Question: Find fect or loob QUESTION 1 ( 3 0 marks, 5 4 minutes ) Lucky Dlamini Steel ( Pty ) Ltd ( LDS ) manufactures

Find fect or loob

QUESTION marks, minutes

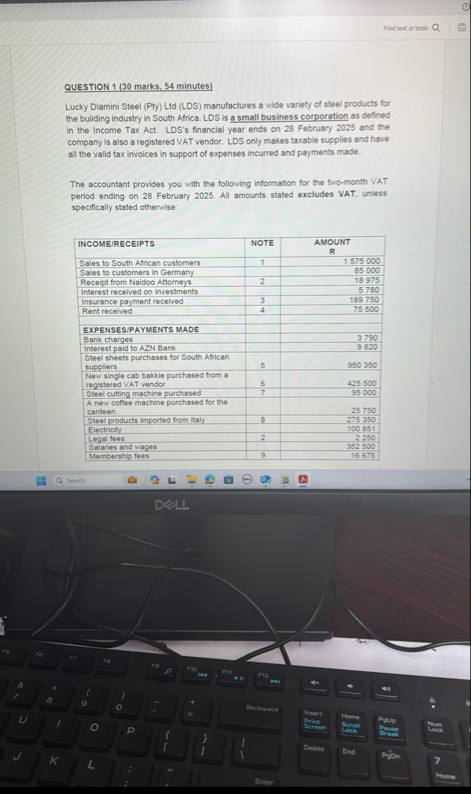

Lucky Dlamini Steel Pty Ltd LDS manufactures a wide variety of steel products for the building industry in South Africa. LDS is a small business corporation as defined in the income Tax Act. LDSs financial year ends on February and the company is also a registered VAT vendor. LDS only makes taxable supplies and have all the valid tax invoices in support of expenses incurred and payments made.

The accountant provides you with the following information for the twomonth VAT period ending on February All amounts stated excludes VAT, unless specifically stated otherwise:

tableINCOMERECEIPTSNOTE,AMOUNT

Findsertortooks

Notes

Included in the amount of the sales to South African customers is an amount of R for sales made to Mr D Moto on January Mr D Moto was finally sequestrated on February in the Pretoria High Court.

The receipt of R from Naidoo Attorneys relates to an amount that was written off as a bad debt on February for a sale to Peter Odinga Manufacturing Pty Ltd during the year of assessment. This amount includes VAT. The legal fees paid of R relates to the collection of the bad debt previously written off.

LDS recelved an amount of R on February from its insurance company. The amount recelved represents a claim for the following:

R for a damaged steel cutting machine used in the manufacturing process.

R for a damaged coffee machine used by statf members in their canteen.

The rent recelved of R is for rental income from DCT Consulting Pty Led renting vacant office space from LDS

Included in the purchases amount of R is an amount of R that was identified as damaged goods on delivery to the factory buliding of LDS on February The suppler has issued the necessary tax credit nole on February forios.

Findsertortooks

Notes

Included in the amount of the sales to South African customers is an amount of R for sales made to Mr D Moto on January Mr D Moto was finally sequestrated on February in the Pretoria High Court.

The receipt of R from Naidoo Attorneys relates to an amount that was written off as a bad debt on February for a sale to Peter Odinga Manufacturing Pty Ltd during the year of assessment. This amount includes VAT. The legal fees paid of R relates to the collection of the bad debt previously written off.

LDS recelved an amount of R on February from its insurance company. The amount recelved represents a claim for the following:

R for a damaged steel cutting machine used in the manufacturing process.

R for a damaged coffee machine used by statf members in their canteen.

The rent recelved of R is for rental income from DCT Consulting Pty Led renting vacant office space from LDS

Included in the purchases amount of R is an amount of R that was identified as damaged goods on delivery to the factory buliding of LDS on February The suppler has issued the necessary tax credit nole on February forios.

Tind bext ar lools

Notes

Included in the amount of the sales to South African customers is an amount of R for sales made to Mr D Moto on January Mr D Moto was finaly sequestrated on February in the Pretoria High Court.

The receipt of R from Naidoo Attomeys relates to an amount that was written off as a bad debt on February for a sale to Peter Odinga Manufacturing Pty Ltd during the year of assessment. This amount includes VAT. The legal fees paid of R relates to the collection of the bad debt previously written oft.

LDS recelved an amount of R on February from its insurance company. The amount received represents a claim for the following:

R for a damaged steel cutting machine used in the manufacturing process.

R for a damaged coffee machine used by stafl members in their canteen.

The rent recelved of R is for rental income from DCT Consuting Pty Ldd renting vacant office space from LDS

Included in the purchases amount of R is an amount of R that was identified as damaged goods on delivery to the factory bullding of LDS on February The supplier has issued the necessary tax credit note on February for LDS

Find tee ortiocs

A new single cap bakkie was purchased on February for an amount of Rincluding VAT The bakkie was provided as a company vehicle to Mr D Malebuia, the marketing manager of LDS on February Mr Matebula makes not contribution to the cost of the bakkie.

A secondhand cutting machine was purchased from a nonvendor on January for R LDS pald R of the purchase price on January and the balance of R on March

LDS purchased special steel plates from an Italian su

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock