Question: find the net present value More Practice . Bob has just completed the development of a better face shield for health workers. The new product

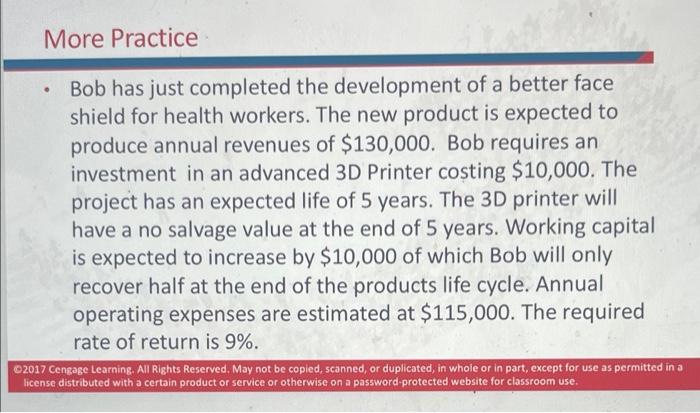

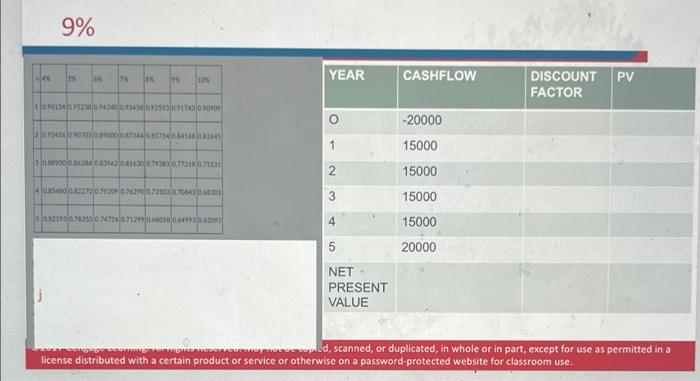

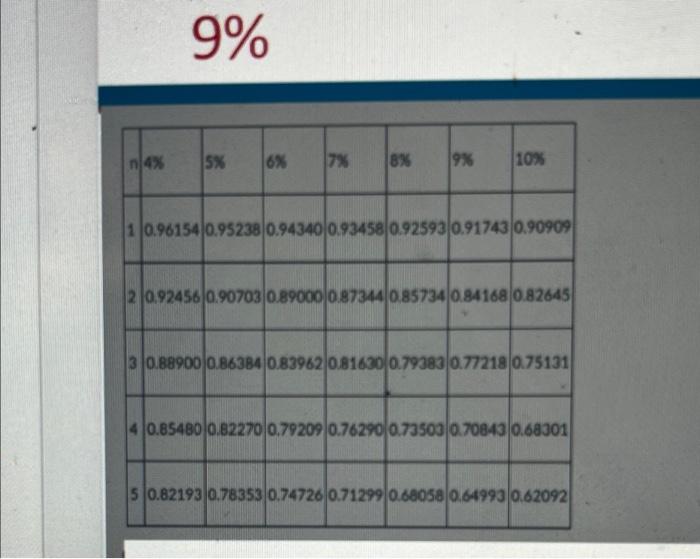

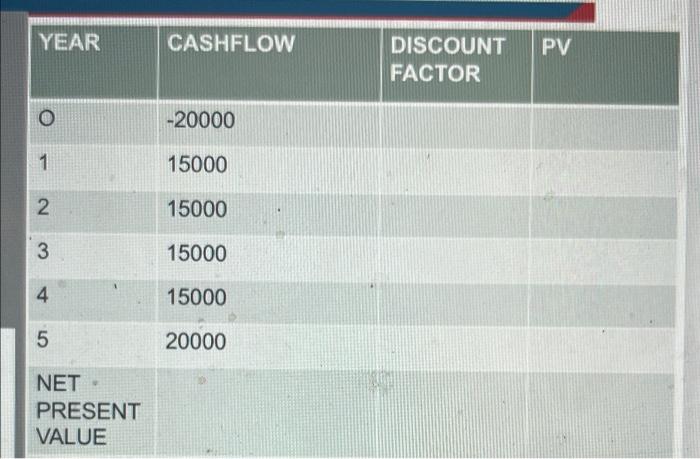

More Practice . Bob has just completed the development of a better face shield for health workers. The new product is expected to produce annual revenues of $130,000. Bob requires an investment in an advanced 3D Printer costing $10,000. The project has an expected life of 5 years. The 3D printer will have a no salvage value at the end of 5 years. Working capital is expected to increase by $10,000 of which Bob will only recover half at the end of the products life cycle. Annual operating expenses are estimated at $115,000. The required rate of return is 9%. 2017 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 9% YEAR CASHFLOW DISCOUNT PV FACTOR 10.315401320434034500230140. 1 3000 73000 7721001 -20000 15000 15000 15000 2 7700772000 72.35030701050 501013070.472.000 73043092 15000 5 20000 NET PRESENT VALUE ped, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 9% n 4x 15% 6% 17% BX 9% 10% 10.961540.95238 0.94340 0.934580.925930.917430.90909 20.92456 0.907030.89000 0.87344 0.85734 0.841680.82645 30.889000.863B40.839620.81630 0.793830.77218 0.75131 0.85480 0.82270 0.792090.76290 0.73503070843 0.68301 5 0.821930.78353 0.747260.71299 0.68058 0.649930.62092 YEAR CASHFLOW PV DISCOUNT FACTOR O -20000 1 15000 2 15000 3 15000 4 15000 5 20000 NET PRESENT VALUE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts