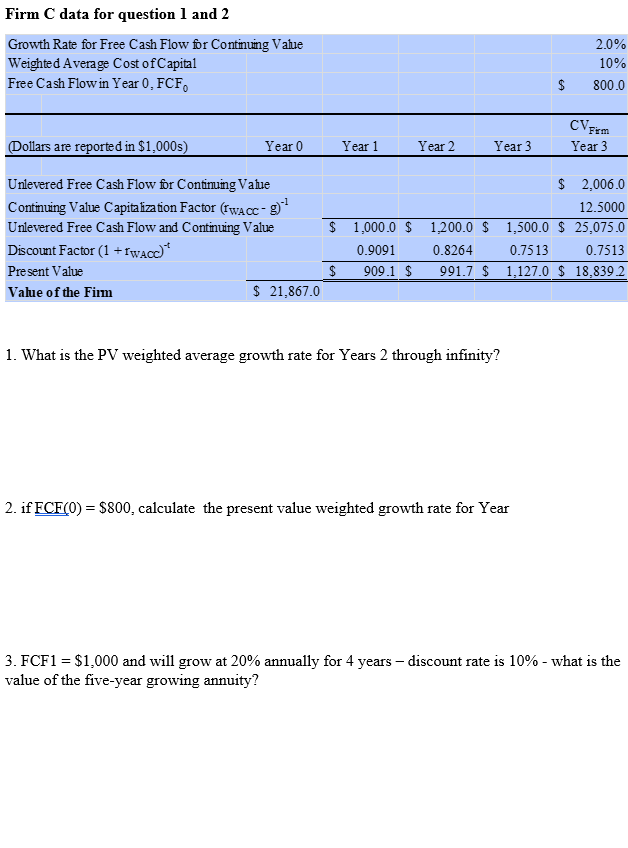

Question: Firm C data for question 1 and 2 Growth Rate for Free Cash Flow for Continuing Valle Weighted Average Cost of Capital Free Cash Flow

Firm C data for question 1 and 2 Growth Rate for Free Cash Flow for Continuing Valle Weighted Average Cost of Capital Free Cash Flow in Year 0, FCF 2.0% 10% 800.0 $ Dollars are reported in $1,000s) Year 0 Year 1 Year 2 Year 3 Firm Year 3 Unlevered Free Cash Flow for Continuing Value Continuing Value Capitalization Factor (fwacc-g? Unlevered Free Cash Flow and Continuing Value Discount Factor (1 +IwacC)* Present Value Vale of the Firm $ 21,867.0 $ 2,006.0 12.5000 $ 1.000.0 $ 1.200.0 $ 1,500.0 $ 25,075.0 0.9091 0.8264 0.7513 0.7513 909.1 $ 991.7 $ 1,127.0 $ 18,839.2 1. What is the PV weighted average growth rate for Years 2 through infinity? 2. if FCFCO) = $800, calculate the present value weighted growth rate for Year 3. FCF1 = $1,000 and will grow at 20% annually for 4 years - discount rate is 10% - what is the value of the five-year growing annuity? Firm C data for question 1 and 2 Growth Rate for Free Cash Flow for Continuing Valle Weighted Average Cost of Capital Free Cash Flow in Year 0, FCF 2.0% 10% 800.0 $ Dollars are reported in $1,000s) Year 0 Year 1 Year 2 Year 3 Firm Year 3 Unlevered Free Cash Flow for Continuing Value Continuing Value Capitalization Factor (fwacc-g? Unlevered Free Cash Flow and Continuing Value Discount Factor (1 +IwacC)* Present Value Vale of the Firm $ 21,867.0 $ 2,006.0 12.5000 $ 1.000.0 $ 1.200.0 $ 1,500.0 $ 25,075.0 0.9091 0.8264 0.7513 0.7513 909.1 $ 991.7 $ 1,127.0 $ 18,839.2 1. What is the PV weighted average growth rate for Years 2 through infinity? 2. if FCFCO) = $800, calculate the present value weighted growth rate for Year 3. FCF1 = $1,000 and will grow at 20% annually for 4 years - discount rate is 10% - what is the value of the five-year growing annuity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts