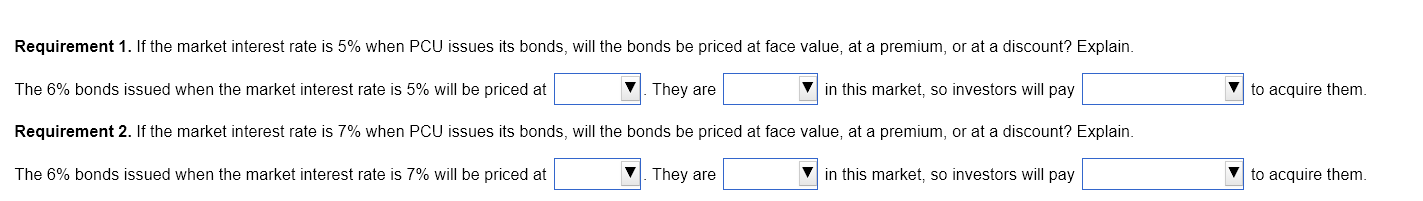

Question: First Blank options (a discount, a premium, face value) Second blank options (attractive unattractive) third blank options (less than face value, more than face value,

First Blank options (a discount, a premium, face value) Second blank options (attractive unattractive) third blank options (less than face value, more than face value, face value)

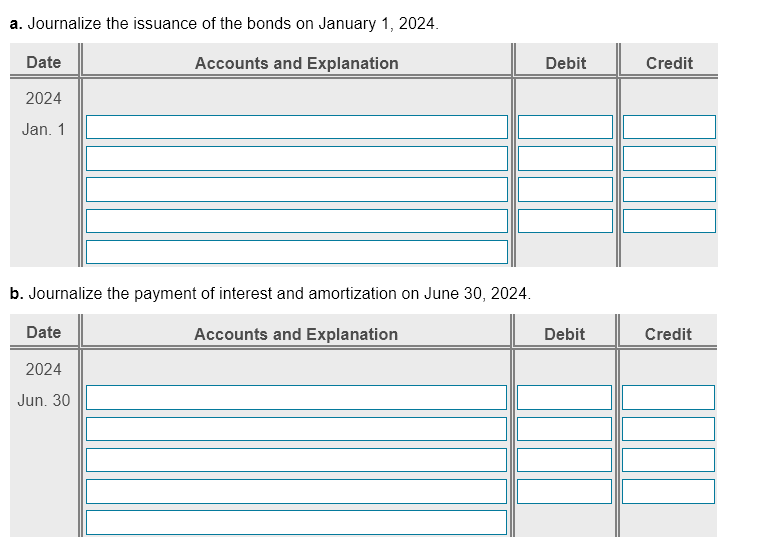

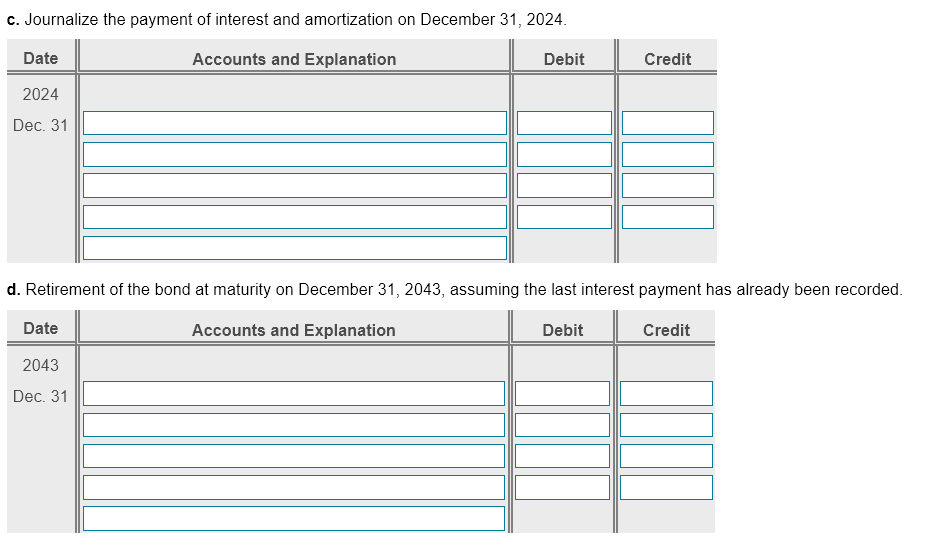

Requirement 1. If the market interest rate is 5% when PCU issues its bonds, will the bonds be priced at face value, at a premium, or at a discount? Explain. The 6% bonds issued when the market interest rate is 5% will be priced at They are in this market, so investors will pay to acquire them. Requirement 2. If the market interest rate is 7% when PCU issues its bonds, will the bonds be priced at face value, at a premium, or at a discount? Explain. The 6% bonds issued when the market interest rate is 7% will be priced at They are in this market, so investors will pay to acquire them. a. Journalize the issuance of the bonds on January 1, 2024. b. Journalize the payment of interest and amortization on June 30, 2024 . c. Journalize the payment of interest and amortization on December 31, 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts