Question: Finding alpha. Consider a two-factor return model, where only two risk factors are priced (1and 2). That is, the return of any fairly priced stock

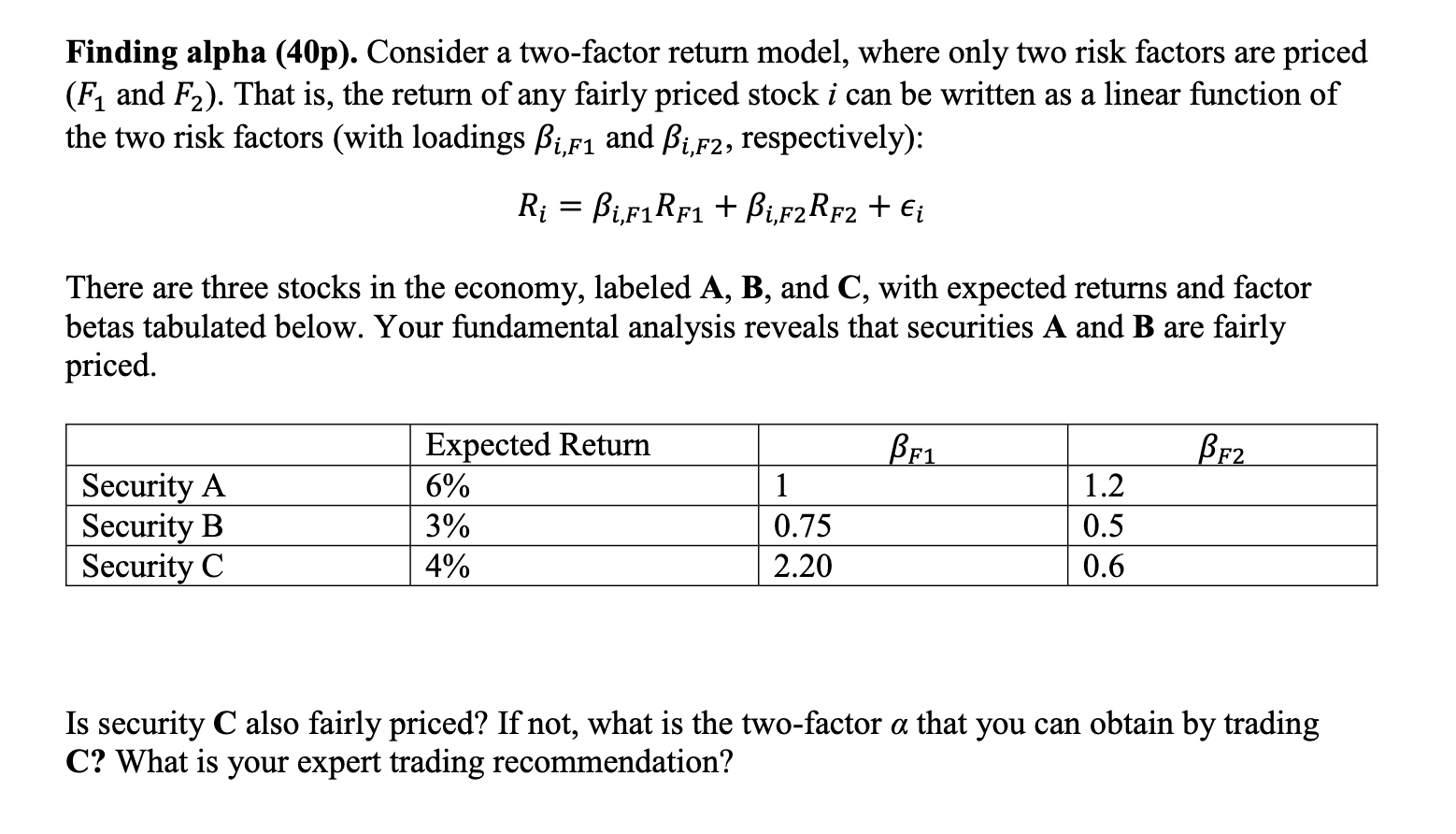

Finding alpha. Consider a two-factor return model, where only two risk factors are priced (1and 2). That is, the return of any fairly priced stock i can be written as a linear function of the two risk factors (with loadings ,1and ,2, respectively):

= ,11 + ,22 +

There are three stocks in the economy, labeled A, B, and C, with expected returns and factor betas tabulated below. Your fundamental analysis reveals that securities A and B are fairly priced.

Expected Return 1 2

Security A 6% 1 1.2

Security B 3% 0.75 0.5

Security C 4% 2.20 0.6

Is security C also fairly priced? If not, what is the two-factor that you can obtain by trading C? What is your expert trading recommendation?

Finding alpha (40p). Consider a two-factor return model, where only two risk factors are priced (F1 and F2). That is, the return of any fairly priced stock i can be written as a linear function of the two risk factors (with loadings Bi,f1 and Bi,F2, respectively): R; = Bi,F1RF1 + Bi,F2RF2 + Ei There are three stocks in the economy, labeled A, B, and C, with expected returns and factor betas tabulated below. Your fundamental analysis reveals that securities A and B are fairly priced. Bfi BEZ Security A Security B Security C Expected Return 6% 3% 4% 1 0.75 2.20 1.2 0.5 0.6 Is security C also fairly priced? If not, what is the two-factor a that you can obtain by trading C? What is your expert trading recommendation? Finding alpha (40p). Consider a two-factor return model, where only two risk factors are priced (F1 and F2). That is, the return of any fairly priced stock i can be written as a linear function of the two risk factors (with loadings Bi,f1 and Bi,F2, respectively): R; = Bi,F1RF1 + Bi,F2RF2 + Ei There are three stocks in the economy, labeled A, B, and C, with expected returns and factor betas tabulated below. Your fundamental analysis reveals that securities A and B are fairly priced. Bfi BEZ Security A Security B Security C Expected Return 6% 3% 4% 1 0.75 2.20 1.2 0.5 0.6 Is security C also fairly priced? If not, what is the two-factor a that you can obtain by trading C? What is your expert trading recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts