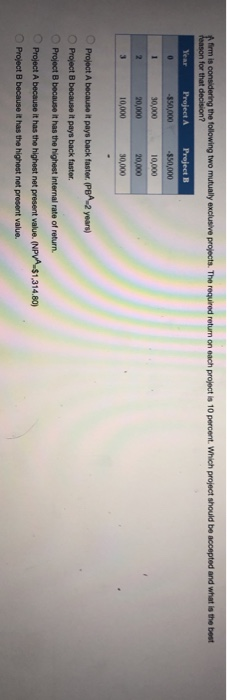

Question: firm is considering the following two mutually exclusive projects. The required return on each project is 10 percent. Which project should be accepted and what

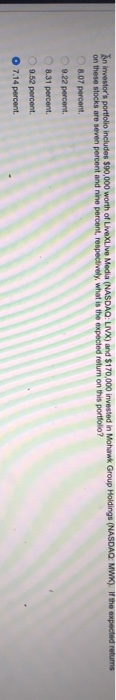

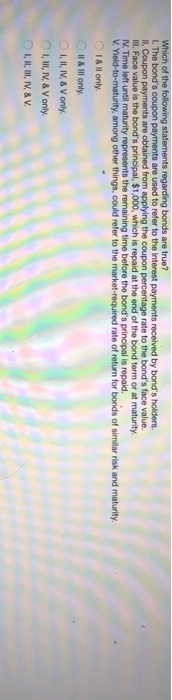

firm is considering the following two mutually exclusive projects. The required return on each project is 10 percent. Which project should be accepted and what is the best reason for that decision? Year Project Project B -$50,000 $50,000 30,000 10,000 20,000 20,000 3 10,000 30,000 Project A because it pays back faster. (PBA-2 years) Project B because it pays back faster, Project B because it has the highest internal rate of return Project A because it has the highest net present value. (NPVA-$1,314.80) Project because it has the highest not present value. An investor's portfolio includes $90,000 worth of LiveXLive Media (NASDAQ: LIVX) and $170,000 invested in Mohawk Group Holdings (NASDAQ: MWK). If the expected returns on these stocks are seven percent and nine percent, respectively, what is the expected return on this portfolio? 8.07 percent 9.22 percent 8.31 percent 9.52 percent. O 7.14 percent. Which of the following statements regarding bonds are true? 1. The bond's coupon payments are used to refer to the interest payments received by bond's holders II. Coupon payments are obtained from applying the coupon percentage rate to the bond's face value. III. Face value is the bond's principal, $1,000, which is repaid at the end of the bond term or at maturity IV. Time loft until maturity represents the remaining time before the bond's principal is ropaid. V. Yield-to-maturity, among other things, could refer to the market-required rate of return for bonds of similar risk and maturity 1 & ll only Il & Ill only I, II, IV & V only. I, III, IV, &V only. I, II, III, IV, & V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts