Question: first correct answer will get an immediate upvote, closely watching this question Your company is planning to open a new gold mine that will cost

first correct answer will get an immediate upvote, closely watching this question

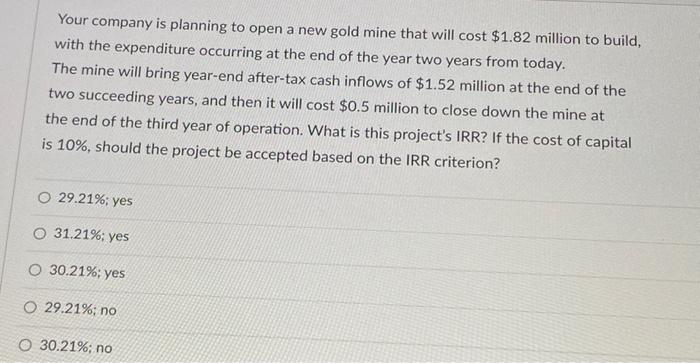

Your company is planning to open a new gold mine that will cost $1.82 million to build, with the expenditure occurring at the end of the year two years from today. The mine will bring year-end after-tax cash inflows of $1.52 million at the end of the two succeeding years, and then it will cost $0.5 million to close down the mine at the end of the third year of operation. What is this project's IRR? If the cost of capital is 10%, should the project be accepted based on the IRR criterion? 29.21%; yes 31.21%; yes 30.21%: yes 29.21%; no 30.21%; no

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock