Question: Financial Statement Reporting for an Operating Lease Harmeling Paint Ball (HPB) Corporation needs a new air compressor that costs $80,000. HPB will need it for

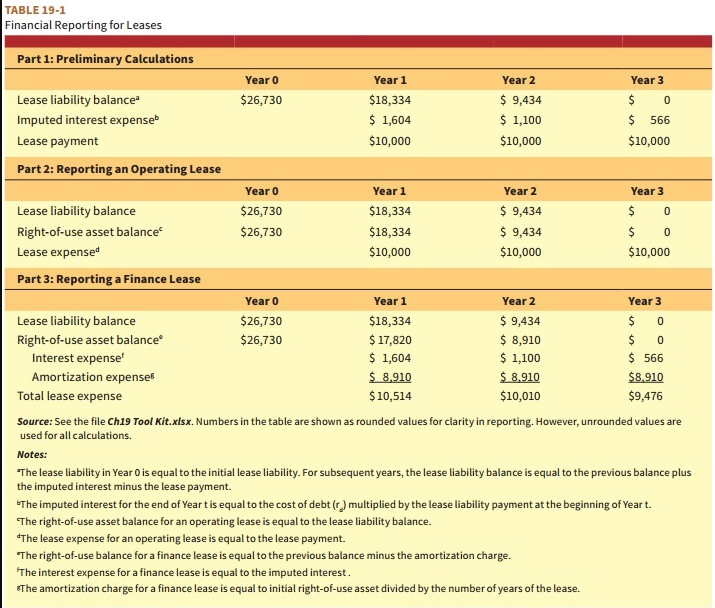

| Financial Statement Reporting for an Operating Lease Harmeling Paint Ball (HPB) Corporation needs a new air compressor that costs $80,000. HPB will need it for only 3 years even though the compressor's economic life is long enough so that the lease is an operating lease. The firm can lease the compressor for 3 years with $30,000 lease payments at the end of each year. HPB's cost of debt is 8%. Answer the following questions. (Hint: See Table 19-1.)

$

$

$

$

$

$

|

TABLE 19-1 Financial Reporting for Leases IULal tedse experise $10,514 99,410 Source: See the file Ch19 Tool Kit.xls.x. Numbers in the table are shown as rounded values for clarity in reporting. However, unrounded values are used for all calculations. Notes: The lease liability in Year 0 is equal to the initial lease liability. For subsequent years, the lease liability balance is equal to the previous balance plus the imputed interest minus the lease payment. the imputed interest for the end of Year t is equal to the cost of debt (rd) multiplied by the lease liability payment at the beginning of Year t. The right-of-use asset balance for an operating lease is equal to the lease liability balance. dT The lease expense for an operating lease is equal to the lease payment. The right-of-use balance for a finance lease is equal to the previous balance minus the amortization charge. 'The interest expense for a finance lease is equal to the imputed interest . sThe amortization charge for a finance lease is equal to initial right-of-use asset divided by the number of years of the lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts