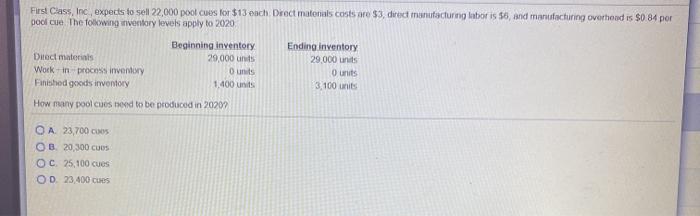

Question: First Class, Inc, expects to sell 22,000 pool cues for $13 ench Direct materials costs are $3, direct manufacturing laboris 6, and manufacturing overhoed is

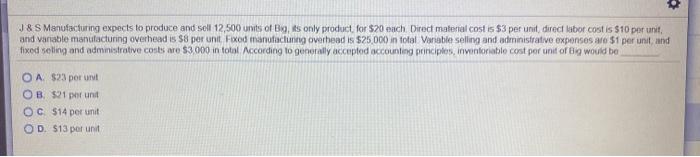

First Class, Inc, expects to sell 22,000 pool cues for $13 ench Direct materials costs are $3, direct manufacturing laboris 6, and manufacturing overhoed is $0 84 por pool cue. The following inventory levels apply to 2020 Beginning inventory Ending Inventory Direct materials 29,000 units 29,000 units Work in process inventory Ons 0 units Finished goods inventory 1.400 units 3,100 units How many pool cues need to be produced in 20202 OA 23,700 OB 20,300 Cuos OC 25,100 cues OD 23.400 CS J & S Manufacturing experts to produce and sell 12,500 units of Big, is only product for $20 each Direct material cost is $3 per unit direct labor cost is $10 per unit, and variable manufacturing overhead is $8 per unit, Food manufacturing overhead is $25.000 in total Vanable selling and administrative expenses are $1 per unit and fixed selling and administrative costs are $3.000 in total. According to genotally accepted accounting principles, inventoriatilo cost per unit of a would be OA. $23 por un OB. $21 per unit OC 514 per unit OD. $13 por unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts