Question: Firm E must choose between two alternative transactions. Transaction 1 requires a $13,650 cash outlay that would be nonaeauctiDIE IN the computation of taxable

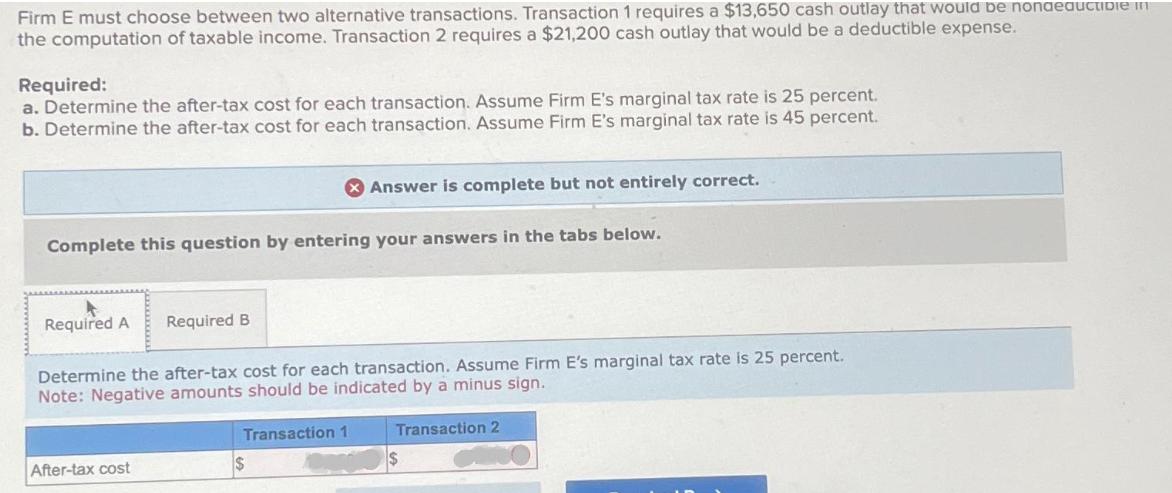

Firm E must choose between two alternative transactions. Transaction 1 requires a $13,650 cash outlay that would be nonaeauctiDIE IN the computation of taxable income. Transaction 2 requires a $21,200 cash outlay that would be a deductible expense. Required: a. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 25 percent. b. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 45 percent. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 25 percent. Note: Negative amounts should be indicated by a minus sign. Transaction 1 Transaction 2 After-tax cost $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts