Question: find solution for this problem Ictoria. Ples sactions: Expense, 511: Series Expense, 521: Telephone Expense, 531. 133. In June, Landis Saunders of Lou's Auto Spa

find solution for this problem

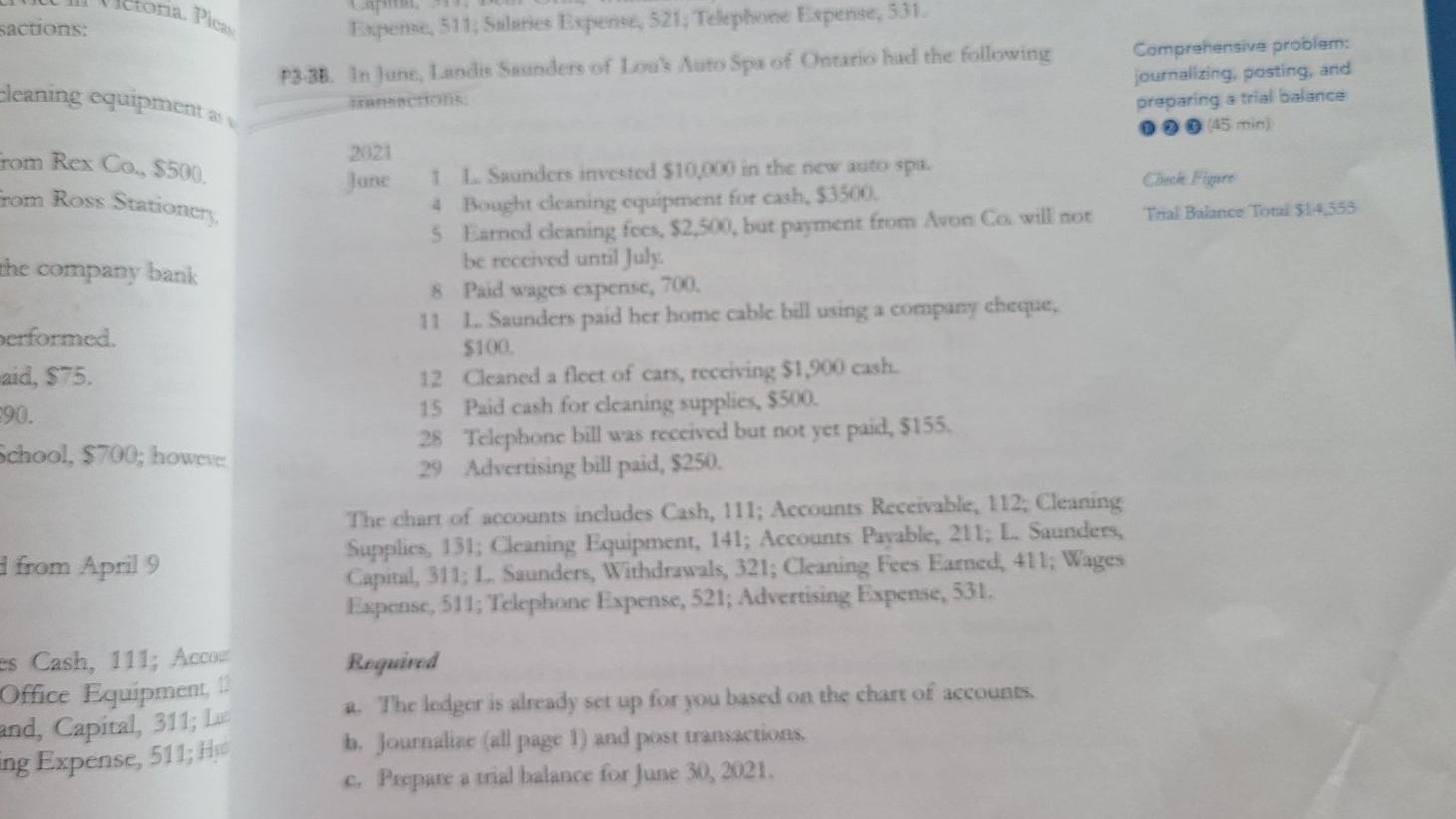

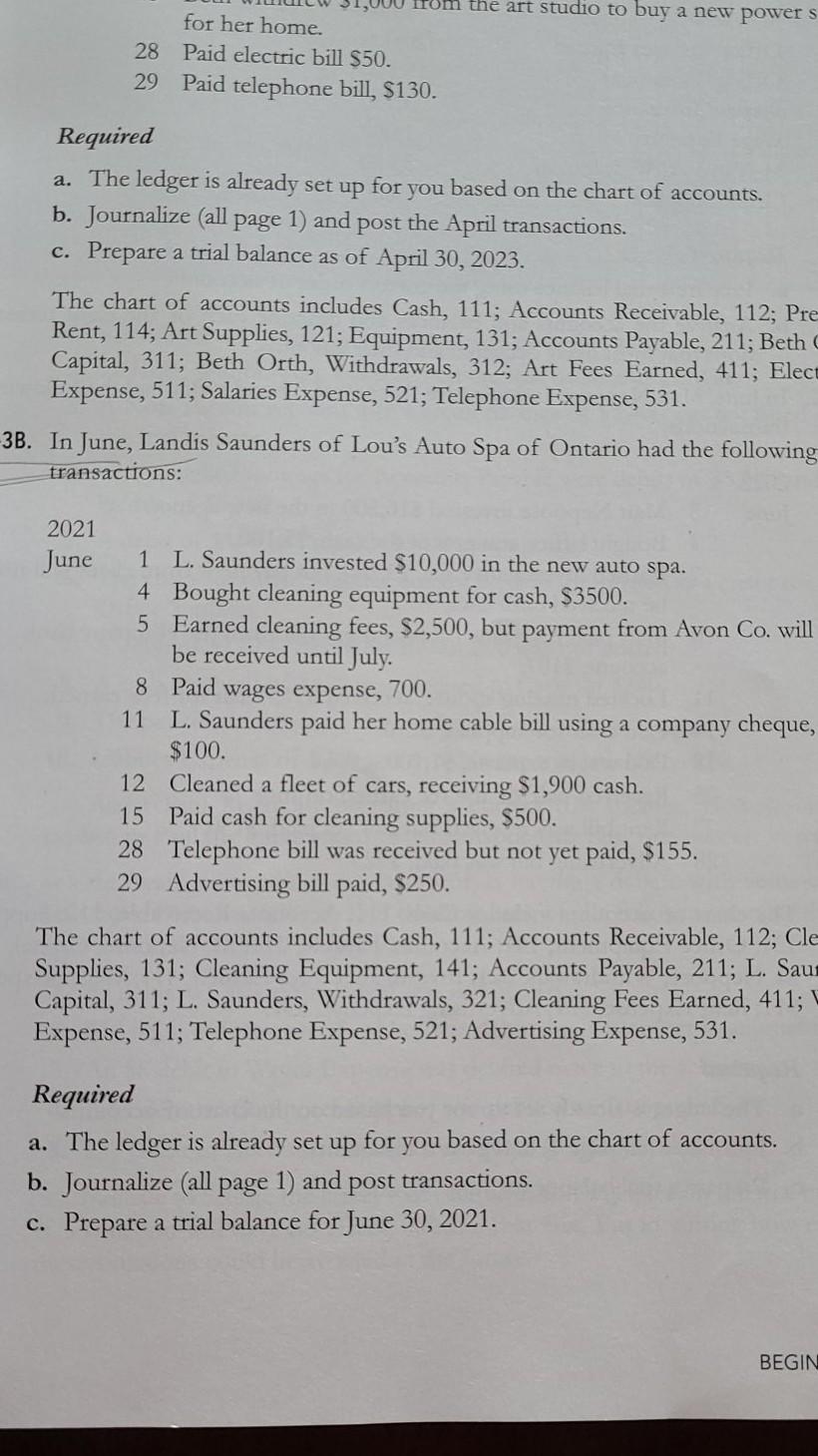

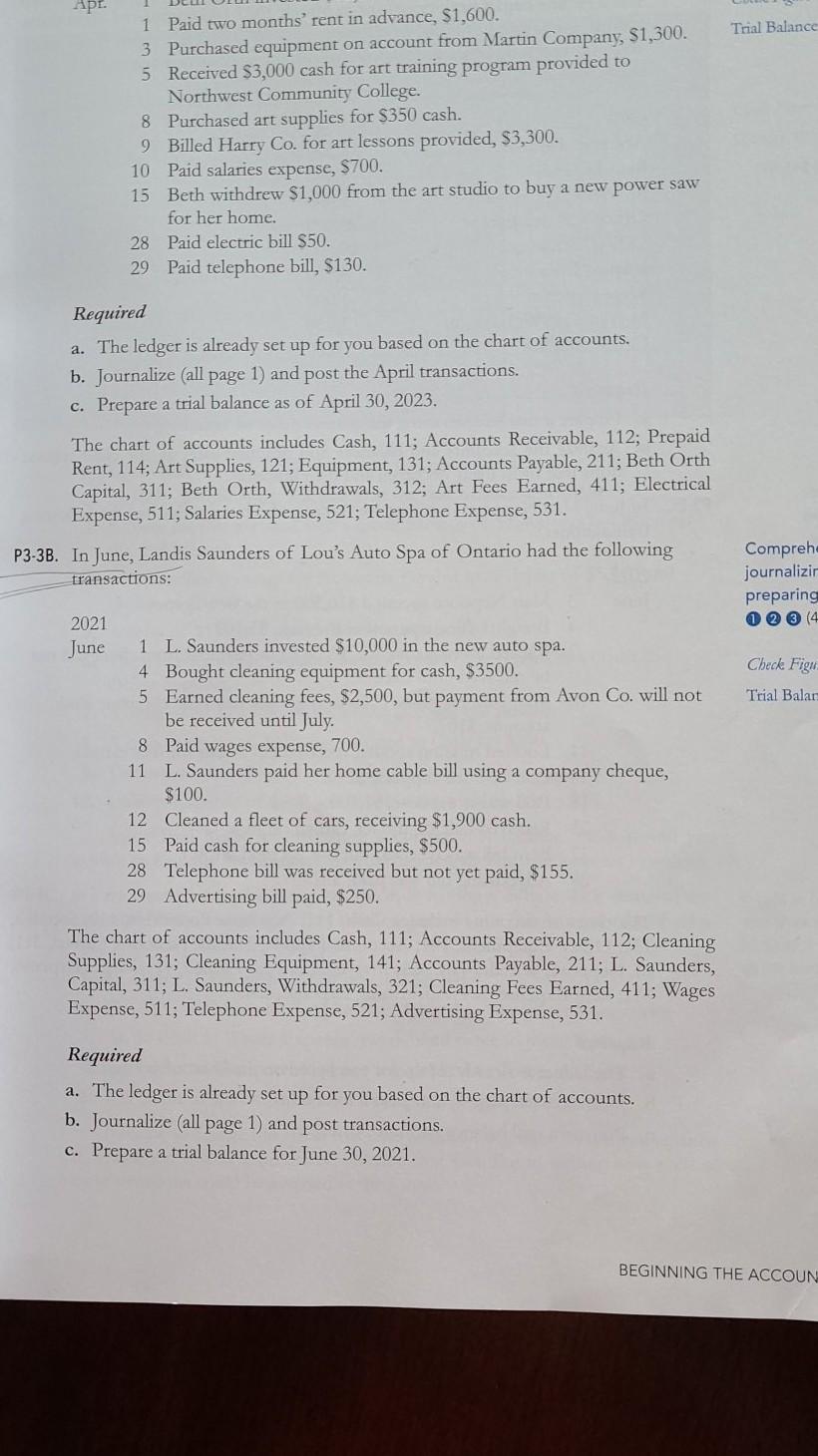

Ictoria. Ples sactions: Expense, 511: Series Expense, 521: Telephone Expense, 531. 133. In June, Landis Saunders of Lou's Auto Spa of Ontario had the following Cleaning equipment Comprehensive problem: journalizing, gosting, and preparing a trial balance 09 45 min From Rex Co., $500, From Ross Stationery Chicle Frate Thal Balance Total 514 555 the company bank performed aid, 575, E90. School, $700; hower 2021 Jane 1 L Saunders invested $10,000 in the new auto spa. 4 Bought deaning equipment for cash, 53500 5 Earned deaning fees, $2,500, but payment from Avon Co will not be received until July 8 Paid wages expense, 700 11 L. Saunders paid her home cable bil using a company cheque. $100 12 Cleaned a fleet of cars, receiving $1,900 cash. 15 Paid cash for deaning supplies, $500 28 Telephone bill was received but not yet paid $155. 29 Advertising bill paid, $250. The chart of accounts includes Cash, 111; Accounts Receivable, 112. Cleaning Supplies, 131; Cleaning Equipment, 141; Accounts Payable, 211; L Saunders, Capital, 311; 1. Saunders, Withdrawals, 321; Cleaning Fees Earned, 411: Wages Expense, 511; Telephone Expense, 521; Advertising Expense, 531. from April 9 Es Cash, 111; Accou Office Equipment, and, Capital, 311; L ing Expense, 511; Hy Required a. The lodger is already set up for you based on the chart of accounts. b. Journalize (all page 1) and post transactions c. Prepare a trial balance for June 30, 2021. 000 Trom the art studio to buy a new power s for her home. 28 Paid electric bill $50. 29 Paid telephone bill, $130. Required a. The ledger is already set up for you based on the chart of accounts. b. Journalize (all page 1) and post the April transactions. c. Prepare a trial balance as of April 30, 2023. The chart of accounts includes Cash, 111; Accounts Receivable, 112; Pre Rent, 114; Art Supplies, 121; Equipment, 131; Accounts Payable, 211; Beth Capital, 311; Beth Orth, Withdrawals, 312; Art Fees Earned, 411; Elect Expense, 511; Salaries Expense, 521; Telephone Expense, 531. -3B. In June, Landis Saunders of Lou's Auto Spa of Ontario had the following transactions: 2021 June 1 L. Saunders invested $10,000 in the new auto spa. 4 Bought cleaning equipment for cash, $3500. 5 Earned cleaning fees, $2,500, but payment from Avon Co. will be received until July. 8 Paid wages expense, 700. 11 L. Saunders paid her home cable bill using a company cheque, $100. 12 Cleaned a fleet of cars, receiving $1,900 cash. 15 Paid cash for cleaning supplies, $500. 28 Telephone bill was received but not yet paid, $155. 29 Advertising bill paid, $250. The chart of accounts includes Cash, 111; Accounts Receivable, 112; Cle Supplies, 131; Cleaning Equipment, 141; Accounts Payable, 211; L. Sau Capital, 311; L. Saunders, Withdrawals, 321; Cleaning Fees Earned, 411; Expense, 511; Telephone Expense, 521; Advertising Expense, 531. based on the chart of accounts. Required a. The ledger is already set up for you b. Journalize (all page 1) and post transactions. c. Prepare a trial balance for June 30, 2021. BEGIN Apr. Trial Balance 1 Paid two months' rent in advance, $1,600. 3 Purchased equipment on account from Martin Company, $1,300. 5 Received $3,000 cash for art training program provided to Northwest Community College. 8 Purchased art supplies for $350 cash. 9 Billed Harry Co. for art lessons provided, $3,300. 10 Paid salaries expense, $700. 15 Beth withdrew $1,000 from the art studio to buy a new power saw for her home. 28 Paid electric bill $50. 29 Paid telephone bill, $130. Required a. The ledger is already set up for you based on the chart of accounts. b. Journalize (all page 1) and post the April transactions. c. Prepare a trial balance as of April 30, 2023. The chart of accounts includes Cash, 111; Accounts Receivable, 112; Prepaid Rent, 114; Art Supplies, 121; Equipment, 131; Accounts Payable, 211; Beth Orth Capital, 311; Beth Orth, Withdrawals, 312, Art Fees Earned, 411; Electrical Expense, 511; Salaries Expense, 521; Telephone Expense, 531. P3-3B. In June, Landis Saunders of Lou's Auto Spa of Ontario had the following transactions: Compreh journalizir preparing 0 3 4 Check Figu Trial Balan 2021 June 1 L. Saunders invested $10,000 in the new auto spa. 4 Bought cleaning equipment for cash, $3500. 5 Earned cleaning fees, $2,500, but payment from Avon Co. will not be received until July. 8 Paid wages expense, 700. 11 L. Saunders paid her home cable bill using a company cheque, $100. 12 Cleaned a fleet of cars, receiving $1,900 cash. 15 Paid cash for cleaning supplies, $500. 28 Telephone bill was received but not yet paid, $155. 29 Advertising bill paid, $250. The chart of accounts includes Cash, 111; Accounts Receivable, 112; Cleaning Supplies, 131; Cleaning Equipment, 141; Accounts Payable, 211; L. Saunders, Capital, 311; L. Saunders, Withdrawals, 321; Cleaning Fees Earned, 411; Wages Expense, 511; Telephone Expense, 521; Advertising Expense, 531. Required a. The ledger is already set up for you based on the chart of accounts. b. Journalize (all page 1) and post transactions. c. Prepare a trial balance for June 30, 2021. BEGINNING THE ACCOUN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts