Question: Financial Statement Analysis: True or False ( Questions 1 - 5 ) Creditors of a business are more concerned with the future cash flows of

Financial Statement Analysis:

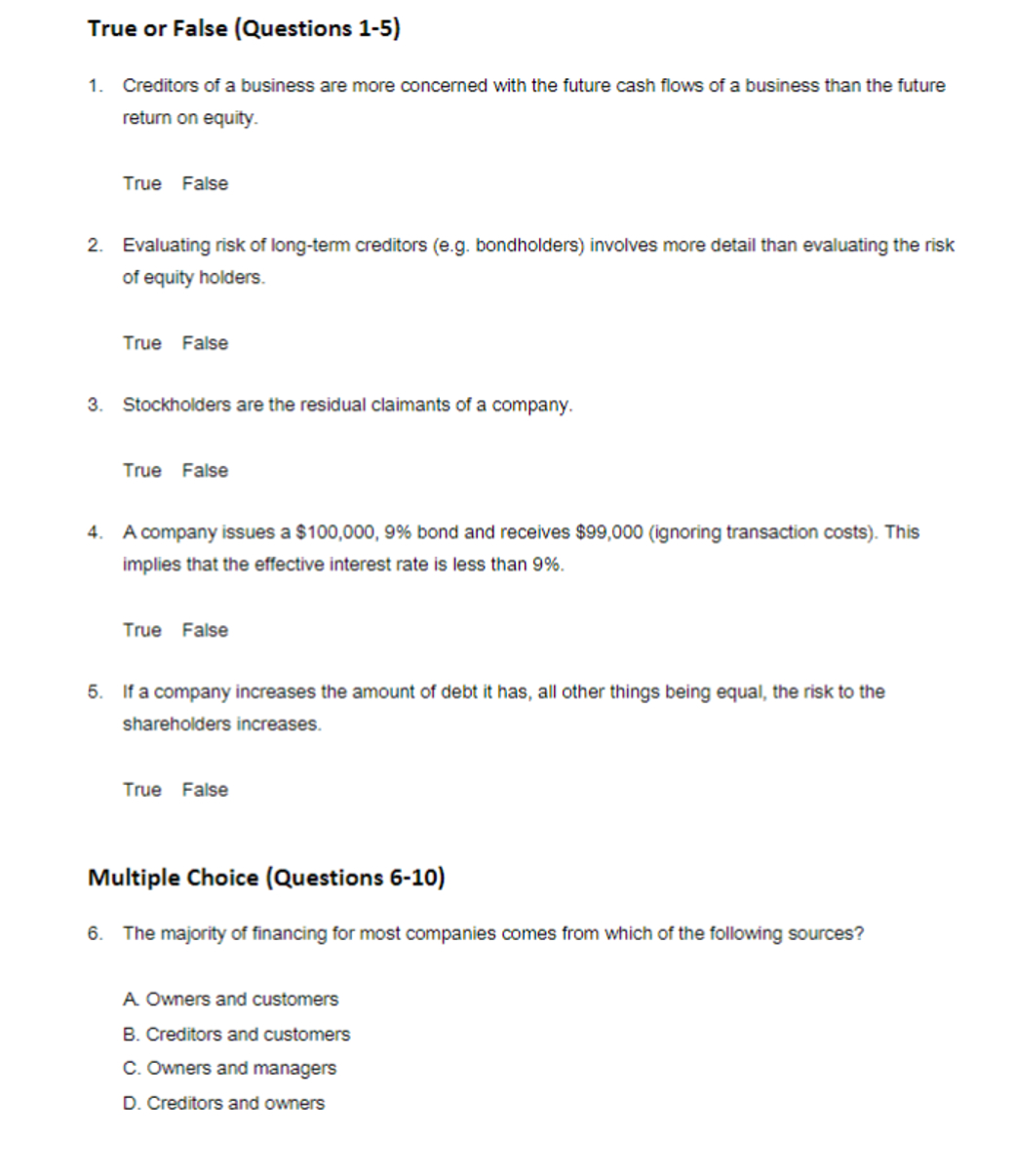

True or False Questions

Creditors of a business are more concerned with the future cash flows of a business than the future

return on equity.

True False

Evaluating risk of longterm creditors eg bondholders involves more detail than evaluating the risk

of equity holders.

True False

Stockholders are the residual claimants of a company.

True False

A company issues a $ bond and receives $ignoring transaction costs This

implies that the effective interest rate is less than

True False

If a company increases the amount of debt it has, all other things being equal, the risk to the

shareholders increases.

True False

Multiple Choice Questions

The majority of financing for most companies comes from which of the following sources?

A Owners and customers

B Creditors and customers

C Owners and managers

D Creditors and owners Chapter Three Exercises

Which of the following would not be found listed as a liability on a company's balance sheet?

A Operating lease obligations

B Capital lease obligations

C Bonds payable

D Taxes payable

Which of the following is true concerning bond covenants?

A Bond covenants are restrictions placed on bondholders to protect rights of equity holders.

B Violation of a bond covenant requires that a company declares bankruptcy.

C If a company violates a bond covenant, it means it has failed to make interest or principal

repayments on debt in a timely manner.

D Bond covenants are legal restrictions placed in order to minimize the risk of default on bonds.

Treasury stock is:

A investments in government securities

B retained earnings that have been appropriated to make equity investments.

C a company's own stock that it has repurchased.

D assets held for safekeeping in company's vaults.

A defined benefit pension plan is said to be underfunded, if:

A the pension obligation is more than the asset value.

B the pension obligation is less than the asset value.

C the pension obligation is equal to the asset value.

D None of the above The purchase of treasury stock commonly called stock buybacks is being done with increasing

frequency in lieu of dividend payments.

Required:

a Explain why stock buybacks are similar to dividends from the company's viewpoint.

b Explain why managers might prefer the purchase of treasury shares to the payment of

dividends.

c Explain why investors might prefer that firms use excess cash to purchase treasury shares rather

than pay dividends.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock