Question: Financial Statement Analysis and EPS Forecasting Report Assignment First, choose a publicly traded company to analyze this semester. Choosing a US company which has

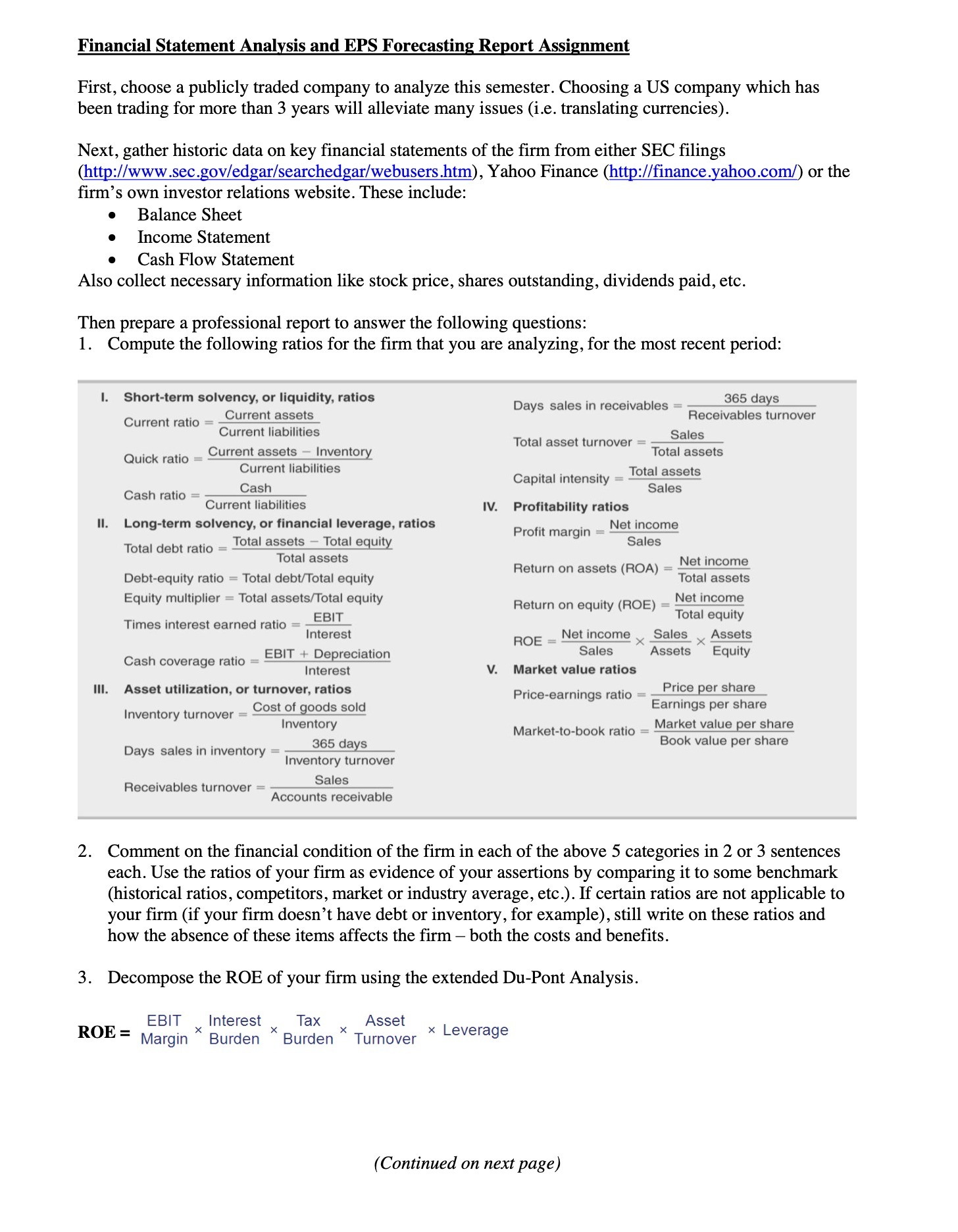

Financial Statement Analysis and EPS Forecasting Report Assignment First, choose a publicly traded company to analyze this semester. Choosing a US company which has been trading for more than 3 years will alleviate many issues (i.e. translating currencies). Next, gather historic data on key financial statements of the firm from either SEC filings (http://www.sec.gov/edgar/searchedgar/webusers.htm), Yahoo Finance (http://finance.yahoo.com/) or the firm's own investor relations website. These include: . Balance Sheet Income Statement Cash Flow Statement Also collect necessary information like stock price, shares outstanding, dividends paid, etc. Then prepare a professional report to answer the following questions: 1. Compute the following ratios for the firm that you are analyzing, for the most recent period: Current liabilities I. Short-term solvency, or liquidity, ratios Current assets Current ratio = Quick ratio = Current assets - Inventory Cash ratio II. Total debt ratio = Cash Current liabilities Current liabilities Long-term solvency, or financial leverage, ratios Total assets - Total equity Total assets Debt-equity ratio = Total debt/Total equity Equity multiplier = Total assets/Total equity Times interest earned ratio = EBIT Interest Cash coverage ratio = EBIT Depreciation Interest III. Asset utilization, or turnover, ratios Inventory turnover = Cost of goods sold Days sales in inventory Receivables turnover = Inventory 365 days Inventory turnover Sales Accounts receivable Days sales in receivables 365 days Receivables turnover Sales Total assets Total assets Sales Total asset turnover = Capital intensity = IV. Profitability ratios Profit margin = Net income Sales Net income Return on assets (ROA) = Total assets Net income Return on equity (ROE) Total equity ROE = Net income Sales Sales Assets Assets Equity V. Market value ratios Price-earnings ratio = Market-to-book ratio = Price per share Earnings per share Market value per share Book value per share 2. Comment on the financial condition of the firm in each of the above 5 categories in 2 or 3 sentences each. Use the ratios of your firm as evidence of your assertions by comparing it to some benchmark (historical ratios, competitors, market or industry average, etc.). If certain ratios are not applicable to your firm (if your firm doesn't have debt or inventory, for example), still write on these ratios and how the absence of these items affects the firm - both the costs and benefits. 3. Decompose the ROE of your firm using the extended Du-Pont Analysis. ROE = EBIT Interest Margin Burden Burden Turnover Tax Asset X * Leverage (Continued on next page)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts