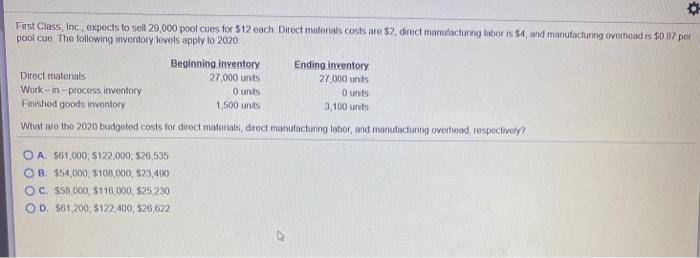

Question: First Class, Inc., expects to sell 29,000 pool cues for $12 each Direct materials costs are $2, direct manufacturing laboris $4, and manufacturing overhead is

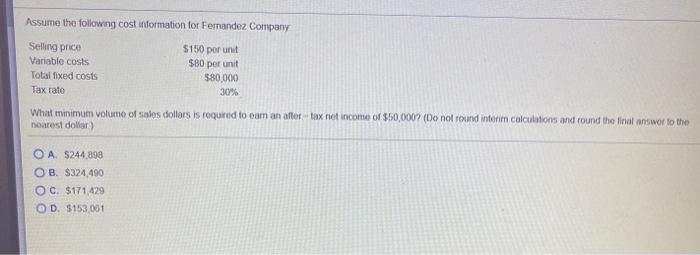

First Class, Inc., expects to sell 29,000 pool cues for $12 each Direct materials costs are $2, direct manufacturing laboris $4, and manufacturing overhead is $0 37 per pool cue. The following inventory levels apply to 2020 Beginning inventory Ending inventory Direct materials 27,000 unts 27,000 units Workin-process inventory O unts Ounts Finished goods inventory 1,500 units 3,100 units What are the 2020 budgeted costs for direct materials, direct manufacturing lobor, and manufacturing overhead, respectively? OA $61,000, 5122,000, 526,535 OB. $54,000 $100,000, $23,490 OC. 558.000 5110,000, $25,230 OD. $81,200, 5122,400, 526 622 Assume the following cost information for Fernandez Company Selling price $150 por unit Variable costs $80 per unit Totalfixed costs $80.000 Tax rato 30% What minimum volume of sales dollars is required to cam an after tax net income of $50,0002 (Do not found interim calculations and round the final answer to the Dones dolor OA $244.898 OB. $324 490 OC. $171,429 OD. $153,061

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts