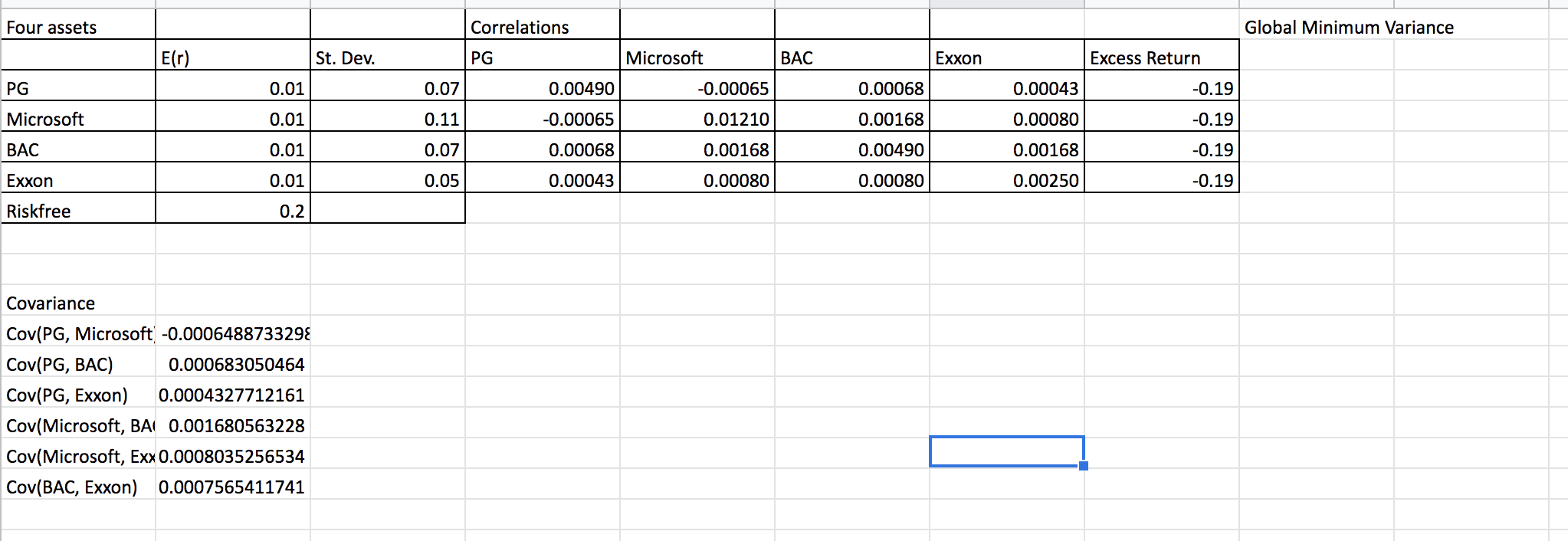

Question: Find minimum variance Four assets Eir) PG Microsoft BAC Exxon St. Dev. 0.01 0.01 0.01 0.01 0.01 0.2 0.07 0.11 0.07 0.05 Correlations PG Microsoft

Find minimum variance

Find minimum variance

Four assets Eir) PG Microsoft BAC Exxon St. Dev. 0.01 0.01 0.01 0.01 0.01 0.2 0.07 0.11 0.07 0.05 Correlations PG Microsoft BAC 0.00490 -0.00065 -0.00065 0.01210 0.00068 0.00168 0.00043 0.00080 Exxon 0.00068 0.00168 0.00490 0.00080 | Global Minimum Variance Excess Return 0.00043 -0.19 0.00080 -0.19 0.00168 -0.19 0.00250 -0.19 Riskfree Covariance Cov(PG, Microsoft -0.0006488733298 Cov(PG, BAC) 0.000683050464 Cov(PG, Exxon) 0.0004327712161 Cov(Microsoft, BAI 0.001680563228 Cov(Microsoft, Exx0.0008035256534 Cov(BAC, Exxon) 0.0007565411741 Four assets Eir) PG Microsoft BAC Exxon St. Dev. 0.01 0.01 0.01 0.01 0.01 0.2 0.07 0.11 0.07 0.05 Correlations PG Microsoft BAC 0.00490 -0.00065 -0.00065 0.01210 0.00068 0.00168 0.00043 0.00080 Exxon 0.00068 0.00168 0.00490 0.00080 | Global Minimum Variance Excess Return 0.00043 -0.19 0.00080 -0.19 0.00168 -0.19 0.00250 -0.19 Riskfree Covariance Cov(PG, Microsoft -0.0006488733298 Cov(PG, BAC) 0.000683050464 Cov(PG, Exxon) 0.0004327712161 Cov(Microsoft, BAI 0.001680563228 Cov(Microsoft, Exx0.0008035256534 Cov(BAC, Exxon) 0.0007565411741

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts