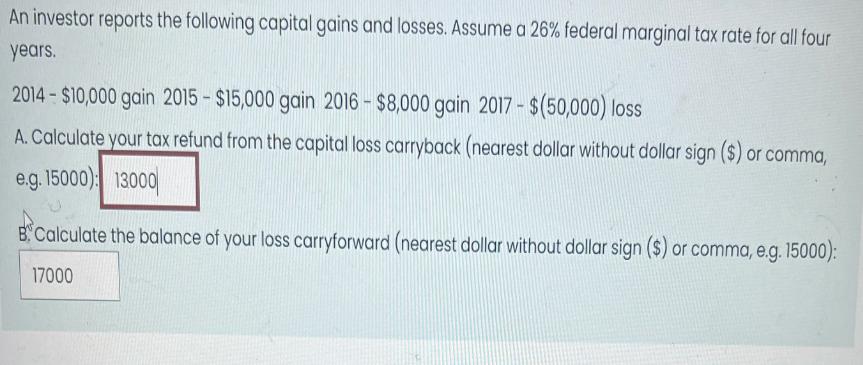

Question: An investor reports the following capital gains and losses. Assume a 26% federal marginal tax rate for all four years. 2014-$10,000 gain 2015 -

An investor reports the following capital gains and losses. Assume a 26% federal marginal tax rate for all four years. 2014-$10,000 gain 2015 - $15,000 gain 2016 - $8,000 gain 2017 - $(50,000) loss A. Calculate your tax refund from the capital loss carryback (nearest dollar without dollar sign ($) or comma, e.g. 15000): 13000 B. Calculate the balance of your loss carryforward (nearest dollar without dollar sign ($) or comma, e.g. 15000): 17000

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

A Tax refund from capital loss carryback Net capital gain before loss Sum of gains10... View full answer

Get step-by-step solutions from verified subject matter experts