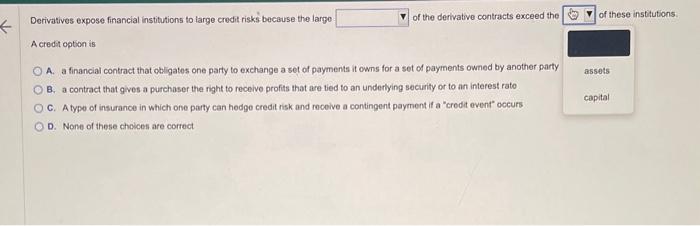

Question: first drop down answer options are a: Notional amounts b: Market value Derivatives expose financial institutions to large credit risks because the large of the

Derivatives expose financial institutions to large credit risks because the large of the derivative contracts exceed the of these institutions A credit option is A. a financial contract that obligates one party to exchange a set of payments it owns for a set of payments owned by another party B. a contract that gives a purchaser the night to receive profits that are tied to an underlying security or to an interest rate C. A type of insurance in which one party can hodge credit risk and recoive a contingent payment if a "credit event" occurs D. None of these choices are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts