Question: Firm A can issue fixed-rate debt @ 9.5% and floating rate debt @ LIBOR + 40 bps. Firm B, less credit worthy, can issue

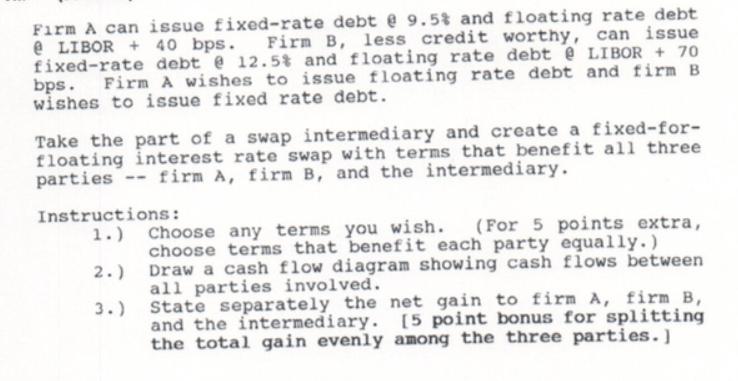

Firm A can issue fixed-rate debt @ 9.5% and floating rate debt @ LIBOR + 40 bps. Firm B, less credit worthy, can issue fixed-rate debt @ 12.5% and floating rate debt @ LIBOR + 70 bps. Firm A wishes to issue floating rate debt and firm B wishes to issue fixed rate debt. Take the part of a swap intermediary and create a fixed-for- floating interest rate swap with terms that benefit all three parties firm A, firm B, and the intermediary. Instructions: 2.) 1.) Choose any terms you wish. (For 5 points extra, choose terms that benefit each party equally.) Draw a cash flow diagram showing cash flows between all parties involved. 3.) State separately the net gain to firm A, firm B, and the intermediary. [5 point bonus for splitting the total gain evenly among the three parties.]

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Answer As given in the question that Firm A wishes to issue bloaking rate dest wishes to issue fixed ... View full answer

Get step-by-step solutions from verified subject matter experts