Question: Firm A is considering a merger with Fim B. Based on the following data, what is the stock exchange ratio if Fim A negotiates a

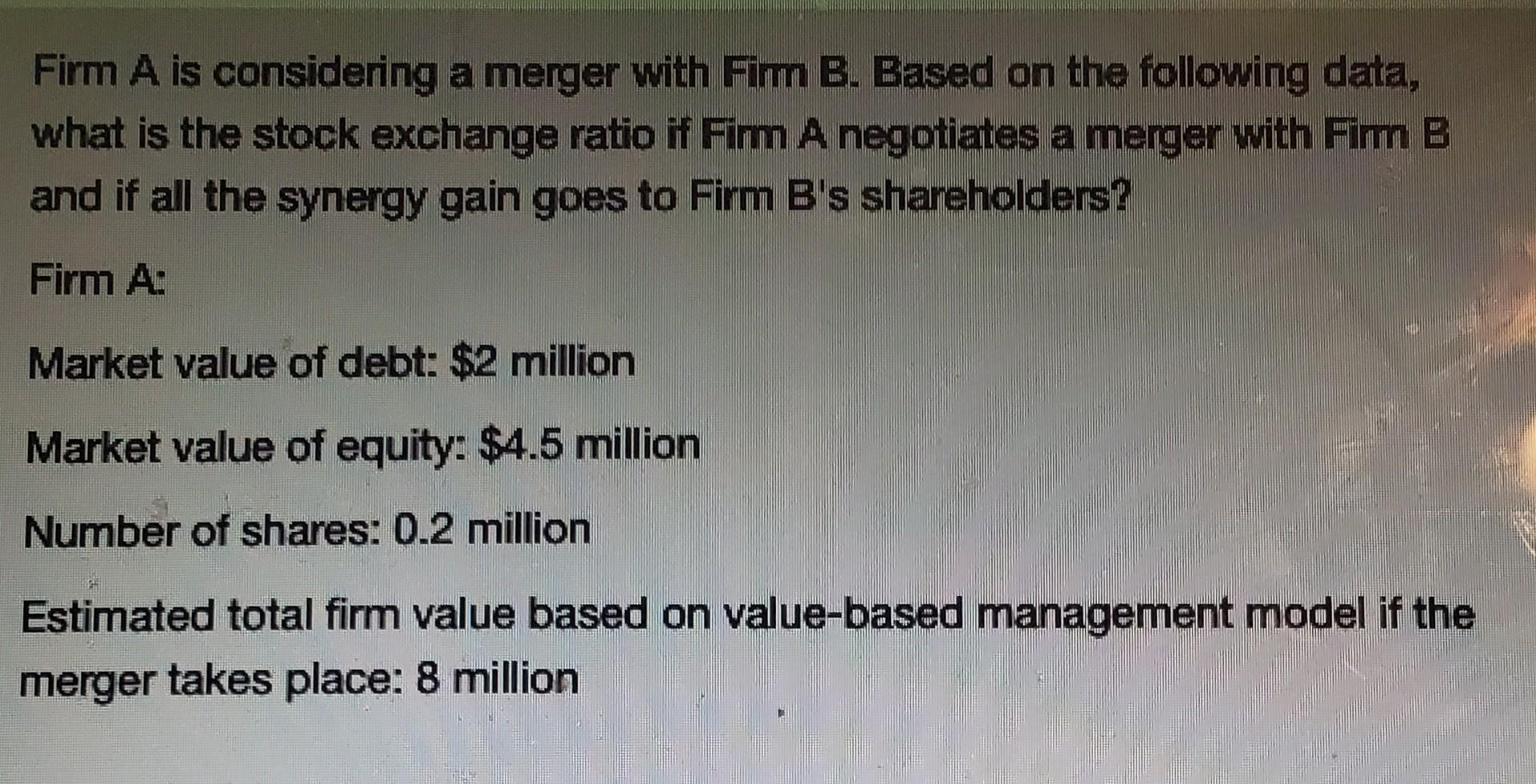

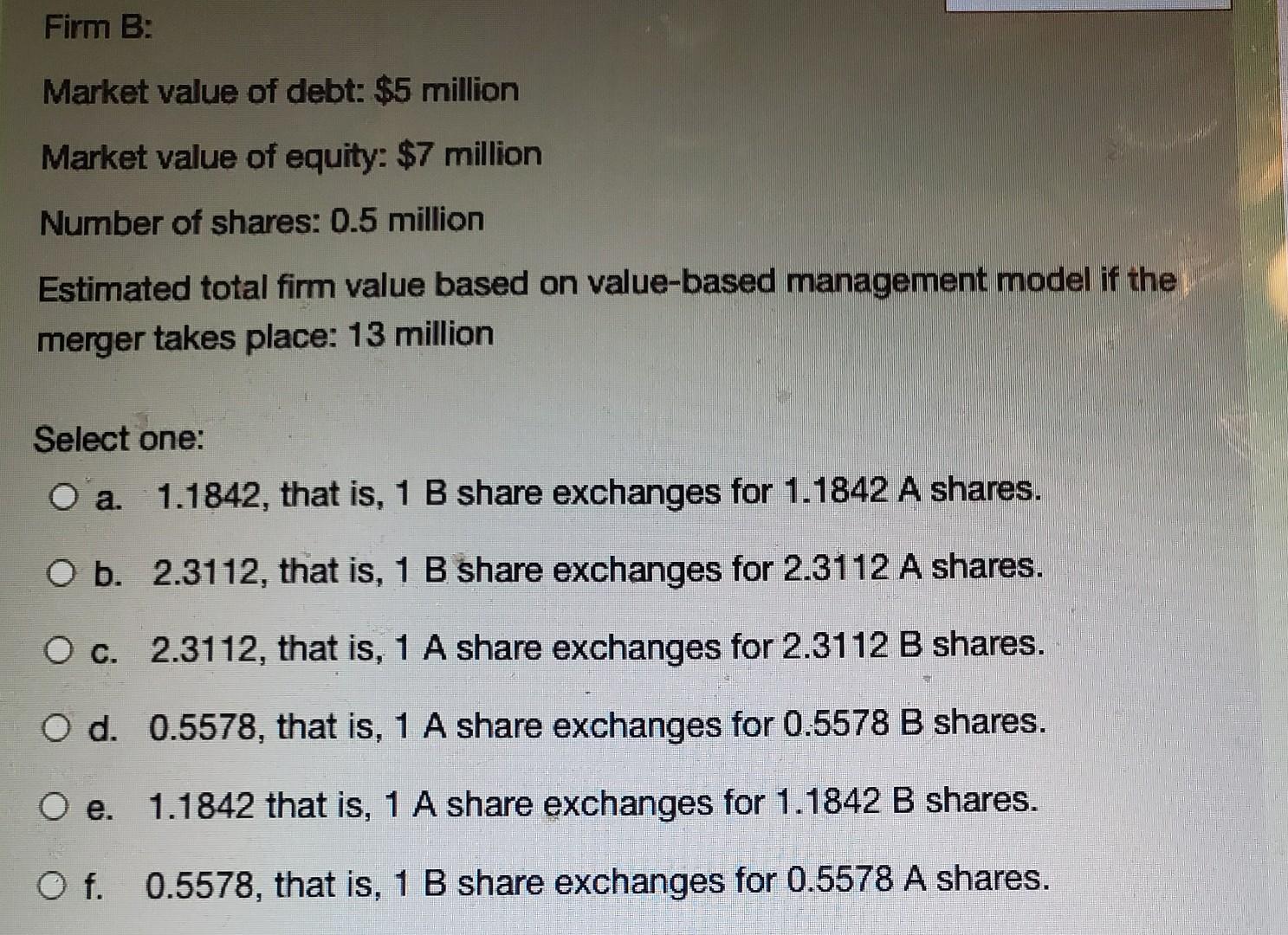

Firm A is considering a merger with Fim B. Based on the following data, what is the stock exchange ratio if Fim A negotiates a merger with Fim B and if all the synergy gain goes to Firm B's shareholders? Firm A: Market value of debt: $2 million Market value of equity: $4.5 million Number of shares: 0.2 million Estimated total firm value based on value-based management model if the merger takes place: 8 million Firm B: Market value of debt: $5 million Market value of equity: $7 million Number of shares: 0.5 million Estimated total firm value based on value-based management model if the merger takes place: 13 million Select one: O a. 1.1842, that is, 1 B share exchanges for 1.1842 A shares. O b. 2.3112, that is, 1 B share exchanges for 2.3112 A shares. O c. 2.3112, that is, 1 A share exchanges for 2.3112 B shares. O d. 0.5578, that is, 1 A share exchanges for 0.5578 B shares. O e. 1.1842 that is, 1 A share exchanges for 1.1842 B shares. Of. 0.5578, that is, 1 B share exchanges for 0.5578 A shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts