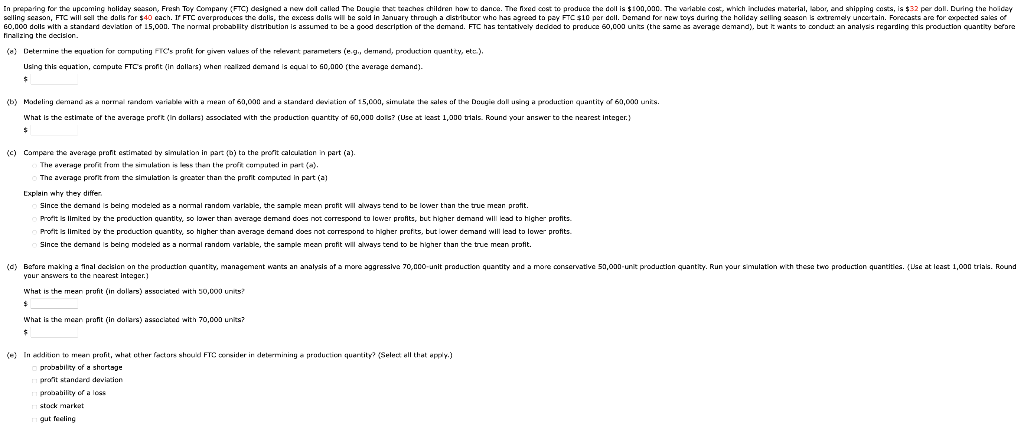

Question: finsiling the cosizior. Using this equation, compute FTCs proft (in dallari) when roslizad demand is cqusi to 60, aco (the average dechand). What is the

finsiling the cosizior. Using this equation, compute FTCs proft (in dallari) when roslizad demand is cqusi to 60, aco (the average dechand). What is the estimate of the aversge preft (in dollars) sasoclated with the productan quartity of 63,030 dols? (Use st lesst 1,000 tidale. Foune your answer to the nearest integer.) (c) Compare the avaraga prafit estimated by simulation in part (o) ta the proft caloulstion in part (a). The averefge peefit fram the sirmulatien is bess then the profi, currauted in pert {a}. The average profit fram the simulstion ta groster than the prafit computed in pait (a) Explain why tey differ: Since the demand is beirg modelod as a normal random varisble, the sample meen profit wil sways tend to te lower than the true mean protit. Prott is limited by the precuction quentity, so higher than aversge demand does not correspond to higher prot tes, tut lower cemand will issd to lowe' profits. Slnce the demand is belro modeled as a normal random varisble, the samole meen profit wil sways tend to te higher than the the mean proflt. pour snswera to the nearest integer.] What is the mean profit (in doliars) assedeisted with 50,603 units? What is the mean prafit (in dalars) asencisted with 70,000 Lnits? prosability of a shertsge pronit standard doviatien prosabilizy of a loas stack markat gut fecling finsiling the cosizior. Using this equation, compute FTCs proft (in dallari) when roslizad demand is cqusi to 60, aco (the average dechand). What is the estimate of the aversge preft (in dollars) sasoclated with the productan quartity of 63,030 dols? (Use st lesst 1,000 tidale. Foune your answer to the nearest integer.) (c) Compare the avaraga prafit estimated by simulation in part (o) ta the proft caloulstion in part (a). The averefge peefit fram the sirmulatien is bess then the profi, currauted in pert {a}. The average profit fram the simulstion ta groster than the prafit computed in pait (a) Explain why tey differ: Since the demand is beirg modelod as a normal random varisble, the sample meen profit wil sways tend to te lower than the true mean protit. Prott is limited by the precuction quentity, so higher than aversge demand does not correspond to higher prot tes, tut lower cemand will issd to lowe' profits. Slnce the demand is belro modeled as a normal random varisble, the samole meen profit wil sways tend to te higher than the the mean proflt. pour snswera to the nearest integer.] What is the mean profit (in doliars) assedeisted with 50,603 units? What is the mean prafit (in dalars) asencisted with 70,000 Lnits? prosability of a shertsge pronit standard doviatien prosabilizy of a loas stack markat gut fecling

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts