Question: Financial Statement Analysis Guidelines: 1. The student must find a publicly listed company for his/her analysis. Use the Phil. Stock Exchange in looking for a

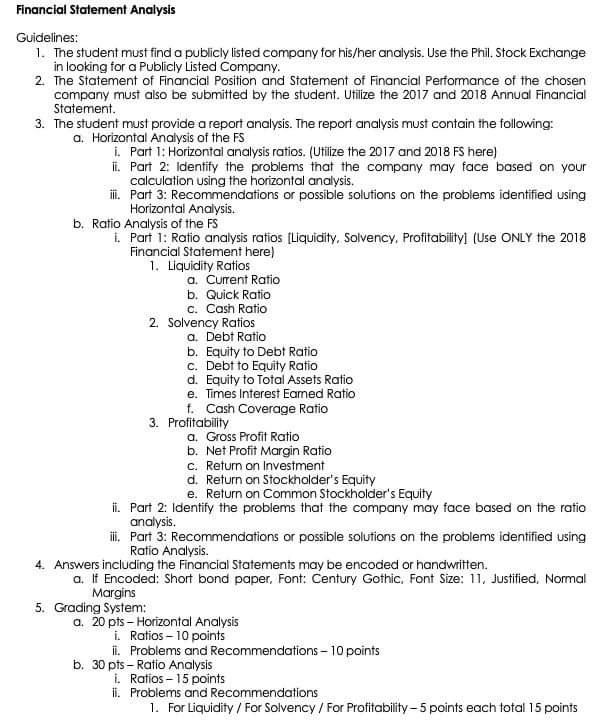

Financial Statement Analysis Guidelines: 1. The student must find a publicly listed company for his/her analysis. Use the Phil. Stock Exchange in looking for a Publicly Listed Company. 2 The Statement of Financial Position and Statement of Financial Performance of the chosen company must also be submitted by the student. Utilize the 2017 and 2018 Annual Financial Statement 3. The student must provide a report analysis. The report analysis must contain the following: a. Horizontal Analysis of the FS i. Part 1: Horizontal analysis ratios. (Utilize the 2017 and 2018 FS here) i Part 2: Identify the problems that the company may face based on your calculation using the horizontal analysis. ii. Part 3: Recommendations or possible solutions on the problems identified using Horizontal Analysis. b. Ratio Analysis of the FS Part 1: Ratio analysis ratios (Liquidity, Solvency. Profitability (Use ONLY the 2018 Financial Statement here) 1. Liquidity Ratios a. Current Ratio b. Quick Ratio C. Cash Ratio 2 Solvency Ratios a. Debt Ratio b. Equity to Debt Ratio c. Debt to Equity Ratio d. Equity to Total Assets Ratio e. Times Interest Eamed Ratio t. Cash Coverage Ratio 3. Profitability a. Gross Profit Ratio b. Net Profit Margin Ratio C. Return on Investment d. Return on Stockholder's Equity e. Return on Common Stockholder's Equity ii. Part 2: Identify the problems that the company may face based on the ratio analysis. ill. Part 3: Recommendations or possible solutions on the problems identified using Ratio Analysis. 4. Answers including the Financial Statements may be encoded or handwritten. a. If Encoded: short bond paper, Font: Century Gothic, Font Size: 11. Justified. Normal Margins 5. Grading System: a. 20 pts - Horizontal Analysis i. Ratios - 10 points i. Problems and Recommendations - 10 points b. 30 pts - Ratio Analysis Ratios -15 points ii. Problems and Recommendations 1. For Liquidity / For Solvency / For Profitability - 5 points each total 15 points Financial Statement Analysis Guidelines: 1. The student must find a publicly listed company for his/her analysis. Use the Phil. Stock Exchange in looking for a Publicly Listed Company. 2 The Statement of Financial Position and Statement of Financial Performance of the chosen company must also be submitted by the student. Utilize the 2017 and 2018 Annual Financial Statement 3. The student must provide a report analysis. The report analysis must contain the following: a. Horizontal Analysis of the FS i. Part 1: Horizontal analysis ratios. (Utilize the 2017 and 2018 FS here) i Part 2: Identify the problems that the company may face based on your calculation using the horizontal analysis. ii. Part 3: Recommendations or possible solutions on the problems identified using Horizontal Analysis. b. Ratio Analysis of the FS Part 1: Ratio analysis ratios (Liquidity, Solvency. Profitability (Use ONLY the 2018 Financial Statement here) 1. Liquidity Ratios a. Current Ratio b. Quick Ratio C. Cash Ratio 2 Solvency Ratios a. Debt Ratio b. Equity to Debt Ratio c. Debt to Equity Ratio d. Equity to Total Assets Ratio e. Times Interest Eamed Ratio t. Cash Coverage Ratio 3. Profitability a. Gross Profit Ratio b. Net Profit Margin Ratio C. Return on Investment d. Return on Stockholder's Equity e. Return on Common Stockholder's Equity ii. Part 2: Identify the problems that the company may face based on the ratio analysis. ill. Part 3: Recommendations or possible solutions on the problems identified using Ratio Analysis. 4. Answers including the Financial Statements may be encoded or handwritten. a. If Encoded: short bond paper, Font: Century Gothic, Font Size: 11. Justified. Normal Margins 5. Grading System: a. 20 pts - Horizontal Analysis i. Ratios - 10 points i. Problems and Recommendations - 10 points b. 30 pts - Ratio Analysis Ratios -15 points ii. Problems and Recommendations 1. For Liquidity / For Solvency / For Profitability - 5 points each total 15 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts