probability is 40% that for R1 invested, he could lose 20%, and end with 80% at the end of the year. Otherwise, he could earn 40% on the investment. 8.1 Which investment option should he choose? Justify your answer. [3] 8.2 If his wealth available for investment increases, would he change his choice? Use the Arrow-Pratt measure to justify your answer. 8.3 Suppose he considers investing a proportion of his wealth in a bank account and the rest in the stock market. If he is an expected utility maximiser, formulate the problem to determine how much money should be invested in each of the two options. Do not solve the problem. [4] Question 8 11 Suppose Peter has a utility function U(I) = In r, where r >0 is the total wealth. Moreover, he has a total wealth of R10 000 available and considers the following investment opportunities: Invest all the money in a bank account. At the end of the year the investment will certainly earn 15%. (ii) Invest all the money in the stock market. The probability is 40% that for R1 invested, he could lose 20%, and end with 80% at the end of the year. Otherwise, he could earn 40% on the investment. 8.1 Which investment option should he choose? Justify your answer. [3] 8.2 If his wealth available for investment increases, would he change his choice? Use the Arrow-Pratt measure to justify your answer. 8.3 Suppose he considers investing a proportion of his wealth in a bank account and the rest in the stock market. If he is an expected utility maximiser, formulate the problem to determine how much money should be invested in each of the two options. Do not solve the problem. [4]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts