Question: Financial Statement GLO202 (No Analysis Tab) - Based on Exercise 2-9 LO A1 Prepare journal entries for each transaction and identify the financial statement impact

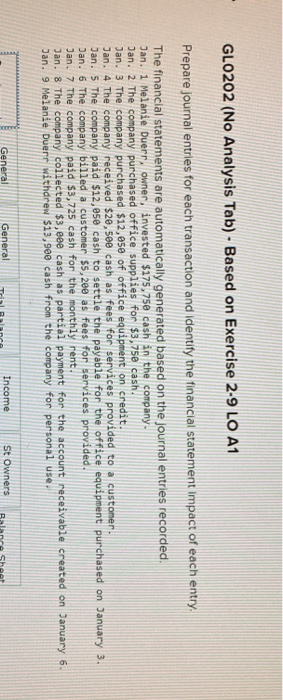

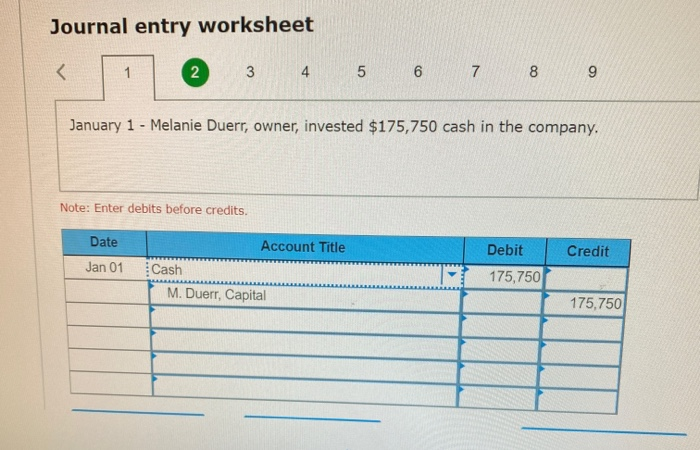

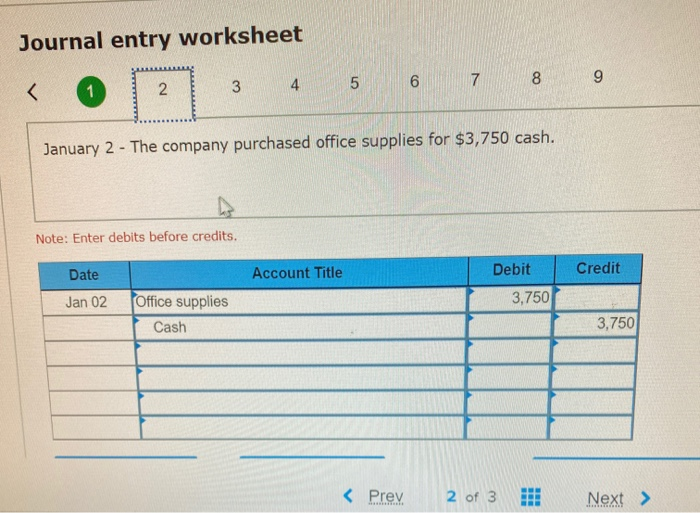

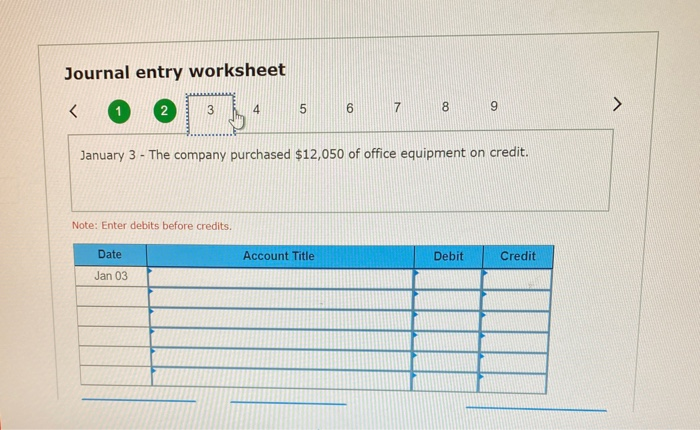

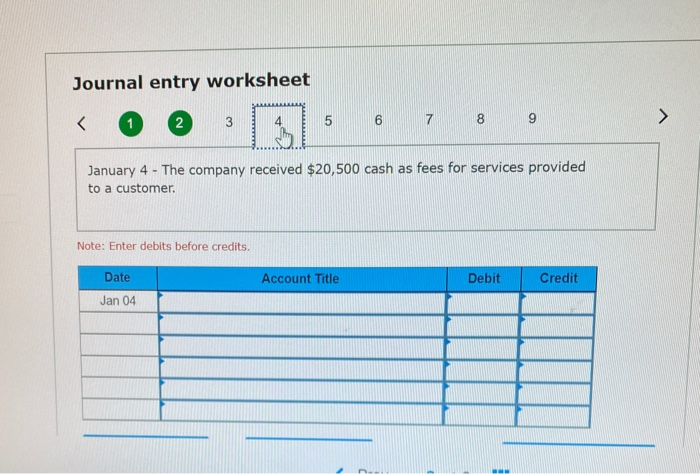

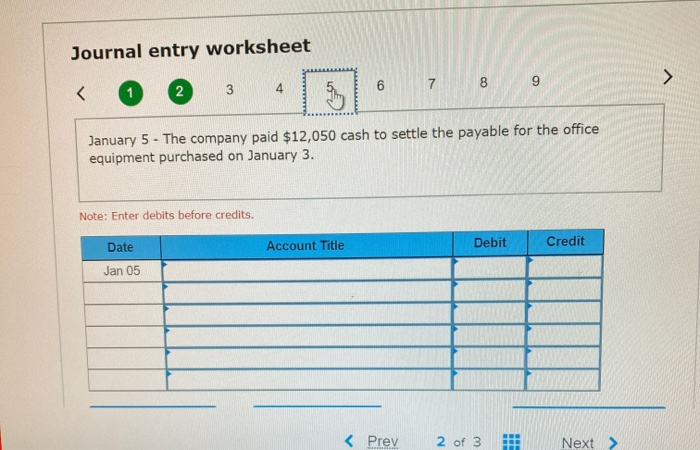

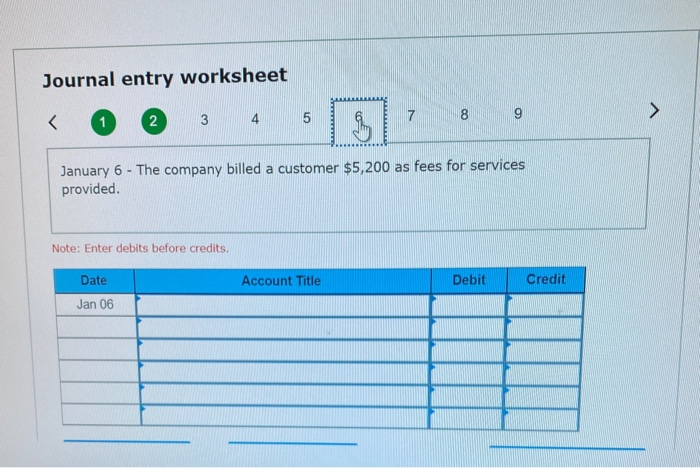

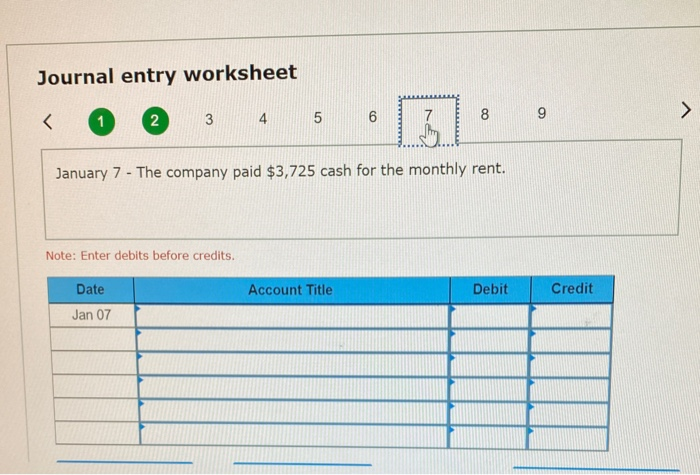

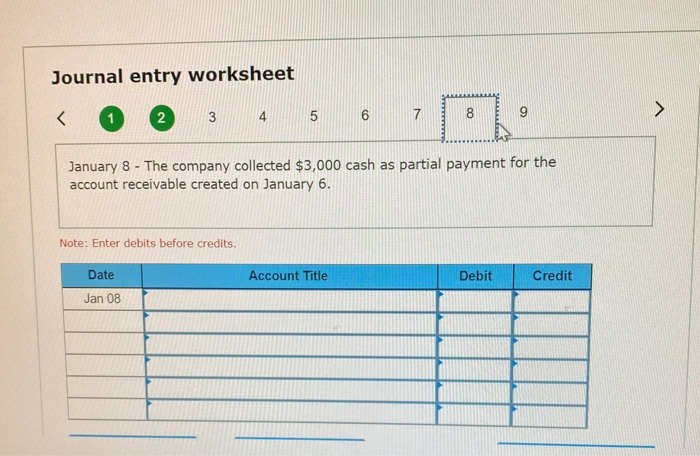

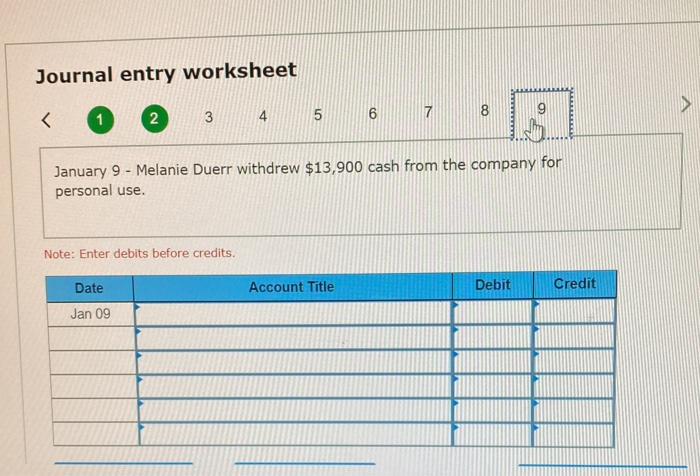

GLO202 (No Analysis Tab) - Based on Exercise 2-9 LO A1 Prepare journal entries for each transaction and identify the financial statement impact of each entry The financial statements are automatically generated based on the journal entries recorded. Jan. 1 Melanie Duerr, owner, invested $175,750 cash in the company. Jan. 2 The company purchased office supplies for $3,750 cash. Jan. 3 The company purchased $12,050 of office equipment on credit. Jan. 4 The company received $20,500 cash as fees for services provided to a customer. Jan. 5 The company paid $12,050 cash to settle the payable for the office equipment purchased on January 3. Jan. 6 The company billed a customer $5,200 as fees for services provided Jan. 7 The company paid $3,725 cash for the monthly rent. Jan. 8 The company collected $3,eee cash as partial payment for the account receivable created on January 6. Jan. 9 Melanie Duerr withdrew $13,900 cash from the company for personal use. General General Trial Income St Owners St Owners Balance Sheet Journal entry worksheet 3 4 5 6 7 8 9 January 1 - Melanie Duerr, owner, invested $175,750 cash in the company. Note: Enter debits before credits. Credit Date Jan 01 Account Title Cash M. Duerr, Capital Debit 175,750 175,750 Journal entry worksheet 3 4 5 6 7 8 9 January 2 - The company purchased office supplies for $3,750 cash. Note: Enter debits before credits. Account Title Credit Date Jan 02 Debit 3,750 Office supplies Cash _ 3,750 Journal entry worksheet 20151 Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts