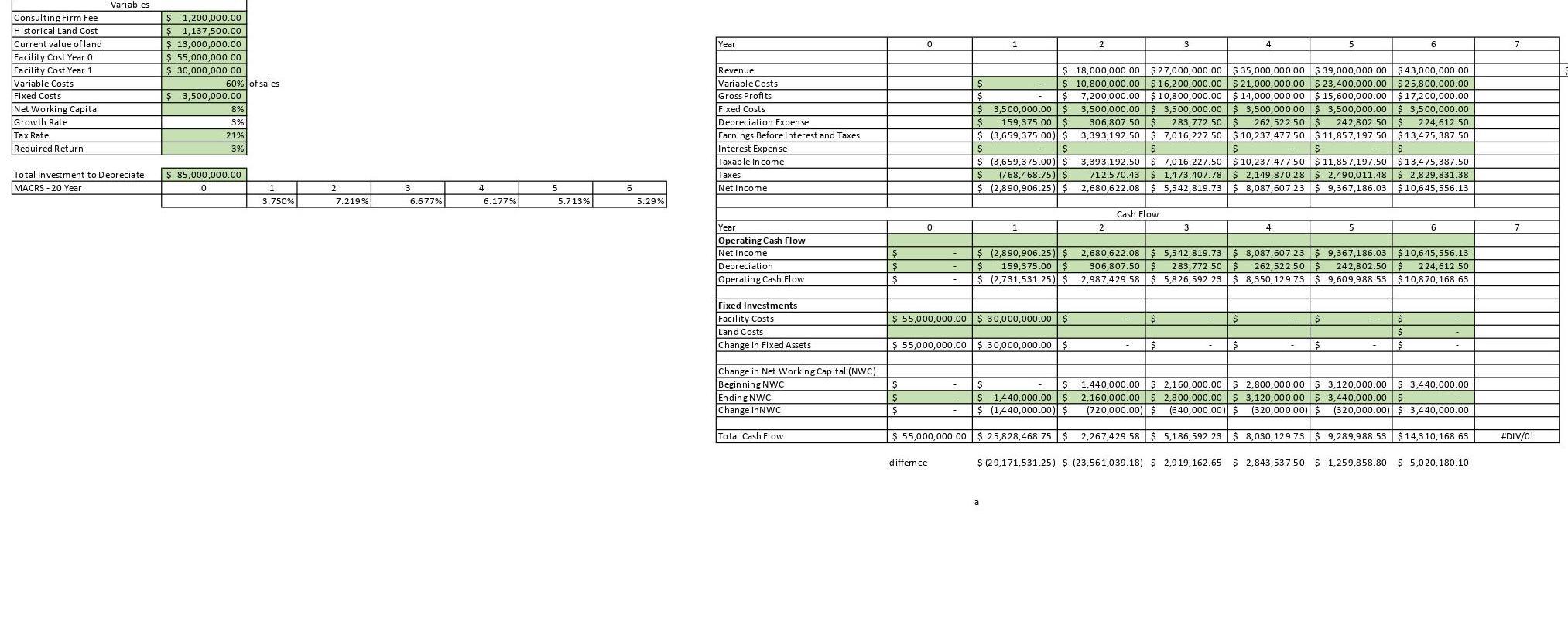

Question: Hello, my question is if any of the variables are incorrect, and if any corrections could be made, like if a number should be marked

Hello, my question is if any of the variables are incorrect, and if any corrections could be made, like if a number should be marked positive rather than negative or vice versa. What is in green are the numbers I entered in and the formulas I created, and what is in white is what was already given or formulas that are preset.

So could someone please help by offering any corrections?

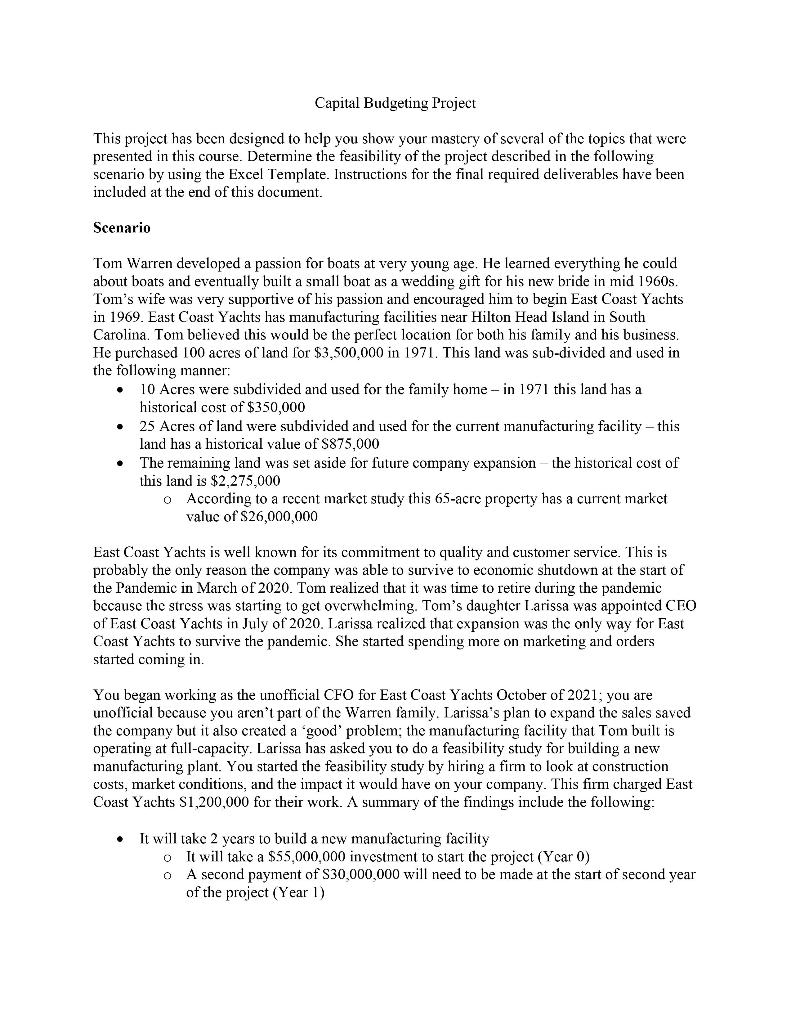

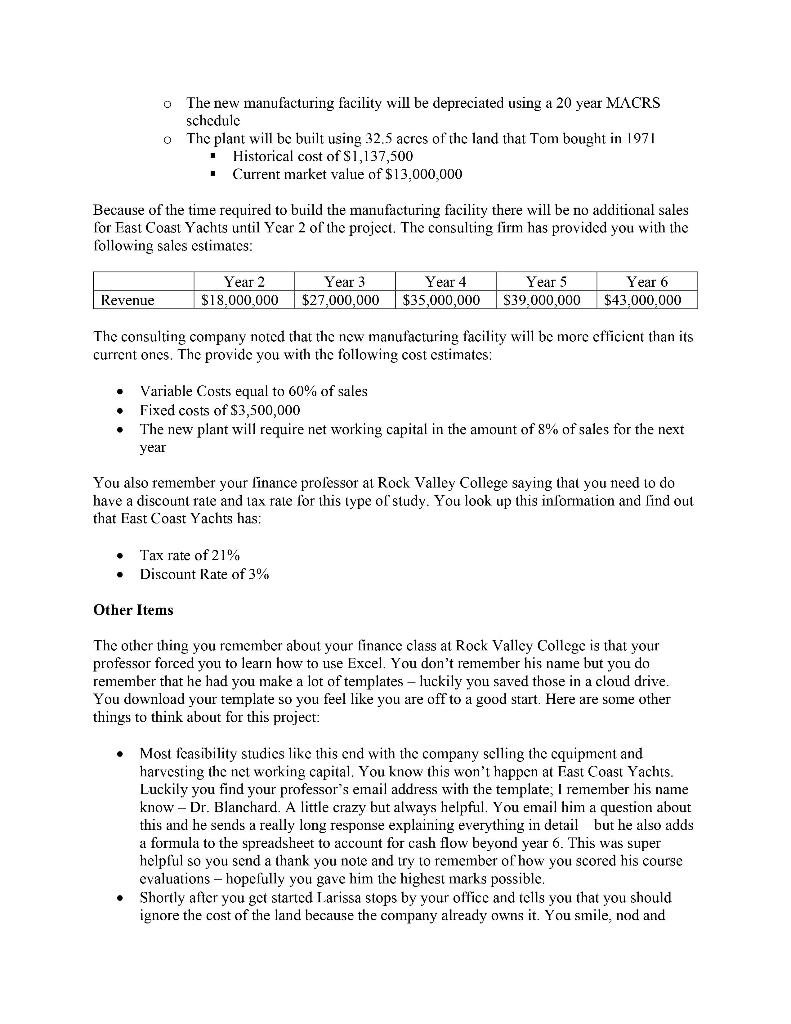

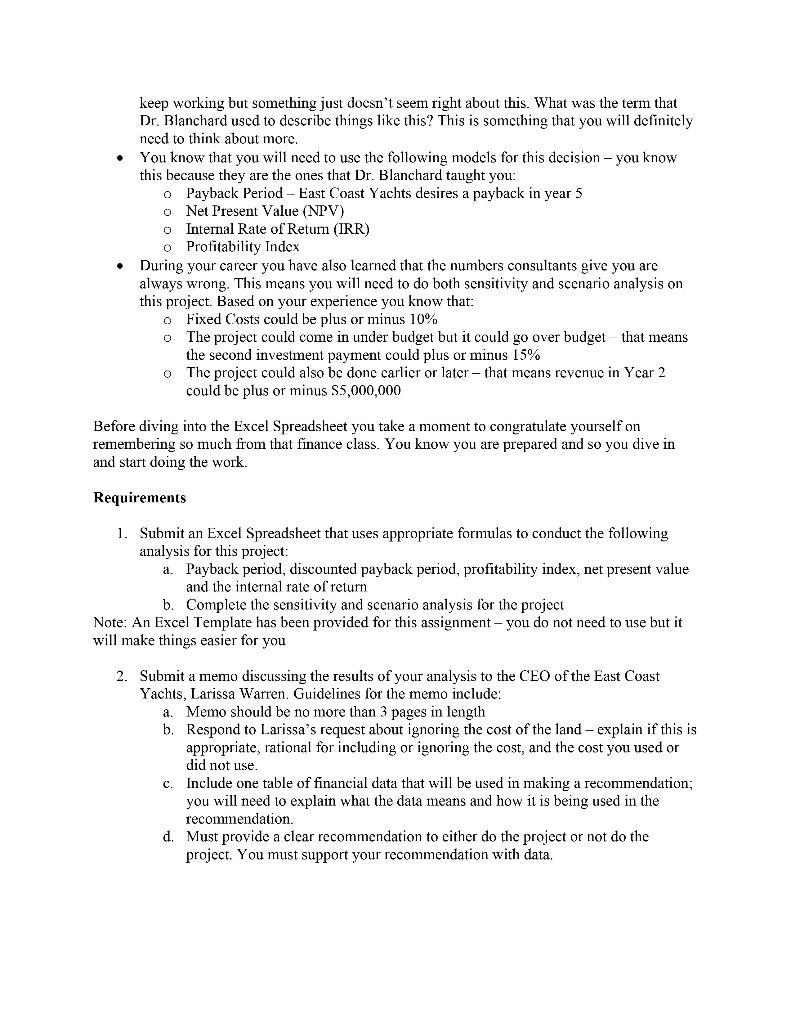

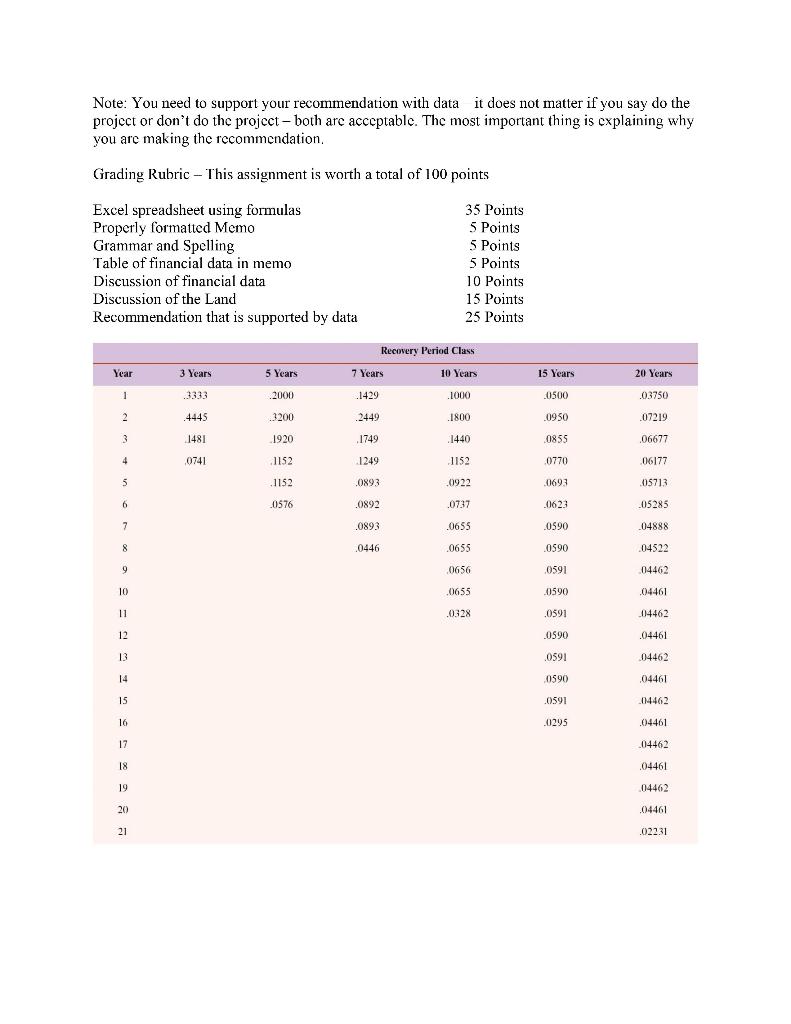

OI 08I'0Z0'5 $0885865Z$05St8Z$59Z9I66Z$ (8I 6095Z)$(5ZISI6Z)$ Capital Budgeting Project This project has been designed to help you show your mastery of several of the topics that were presented in this course. Determine the feasibility of the project described in the following scenario by using the Excel Template. Instructions for the final required deliverables have been included at the end of this document. Scenario Tom Warren developed a passion for boats at very young age. He learned everything he could about boats and eventually built a small boat as a wedding gift for his new bride in mid 1960s. Tom's wife was very supportive of his passion and encouraged him to begin East Coast Yachts in 1969. East Coast Yachts has manufacturing facilities near Hilton Head Island in South Carolina. Tom believed this would be the perfect location for both his family and his business. He purchased 100 acres of land for $3,500,000 in 1971. This land was sub-divided and used in the following manner: - 10 Acres were subdivided and used for the family home - in 1971 this land has a historical cost of $350,000 - 25 Acres of land were subdivided and used for the current manufacturing facility - this land has a historical value of $875,000 - The remaining land was set aside for future company expansion - the historical cost of this land is $2,275,000 o According to a recent market study this 65-acre property has a current market valuc of $26,000,000 East Coast Yachts is well known for its commitment to quality and customer service. This is probably the only reason the company was able to survive to economic shutdown at the start of the Pandemic in March of 2020 . Tom realized that it was time to retire during the pandemic because the stress was starting to get overwhelming. Tom's daughter I.arissa was appointed CEO of East Coast Yachts in July of 2020. Larissa realized that expansion was the only way for Fast Coast Yachts to survive the pandemic. She started spending more on marketing and orders started coming in. You began working as the unofficial CFO for East Coast Yachts October of 2021; you are unofficial because you aren't part of the Warren family. Larissa's plan to expand the sales saved the company but it also created a 'good' problem; the manufacturing facility that Tom built is operating at full-capacity. Larissa has asked you to do a feasibility study for building a new manufacturing plant. You started the feasibility study by hiring a firm to look at construction costs, market conditions, and the impact it would have on your company. This firm charged East Coast Yachts $1,200,000 for their work. A summary of the findings include the following: - It will take 2 ycars to build a new manufacturing facility - It will take a $55,000,000 investment to start the project (Year 0 ) o A second payment of S30,000,000 will need to be made at the start of second year of the project (Year 1) - The new manufacturing facility will be depreciated using a 20 year MACRS schedule o The plant will be built using 32.5 acres of the land that Tom bought in 1971 - Historical cost of $1,137,500 - Current market value of $13,000,000 Because of the time required to build the manufacturing facility there will be no additional sales for East Coast Yachts until Year 2 of the project. The consulting firm has provided you with the following sales estimates: The consulting company noted that the new manufacturing facility will be more efficient than its current ones. The provide you with the following cost estimates: - Variable Costs equal to 60% of sales - Fixed costs of $3,500,000 - The new plant will require net working capital in the amount of 8% of sales for the next year You also remember your linance prolessor at Rock Valley College saying that you need to do have a discount rate and tax rate for this type of study. You look up this information and lind out that East Coast Yachts has: - Tax rate of 21% - Discount Rate of 3% Other Items The other thing you remember about your finance class at Rock Valley College is that your professor forced you to learn how to use Excel. You don't remember his name but you do remember that he had you make a lot of templates - luckily you saved those in a cloud drive. You download your template so you feel like you are off to a good start. Here are some other things to think about for this project: - Most feasibility studies like this end with the company selling the equipment and harvesting the net working capital. You know this won't happen at East Coast Yachts. Luckily you find your professor's email address with the template; I remember his name know - Dr. Blanchard. A little crazy but always helpful. You email him a question about this and he sends a really long response explaining everything in detail but he also adds a formula to the spreadsheet to account for cash flow beyond year 6 . This was super helpful so you send a thank you note and try to remember of how you scored his course evaluations - hopefully you gave him the highest marks possible. - Shortly after you get started Larissa stops by your office and tells you that you should ignore the cost of the land because the company already owns it. You smile, nod and keep working but something just docsn't seem right about this. What was the term that Dr. Blanchard used to describe things like this? This is something that you will definitely need to think about more. - You know that you will need to use the following models for this decision - you know this because they are the ones that Dr. Blanchard taught you: - Payback Period - East Coast Yachts desires a payback in year 5 - Net Present Value (NPV) - Internal Rate of Return (IRR) o Profitability Index - During your career you have also learned that the numbers consultants give you are always wrong. This means you will need to do both sensitivity and scenario analysis on this project. Based on your experience you know that: 0 Fixed Costs could be plus or minus 10% o. The project could come in under budget but it could go over budget - that means the second investment payment could plus or minus 15% o The project could also be done carlier or later - that means revenue in Year 2 could be plus or minus S5,000,000 Before diving into the Excel Spreadsheet you take a moment to congratulate yourself on remembering so much from that finance class. You know you are prepared and so you dive in and start doing the work. Requirements 1. Submit an Excel Spreadsheet that uses appropriate formulas to conduct the following analysis for this project: a. Payback period, discounted payback period, profitability index, net present value and the internal rate of return b. Complete the sensitivity and scenario analysis for the project Note: An Excel Template has been provided for this assignment - you do not need to use but it will make things easier for you 2. Submit a memo discussing the results of your analysis to the CEO of the East Coast Yachts, Larissa Warren. Guidelines for the memo include: a. Memo should be no more than 3 pages in length b. Respond to Larissa's request about ignoring the cost of the land - explain if this is appropriate, rational for including or ignoring the cost, and the cost you used or did not use. c. Include one table of financial data that will be used in making a recommendation; you will need to explain what the data means and how it is being used in the recommendation. d. Must provide a clear recommendation to either do the project or not do the project. You must support your recommendation with data. Note: You need to support your recommendation with data it does not matter if you say do the project or don't do the project-both are acceptable. The most important thing is explaining why you are making the recommendation. Grading Rubric - This assignment is worth a total of 100 points OI 08I'0Z0'5 $0885865Z$05St8Z$59Z9I66Z$ (8I 6095Z)$(5ZISI6Z)$ Capital Budgeting Project This project has been designed to help you show your mastery of several of the topics that were presented in this course. Determine the feasibility of the project described in the following scenario by using the Excel Template. Instructions for the final required deliverables have been included at the end of this document. Scenario Tom Warren developed a passion for boats at very young age. He learned everything he could about boats and eventually built a small boat as a wedding gift for his new bride in mid 1960s. Tom's wife was very supportive of his passion and encouraged him to begin East Coast Yachts in 1969. East Coast Yachts has manufacturing facilities near Hilton Head Island in South Carolina. Tom believed this would be the perfect location for both his family and his business. He purchased 100 acres of land for $3,500,000 in 1971. This land was sub-divided and used in the following manner: - 10 Acres were subdivided and used for the family home - in 1971 this land has a historical cost of $350,000 - 25 Acres of land were subdivided and used for the current manufacturing facility - this land has a historical value of $875,000 - The remaining land was set aside for future company expansion - the historical cost of this land is $2,275,000 o According to a recent market study this 65-acre property has a current market valuc of $26,000,000 East Coast Yachts is well known for its commitment to quality and customer service. This is probably the only reason the company was able to survive to economic shutdown at the start of the Pandemic in March of 2020 . Tom realized that it was time to retire during the pandemic because the stress was starting to get overwhelming. Tom's daughter I.arissa was appointed CEO of East Coast Yachts in July of 2020. Larissa realized that expansion was the only way for Fast Coast Yachts to survive the pandemic. She started spending more on marketing and orders started coming in. You began working as the unofficial CFO for East Coast Yachts October of 2021; you are unofficial because you aren't part of the Warren family. Larissa's plan to expand the sales saved the company but it also created a 'good' problem; the manufacturing facility that Tom built is operating at full-capacity. Larissa has asked you to do a feasibility study for building a new manufacturing plant. You started the feasibility study by hiring a firm to look at construction costs, market conditions, and the impact it would have on your company. This firm charged East Coast Yachts $1,200,000 for their work. A summary of the findings include the following: - It will take 2 ycars to build a new manufacturing facility - It will take a $55,000,000 investment to start the project (Year 0 ) o A second payment of S30,000,000 will need to be made at the start of second year of the project (Year 1) - The new manufacturing facility will be depreciated using a 20 year MACRS schedule o The plant will be built using 32.5 acres of the land that Tom bought in 1971 - Historical cost of $1,137,500 - Current market value of $13,000,000 Because of the time required to build the manufacturing facility there will be no additional sales for East Coast Yachts until Year 2 of the project. The consulting firm has provided you with the following sales estimates: The consulting company noted that the new manufacturing facility will be more efficient than its current ones. The provide you with the following cost estimates: - Variable Costs equal to 60% of sales - Fixed costs of $3,500,000 - The new plant will require net working capital in the amount of 8% of sales for the next year You also remember your linance prolessor at Rock Valley College saying that you need to do have a discount rate and tax rate for this type of study. You look up this information and lind out that East Coast Yachts has: - Tax rate of 21% - Discount Rate of 3% Other Items The other thing you remember about your finance class at Rock Valley College is that your professor forced you to learn how to use Excel. You don't remember his name but you do remember that he had you make a lot of templates - luckily you saved those in a cloud drive. You download your template so you feel like you are off to a good start. Here are some other things to think about for this project: - Most feasibility studies like this end with the company selling the equipment and harvesting the net working capital. You know this won't happen at East Coast Yachts. Luckily you find your professor's email address with the template; I remember his name know - Dr. Blanchard. A little crazy but always helpful. You email him a question about this and he sends a really long response explaining everything in detail but he also adds a formula to the spreadsheet to account for cash flow beyond year 6 . This was super helpful so you send a thank you note and try to remember of how you scored his course evaluations - hopefully you gave him the highest marks possible. - Shortly after you get started Larissa stops by your office and tells you that you should ignore the cost of the land because the company already owns it. You smile, nod and keep working but something just docsn't seem right about this. What was the term that Dr. Blanchard used to describe things like this? This is something that you will definitely need to think about more. - You know that you will need to use the following models for this decision - you know this because they are the ones that Dr. Blanchard taught you: - Payback Period - East Coast Yachts desires a payback in year 5 - Net Present Value (NPV) - Internal Rate of Return (IRR) o Profitability Index - During your career you have also learned that the numbers consultants give you are always wrong. This means you will need to do both sensitivity and scenario analysis on this project. Based on your experience you know that: 0 Fixed Costs could be plus or minus 10% o. The project could come in under budget but it could go over budget - that means the second investment payment could plus or minus 15% o The project could also be done carlier or later - that means revenue in Year 2 could be plus or minus S5,000,000 Before diving into the Excel Spreadsheet you take a moment to congratulate yourself on remembering so much from that finance class. You know you are prepared and so you dive in and start doing the work. Requirements 1. Submit an Excel Spreadsheet that uses appropriate formulas to conduct the following analysis for this project: a. Payback period, discounted payback period, profitability index, net present value and the internal rate of return b. Complete the sensitivity and scenario analysis for the project Note: An Excel Template has been provided for this assignment - you do not need to use but it will make things easier for you 2. Submit a memo discussing the results of your analysis to the CEO of the East Coast Yachts, Larissa Warren. Guidelines for the memo include: a. Memo should be no more than 3 pages in length b. Respond to Larissa's request about ignoring the cost of the land - explain if this is appropriate, rational for including or ignoring the cost, and the cost you used or did not use. c. Include one table of financial data that will be used in making a recommendation; you will need to explain what the data means and how it is being used in the recommendation. d. Must provide a clear recommendation to either do the project or not do the project. You must support your recommendation with data. Note: You need to support your recommendation with data it does not matter if you say do the project or don't do the project-both are acceptable. The most important thing is explaining why you are making the recommendation. Grading Rubric - This assignment is worth a total of 100 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts