Question: Financing Options. A new tractor can be acquired by: 1. Outright purchase for cash, at a cost of $65,400. 2. Purchase by an installment contract

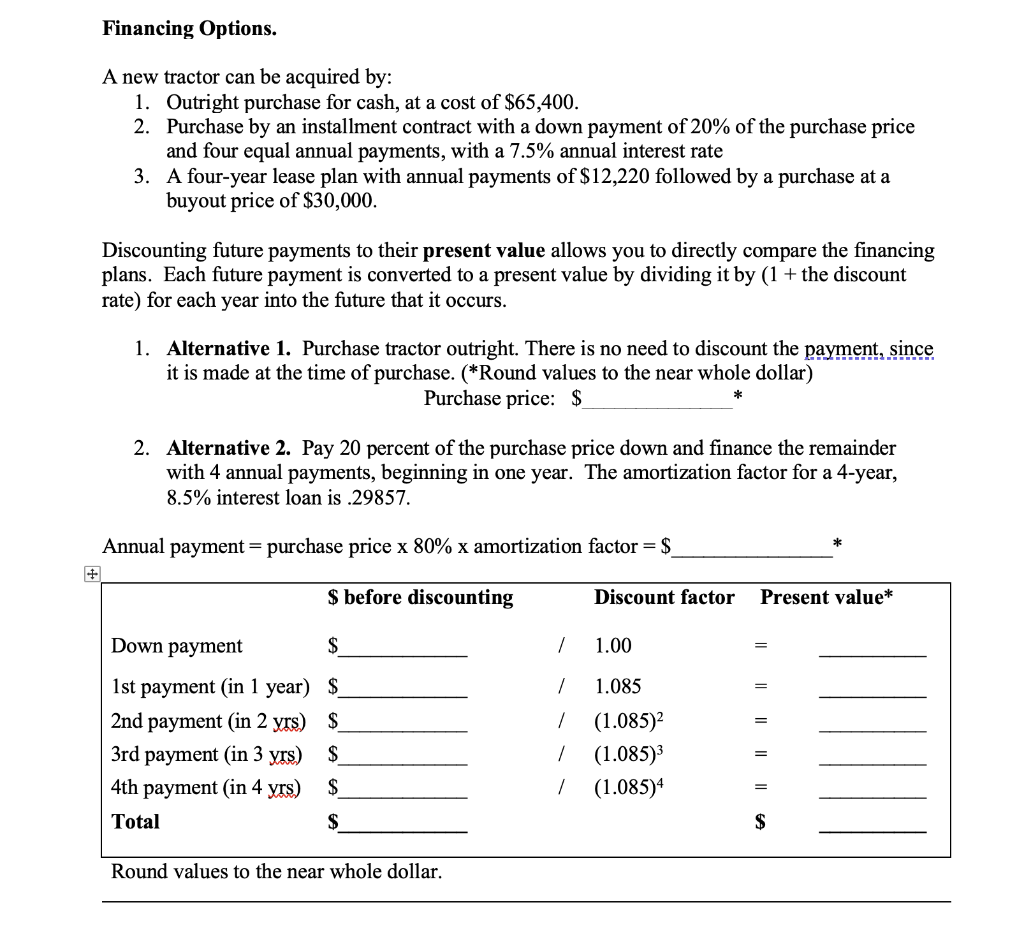

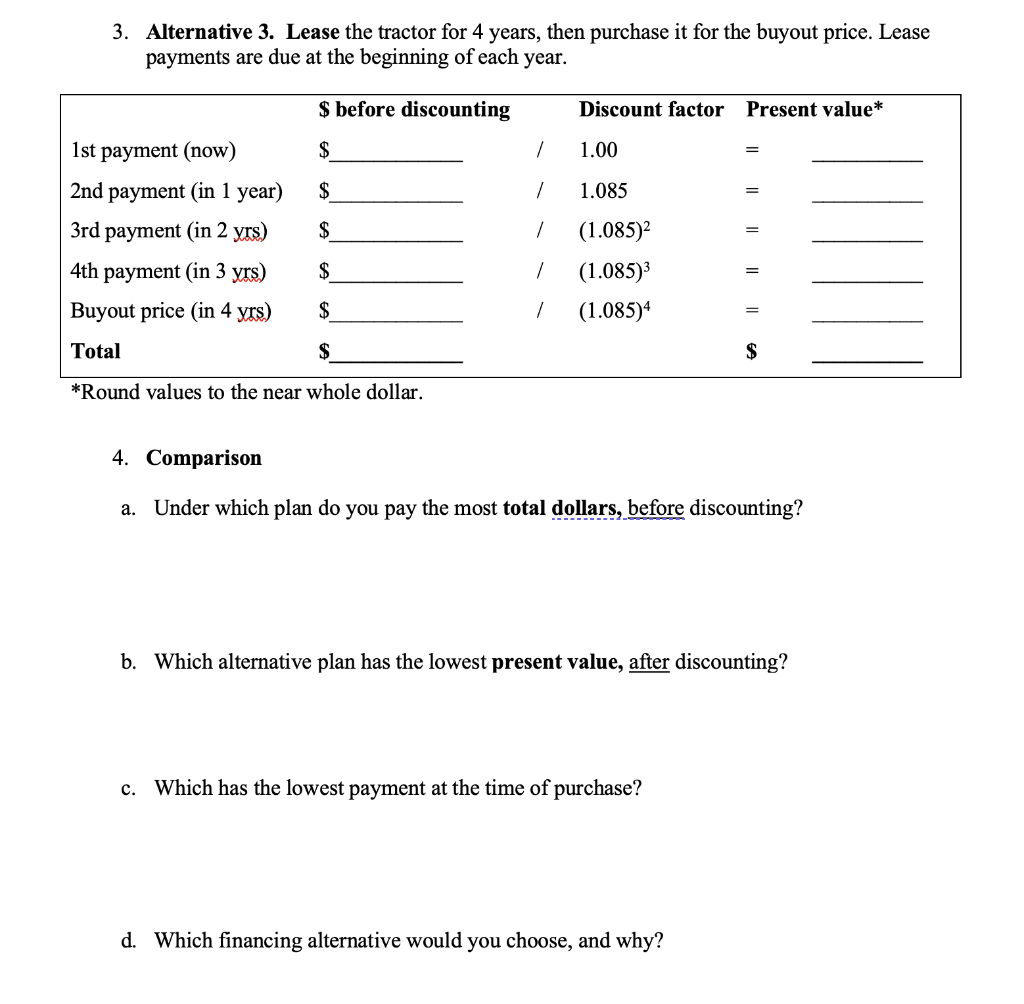

Financing Options. A new tractor can be acquired by: 1. Outright purchase for cash, at a cost of $65,400. 2. Purchase by an installment contract with a down payment of 20% of the purchase price and four equal annual payments, with a 7.5% annual interest rate 3. A four-year lease plan with annual payments of $12,220 followed by a purchase at a buyout price of $30,000. Discounting future payments to their present value allows you to directly compare the financing plans. Each future payment is converted to a present value by dividing it by (1+ the discount rate) for each year into the future that it occurs. 1. Alternative 1. Purchase tractor outright. There is no need to discount the payment since it is made at the time of purchase. (*Round values to the near whole dollar) Purchase price: : 2. Alternative 2. Pay 20 percent of the purchase price down and finance the remainder with 4 annual payments, beginning in one year. The amortization factor for a 4-year, 8.5% interest loan is .29857 . Annual payment = purchase price 80% amortization factor =$ Round values to the near whole dollar. 3. Alternative 3. Lease the tractor for 4 years, then purchase it for the buyout price. Lease payments are due at the beginning of each year. *Round values to the near whole dollar. 4. Comparison a. Under which plan do you pay the most total dollars, before discounting? b. Which alternative plan has the lowest present value, after discounting? c. Which has the lowest payment at the time of purchase? d. Which financing alternative would you choose, and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts