Question: First: Complete the following concepts and sentences: (1) The suitable definition for Governmental Accounting is..... (2) The main differences between Governmental & Financial Accounting

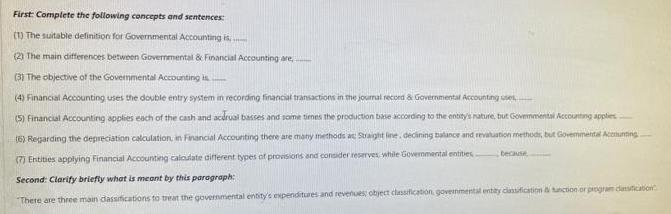

First: Complete the following concepts and sentences: (1) The suitable definition for Governmental Accounting is..... (2) The main differences between Governmental & Financial Accounting are.. (3) The objective of the Governmental Accounting is (4) Financial Accounting uses the double entry system in recording financial transactions in the journal record & Governmental Accounting se (5) Financial Accounting applies each of the cash and acdrual basses and some times the production base according to the entity's nature, but Governmental Accounting applies (6) Regarding the depreciation calculation, in Financial Accounting there are many methods at Straight line, declining balance and revaluation methods, but Governmental Accounting (7) Entities applying Financial Accounting calculate different types of provisions and consider reserves, while Governmental entities. Second: Clarify briefly what is meant by this paragraph: There are three main classifications to treat the governmental entity's expenditures and revenues object classification, governmental entity classification & tunction or program distication because

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

1 A government accounting is a process by which the management of a public authority publishes financial statements that show the financial position performance and cash flows of that authority The de... View full answer

Get step-by-step solutions from verified subject matter experts