Question: Firm A has a Return on Equity (ROE) equal to 24%, while firm B has an ROE of 15% during the same year. Both

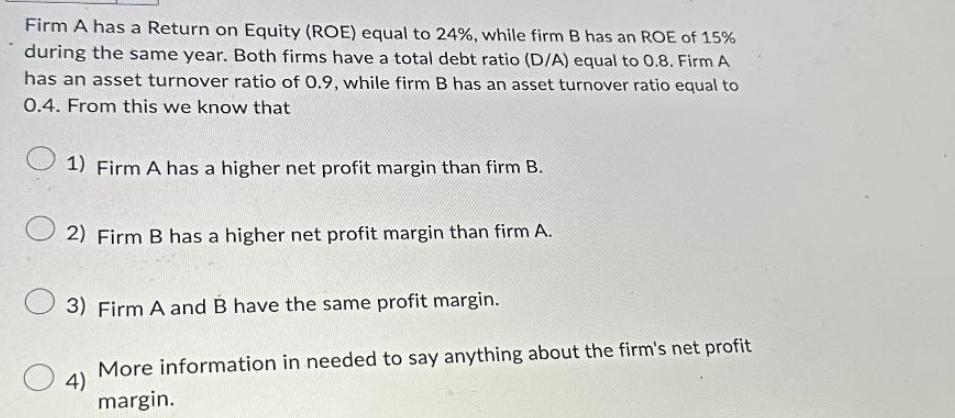

Firm A has a Return on Equity (ROE) equal to 24%, while firm B has an ROE of 15% during the same year. Both firms have a total debt ratio (D/A) equal to 0.8. Firm A has an asset turnover ratio of 0.9, while firm B has an asset turnover ratio equal to 0.4. From this we know that 1) Firm A has a higher net profit margin than firm B. 2) Firm B has a higher net profit margin than firm A. 3) Firm A and B have the same profit margin. More information in needed to say anything about the firm's net profit margin. O 4)

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below To determine which statement is correct ... View full answer

Get step-by-step solutions from verified subject matter experts