Question: journal Entries GLO202 (No Analysis Tab) - Based on Exercise 2-9 LO A1 Prepare journal entries for each transaction and identify the financial statement impact

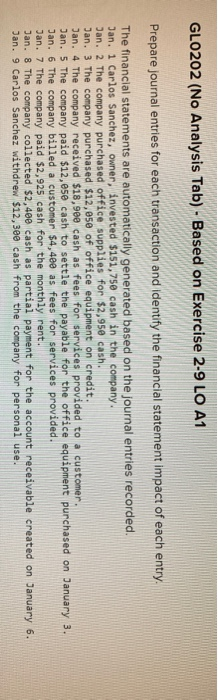

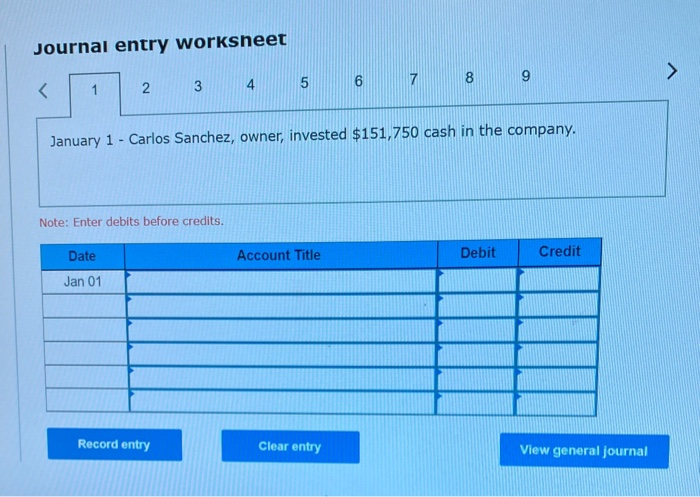

GLO202 (No Analysis Tab) - Based on Exercise 2-9 LO A1 Prepare journal entries for each transaction and identify the financial statement impact of each entry. The financial statements are automatically generated based on the journal entries recorded. Jan. 1 Carlos Sanchez, owner, invested $151,750 cash in the company. Jan. 2 The company purchased office supplies for $2,950 cash. Jan. 3 The company purchased $12,050 of office equipment on credit. Jan. 4 The company received $18,900 cash as fees for services provided to a customer. Jan. 5 The company paid $12, ese cash to settle the payable for the office equipment purchased on January 3. Jan. 6 The company billed a customer $4,400 as fees for services provided. Jan. 7 The company paid $2,925 cash for the monthly rent. Jan. 8 The company collected $2,400 cash as partial payment for the account receivable created on January 6. Jan. 9 Carlos Sanchez withdrew $12,300 cash from the company for personal use. Journal entry worksheet 2 8 9 5 7 3 January 1 - Carlos Sanchez, owner, invested $151,750 cash in the company. Note: Enter debits before credits. Account Title Debit Credit Date Jan 01 MATHE Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts