Question: Find the amount withheld. (1 point each) 1. Stephen Jensen, a pharmacist, is married, earns $369.23 weekly, and claims 2 allowances. 2. Lisa Stenmer is

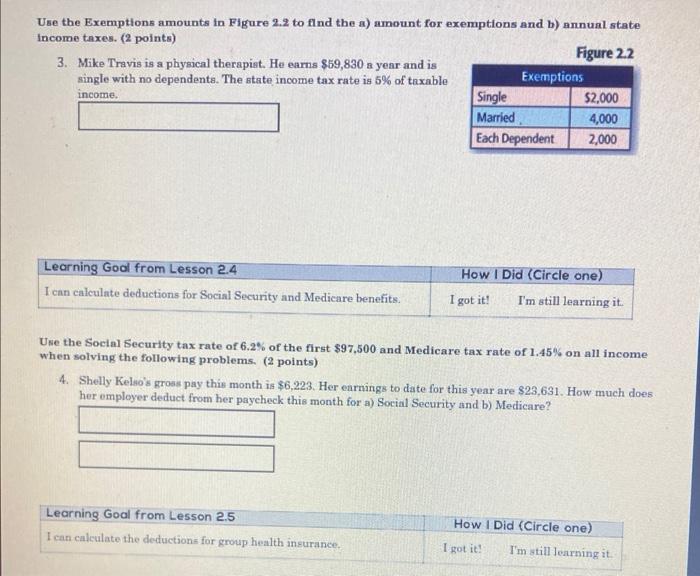

Find the amount withheld. (1 point each) 1. Stephen Jensen, a pharmacist, is married, earns $369.23 weekly, and claims 2 allowances. 2. Lisa Stenmer is married, earns $290.34 weekly as a receptionist, and claims no allowances? Use the Exemptions amounts in Figure 2.2 to find the a) amount for exemptions and b) annual state Income taxes. (2 points) Figure 2.2 3. Mike Travis is a physical therapist. He earns $69,830 n yenr and is single with no dependents. The state income tax rate is 5% of taxable Exemptions Single $2,000 Married 4,000 Each Dependent 2,000 income. Learning Goal from Lesson 2.4 I can calculate deductions for Social Security and Medicare benefits. How I Did (Circle one) I got it! I'm still learning it Une the Social Security tax rate of 6.2% of the first $97,500 and Medicare tax rate of 1.45% on all income when solving the following problems. (2 points) 4. Shelly Kelso's grous pay this month is $6,223. Her earnings to date for this year are $23,631. How much does her employer deduct from her paycheck this month for a) Social Security and b) Medicare? Learning Goal from Lesson 2.5 I can caleulate the deductions for group health insurance How I Did (Circle one) I got it! I'm still learning it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts