Question: (Financial statement analysis) Using the following financial statements for Pamplin, inc: a. Compute the following ratios for both 2012 and 2013 using the financial statements

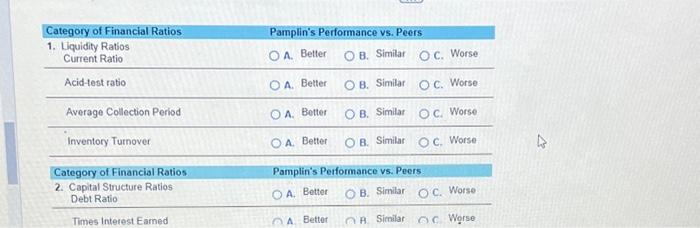

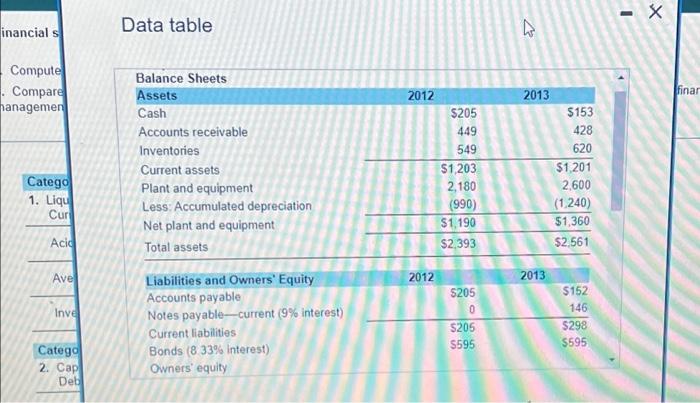

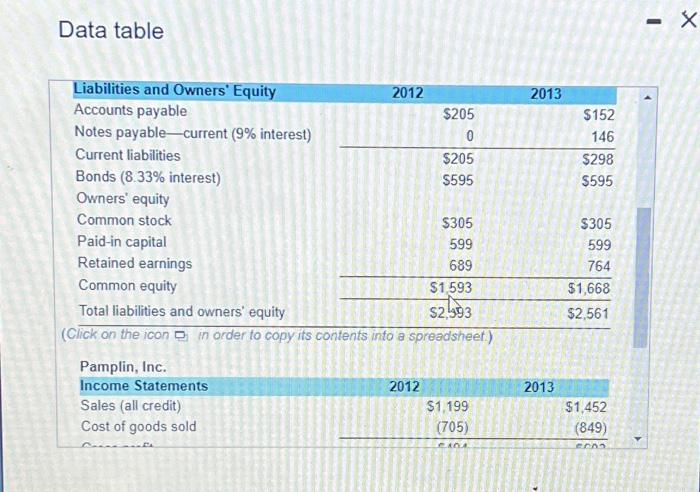

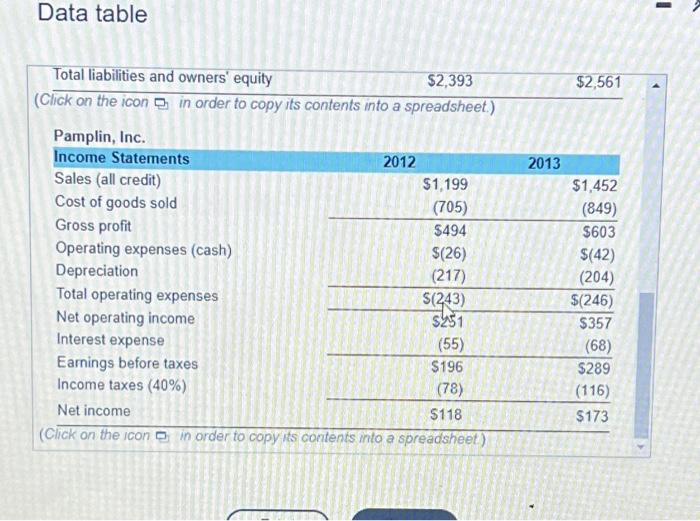

(Financial statement analysis) Using the following financial statements for Pamplin, inc: a. Compute the following ratios for both 2012 and 2013 using the financial statements above. b. Compare Parnplin's financial ratios to the industry norms listed above and assess each of the following altributes of the firm's financial condition. liquifity, capital structure, asset managernent eficiency, and profitablity a. Compute the following ratios for both 2012 and 2013 using the financial statements abover Pamplin's 2012 current iatio is (Round to two decimal places) Pamplin's 2013 cunent ratio is (Round to two dacimal places) Pampins 2012 acid test rato is (Round to two decimal places) Pamplin's 2013 acid lest ratio is (Round to two decimal places) Pampliris 2012 inventory furnover is tmes (Round to tho decmal places) Pamplin's 2013 imventory lumover is times (Round to two decimal places) Pampln's 2012 average collection period is days (Round to one decimal place) Category of Financial Ratios 1. Liquidity Ratios Current Ratio Pamplin's Performance vs. Peers A. Better B. Similar C. Worse Acid-test ratio A. Better B. Similar c. Worse Average Collection Period A. Botter B. Similar c. Worse Inventory Turnover A. Better B. Similar c. Worse Category of Financial Ratios 2. Capital Structure Ratios Debt Ratio Pamplin's Performance vs. Peers A. Better B. Similar C. Worse A Bettor A Similar C Worse Data table Data table Data table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts