Question: please Type your answer for part C 3. You are given the following information about Zoey. Life Situation Age 26; No dependents; 3-year working experience;

please Type your answer for part C

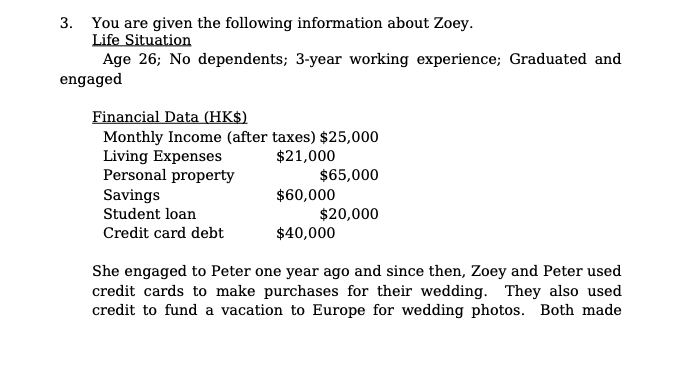

3. You are given the following information about Zoey. Life Situation Age 26; No dependents; 3-year working experience; Graduated and engaged Financial Data (HK$) Monthly Income (after taxes) $25,000 Living Expenses $21,000 Personal property $65,000 Savings $60,000 Student loan $20,000 Credit card debt $40,000 She engaged to Peter one year ago and since then, Zoey and Peter used credit cards to make purchases for their wedding. They also used credit to fund a vacation to Europe for wedding photos. Both made their payments before deadline but they managed to pay around 50 to 60% of the outstanding every month, leaving them with growing credit card debt. They would like to get married next year and consider whether they should buy or rent an apartment. They have no ideas how to fulfill all the goals. (c) What is/are the best way(s) for them to become more aware of the impacts of credit card outstanding on their current, intermediate term, and long-term financial position ? 3. You are given the following information about Zoey. Life Situation Age 26; No dependents; 3-year working experience; Graduated and engaged Financial Data (HK$) Monthly Income (after taxes) $25,000 Living Expenses $21,000 Personal property $65,000 Savings $60,000 Student loan $20,000 Credit card debt $40,000 She engaged to Peter one year ago and since then, Zoey and Peter used credit cards to make purchases for their wedding. They also used credit to fund a vacation to Europe for wedding photos. Both made their payments before deadline but they managed to pay around 50 to 60% of the outstanding every month, leaving them with growing credit card debt. They would like to get married next year and consider whether they should buy or rent an apartment. They have no ideas how to fulfill all the goals. (c) What is/are the best way(s) for them to become more aware of the impacts of credit card outstanding on their current, intermediate term, and long-term financial position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts