Question: Problem 17-9 Lease Valuation Using Formulas (LO2, 3) BigCo is considering leasing the new equipment that it requires, for $137,000 a year, payable in advance.

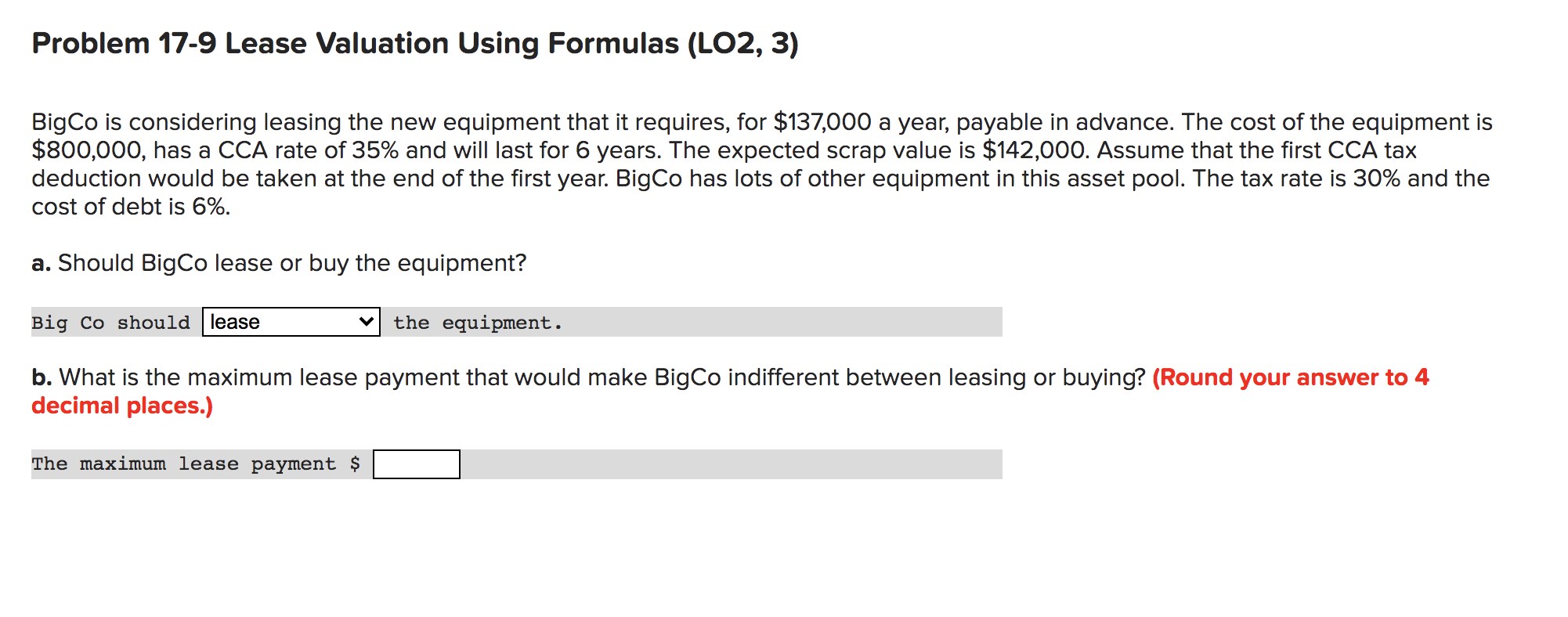

Problem 17-9 Lease Valuation Using Formulas (LO2, 3) BigCo is considering leasing the new equipment that it requires, for $137,000 a year, payable in advance. The cost of the equipment is $800,000, has a CCA rate of 35% and will last for 6 years. The expected scrap value is $142,000. Assume that the first CCA tax deduction would be taken at the end of the first year. BigCo has lots of other equipment in this asset pool. The tax rate is 30% and the cost of debt is 6%. a. Should Big Co lease or buy the equipment? Big Co should lease the equipment. b. What is the maximum lease payment that would make BigCo indifferent between leasing or buying? (Round your answer to 4 decimal places.) The maximum lease payment $ Problem 17-9 Lease Valuation Using Formulas (LO2, 3) BigCo is considering leasing the new equipment that it requires, for $137,000 a year, payable in advance. The cost of the equipment is $800,000, has a CCA rate of 35% and will last for 6 years. The expected scrap value is $142,000. Assume that the first CCA tax deduction would be taken at the end of the first year. BigCo has lots of other equipment in this asset pool. The tax rate is 30% and the cost of debt is 6%. a. Should Big Co lease or buy the equipment? Big Co should lease the equipment. b. What is the maximum lease payment that would make BigCo indifferent between leasing or buying? (Round your answer to 4 decimal places.) The maximum lease payment $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts