Question: Please provide formulas, i need to input into excel. Firm A is considering a merger/acquisition with Firm B. Based on the following data, what is

Please provide formulas, i need to input into excel.

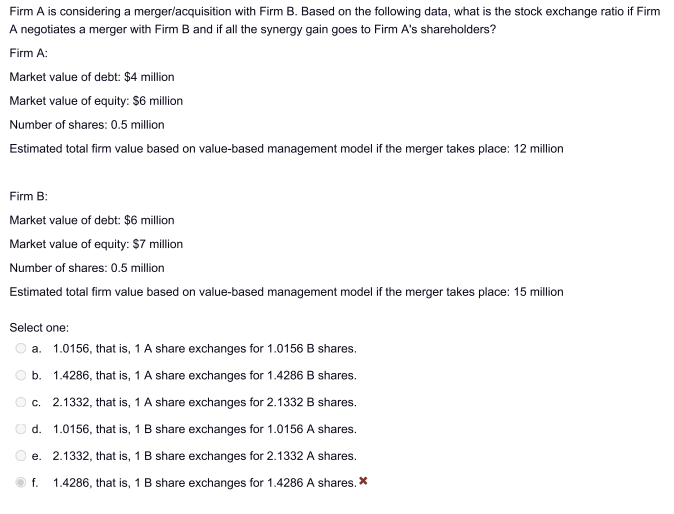

Firm A is considering a merger/acquisition with Firm B. Based on the following data, what is the stock exchange ratio A negotiates a merger with Firm B and if all the synergy gain goes to Firm A's shareholders? Firm A: Market value of debt: $4 million Market value of equity: $6 million Number of shares: 0.5 million Estimated total firm value based on value-based management model if the merger takes place: 12 million Firm B: Market value of debt: $6 million Market value of equity: $7 million Number of shares: 0.5 million Estimated total firm value based on value-based management model if the merger takes place: 15 million Select one: a. 1.0156, that is, 1A share exchanges for 1.0156B shares. b. 1.4286, that is, 1A share exchanges for 1.4286B shares. c. 2.1332, that is, 1A share exchanges for 2.1332B shares. d. 1.0156, that is, 1B share exchanges for 1.0156A shares. e. 2.1332, that is, 1B share exchanges for 2.1332A shares. f. 1.4286, that is, 1B share exchanges for 1.4286A shares. x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts