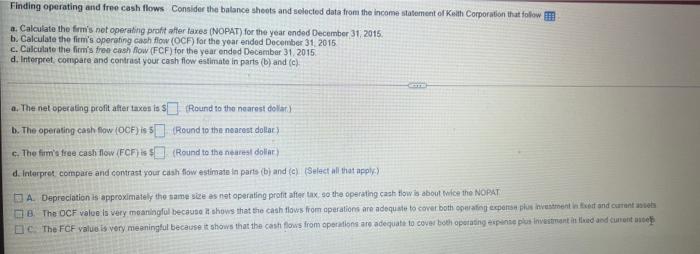

Question: Finding operating and free cash flows Consider the balance sheets and selected data from the income statement of Kolh Corporation that follow a. Calculate the

Finding operating and free cash flows Consider the balance sheets and selected data from the income statement of Kolh Corporation that follow a. Calculate the firm's net operating profit after taxes (NOPAT) for the year ended December 31, 2016. b. Calculate the firm's operating cash flow (OCF) for the year ended December 31, 2015 c. Calculate the firm's free cash flow (FCF) for the year ended December 31, 2015 d. Interpret compare and contrast your cash flow estimate in parts (6) and (c) a. The net operating profit after taxen is $] (Round to the nearest dolat b. The operating cash flow (OCF) is 5 $50 (Round to the nearest dollar) c. The firm's tree cash flow (FCF) is (Round to the nearest dolar) d. Interpret compare and contrast your cash flow estimate in parts (b) and (c)(Select all that apply.) A Depreciation is approximately the same sue as net operating profit after tax to the operating cash flow is about twice the NOPAT The OCF value is very meaningful because it shows that the cash flows from operations are adequate to cover both operating expense plus investment set and current C. The FCF value is very meaningful because it shows that the cash flows from operations are adequate to cover both operating erpinse plus Investment inted and content Finding operating and free cash flows Consider the balance sheets and selected data from the income statement of Kolh Corporation that follow a. Calculate the firm's net operating profit after taxes (NOPAT) for the year ended December 31, 2016. b. Calculate the firm's operating cash flow (OCF) for the year ended December 31, 2015 c. Calculate the firm's free cash flow (FCF) for the year ended December 31, 2015 d. Interpret compare and contrast your cash flow estimate in parts (6) and (c) a. The net operating profit after taxen is $] (Round to the nearest dolat b. The operating cash flow (OCF) is 5 $50 (Round to the nearest dollar) c. The firm's tree cash flow (FCF) is (Round to the nearest dolar) d. Interpret compare and contrast your cash flow estimate in parts (b) and (c)(Select all that apply.) A Depreciation is approximately the same sue as net operating profit after tax to the operating cash flow is about twice the NOPAT The OCF value is very meaningful because it shows that the cash flows from operations are adequate to cover both operating expense plus investment set and current C. The FCF value is very meaningful because it shows that the cash flows from operations are adequate to cover both operating erpinse plus Investment inted and content

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts