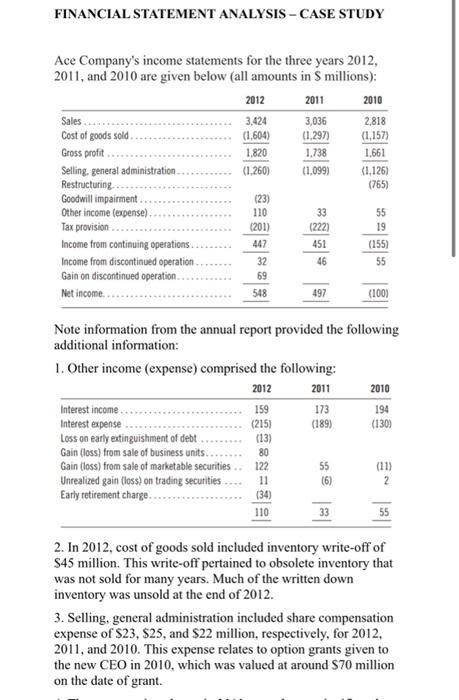

Question: FINANCIAL STATEMENT ANALYSIS - CASE STUDY Ace Company's income statements for the three years 2012, 2011 , and 2010 are given below (all amounts in

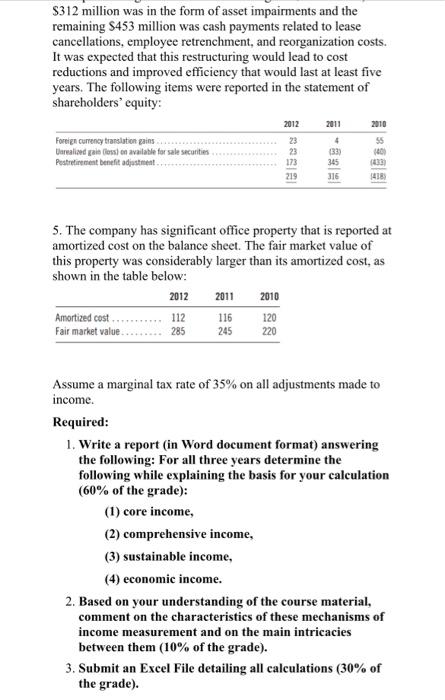

FINANCIAL STATEMENT ANALYSIS - CASE STUDY Ace Company's income statements for the three years 2012, 2011 , and 2010 are given below (all amounts in S millions): Note information from the annual report provided the following additional information: 1. Other income (expense) comprised the following: 2. In 2012, cost of goods sold included inventory write-off of \$45 million. This write-off pertained to obsolete inventory that was not sold for many years. Much of the written down inventory was unsold at the end of 2012. 3. Selling, general administration included share compensation expense of \$23, \$25, and \$22 million, respectively, for 2012 , 2011 , and 2010. This expense relates to option grants given to the new CEO in 2010 , which was valued at around $70 million on the date of grant. \$312 million was in the form of asset impairments and the remaining $453 million was cash payments related to lease cancellations, employee retrenchment, and reorganization costs. It was expected that this restructuring would lead to cost reductions and improved efficiency that would last at least five years. The following items were reported in the statement of shareholders' equity: 5. The company has significant office property that is reported at amortized cost on the balance sheet. The fair market value of this property was considerably larger than its amortized cost, as shown in the table below: Assume a marginal tax rate of 35% on all adjustments made to income. Required: 1. Write a report (in Word document format) answering the following: For all three years determine the following while explaining the basis for your calculation ( 60% of the grade): (1) core income, (2) comprehensive income, (3) sustainable income, (4) economic income. 2. Based on your understanding of the course material, comment on the characteristics of these mechanisms of income measurement and on the main intricacies between them ( 10% of the grade). 3. Submit an Excel File detailing all calculations ( 30% of the grade)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts